The trouble with the EU’s digital tax

SUGGESTED

The European Commission states in their proposal that digital companies face an average tax rate of around 9.5%, compared with a 23.2% rate for others – which they blame on an “outdated tax system”. Their proposal goes on to suggest a new tax policy, which would raise these rates for digital firms.

But is an “outdated” tax model really such a bad thing here? More fundamentally – do we want to be squeezing digital and technology companies for more tax revenue?

Probably not. In fact, judging by the possible consequences of further taxation in this area, Commissioners should arguably be spending less time drafting new tax legislation – and far more trying to be accommodating.

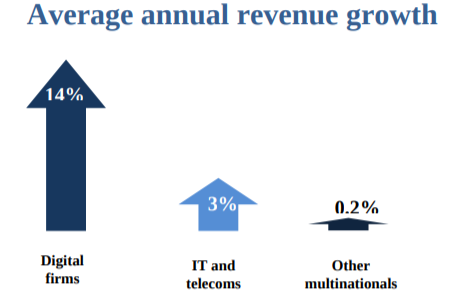

Tech is, after all, the driver of the new industrial revolution in which we live. In fact, the Commission makes note of this in the very report outlining the new tax plan, discussing how digital companies are growing more quickly than the rest of the European economy. The figure below (retrieved from the Commission report) demonstrates this.

It’s clear that digital and tech companies represent a great source of prosperity for whichever market can attract them. Some countries, such as the United Arab Emirates, have realised this and are moving to attract tech start-ups into their markets. In doing so, these markets are providing themselves with a growing source of jobs and output after the previous giants (namely oil) begin to lose their significance.

It’s clear that digital and tech companies represent a great source of prosperity for whichever market can attract them. Some countries, such as the United Arab Emirates, have realised this and are moving to attract tech start-ups into their markets. In doing so, these markets are providing themselves with a growing source of jobs and output after the previous giants (namely oil) begin to lose their significance.Yet in Europe, this message seems to have fallen on deaf ears. Despite claiming that the tax would support growth and competitiveness, the report also states that “The proposed Digital Services Tax would be applied at a rate of 3% on gross annual revenues in the EU derived from specific digital services, due in the Member State(s) where the users involved are located”.

Notice here that the tax is applied to gross annual revenues. This means that the new tax would not take profits into account – in practice, companies barely breaking even might still have to pay 3% to the national government of their home market. This would be a huge deterrent to any young tech startup, as they would not only face the difficulties of building a profitable company, but would also be taxed before they’d even reached that stage.

Thankfully, I’m not the only one to have picked up on this. Officials of many Nordic governments have voiced their opposition to the proposal on this basis, as have other EU Member States, though to a lesser extent.

Hopefully, the less-than-enthusiastic reception to the Commission’s digital tax plan will be enough to stop it from ever coming to fruition. While the EU may try to spin the proposed tax as movement towards modernisation, it really is nothing more than the same old statism we’ve become accustomed to. Should it be implemented, the potential for a thriving European tech market could be seriously undermined.

1 thought on “The trouble with the EU’s digital tax”

Comments are closed.

Regular businesses pay VAT or Sales Tax. This is not a tax on income, its a negotiated sales tax at 1/6th the nominal value of a physical good.

Regardless, the tech companies are not the ones that set up the intra-EU tax havens like Ireland, Luxembourg, Netherlands and Denmark and other miscellaneous free-loaders like Cyprus. The EU commission did that with Mr Tax Dodge himself, President Juncker throwing his own home constituency the largest tax carve out in corporate history.

If national states cannot collect on taxes from transnational corporations, its because the EU set it up this way.

We should never ascribe to malice what can be explained away by incompetence. Yet, the present system is neither a result of either. Its a straight transnational-globalist play in exchange for putting the international back into the socialist international.

Both are incompatible with the wealth of nations and the democratic system.