Energy price hikes: less moralising, more economics

SUGGESTED

It is not a moral problem. It is a matter of bringing supply and demand for various products into alignment. The fact that some people may suffer does not make it a problem that can be solved by moralising. The options for alleviating the suffering are all in the ambit of economics: improving efficiency or welfare measures or ensuring affordable supply.

It is not a market failure, either. The market is doing what it is supposed to do. Supply is tight relative to demand, so prices have risen. They signal not only that we need to restrain demand, but also that additional supply will be valuable, and that there is potential to substitute alternatives.

How should we react to uncomfortable price signals?

Firstly, we need to distinguish between short-term and long-term measures. Technological solutions are long-term. If recent price increases are permanent, the latter have an important role to play. But they will do little to alleviate the impact of the price rises expected in the Spring. We cannot meaningfully increase the efficiency of our buildings, replace gas boilers with heat pumps, increase the supply of native gas, or displace gas-fired generation with low-carbon alternatives that are responsive to the heat demand profile, within the next two years. For that period, we must focus on alleviating the impact on the most vulnerable.

At the moment, the popular option is to try to suppress prices: cut the VAT rate, take the costs of green levies into the general tax base. These are counterproductive in many ways. They have to be paid for, so their costs are not diminished, just shifted. They perpetuate the imbalance of supply and demand that caused the rising prices in the first place. Demand will be reduced by less than it otherwise would have been. The incentive to innovate and substitute alternatives is diminished.

In such a weather-dependent market, the balance of supply and demand can change rapidly, and with it prices. The market may loosen, and the cost of the giveaways will be incurred for little benefit. Or it may remain tight, in which case the market will be inclined to keep driving prices upwards until supply and demand find a new equilibrium. As the market tries to correct for the price-suppression measures, the cost of that suppression rises.

Even if they were not a bad idea, they would be ineffective in the case of gas, because VAT is only 5% on domestic energy, and green levies are minimal. Even on electricity, the combined effect of both measures is not as much as the anticipated price increases.

And as the government noted initially, to its credit, price suppression is an inefficient way of alleviating harm compared to welfare measures. This was an argument for letting the market work by minimising price suppression whilst protecting the most vulnerable.

The least bad short-term alleviation option is to use a combination of the tax and welfare system to offset the rising costs in a progressive manner. This too would have to be paid for, and a combination of high levels of government debt, high levels of taxation, and rising inflation, limits our options.

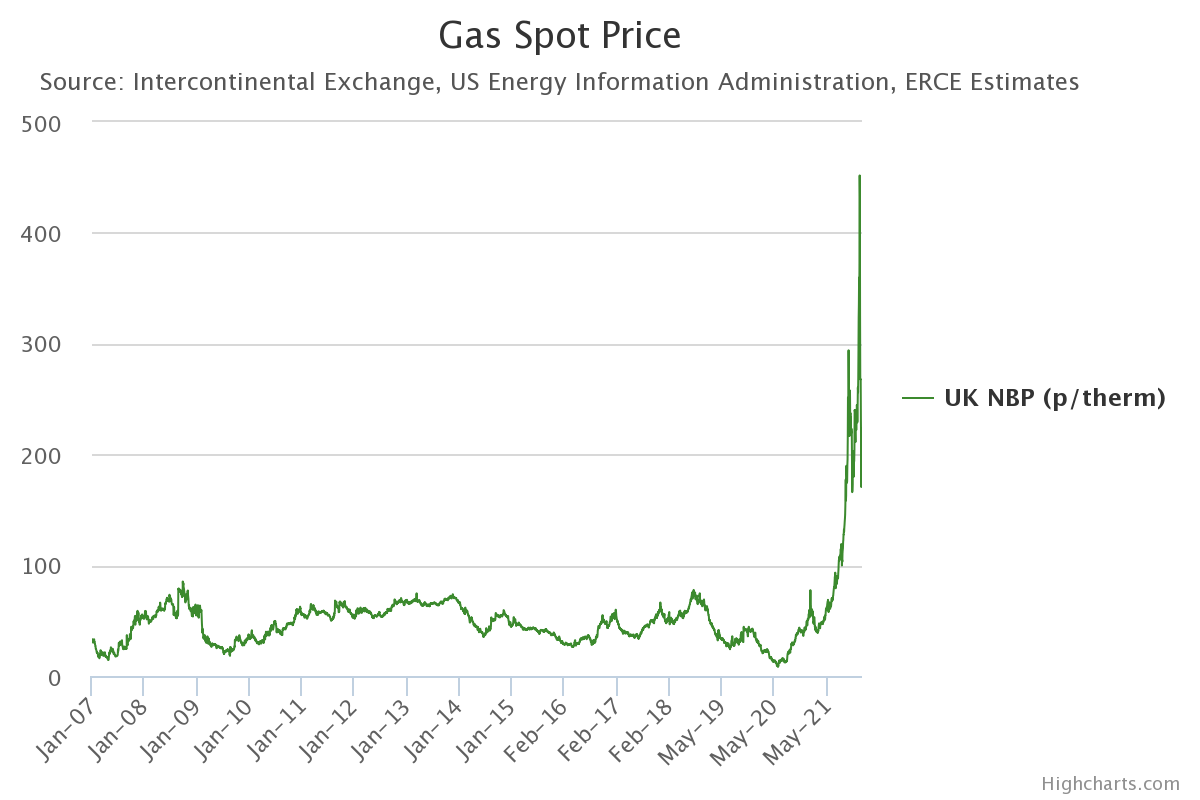

As for the longer term, some people are unwisely confident in the clarity of their looking glass. They are not even very good at their history. Apparently, gas prices are volatile, because they have shot up recently. An increase is not volatility. Frequent increases and decreases is volatility. The chart below (courtesy of ERCE Energy) shows how gas prices at the UK’s National Balancing Point varied over a longer sweep. Before last summer, the only people complaining about volatile gas prices were producers disappointed by the low prices.

Maybe gas prices will stay this high. That is a serious risk for this and next winter. But between and after, it is more likely that prices will fall back. The greater uncertainty is about whether they fall back all the way to their old level, or remain somewhere in between the old and the current one.

It is a dynamic, recursive factor. Our response depends on our expectations. But our response will also affect how things turn out. A modest increase in the global demand for gas (73bcm from 2019-21, compared to nearly 1000bcm from 2007-19, International Energy Agency data) has had a dramatic effect on prices. The opposite might also apply, and modest reductions in gas demand might collapse the price.

And then there are unpredictable geopolitical factors, especially with regard to Russia and the Middle East. There is a strong argument that the current price spike owes at least as much to geopolitics as to fundamentals. Those factors will change, but how?

Part of the picture is in our hands. The British government chose to ban fracking, more for political than good technical reasons. Would the politics be the same when gas prices are three times higher?

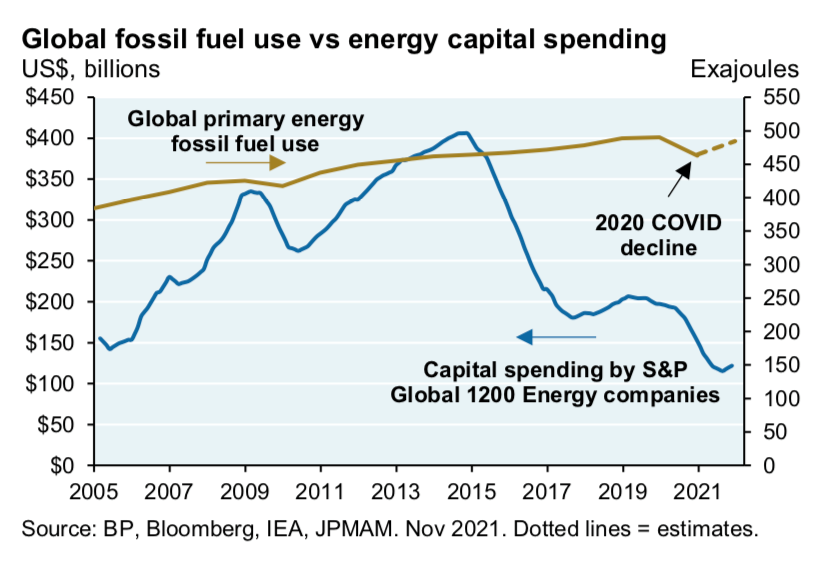

Acute corporate sensitivity to climate risks (driven by regime uncertainty, Environmental, Social and Governance (ESG) departments, and the divestment movement) has deterred investment in fossil fuels in recent years. Given the gaping void between political rhetoric and the actual trend in demand for fossil fuels, might corporations wake up to the reality that demand does not look like it is fading away any time soon? Perhaps more likely, will the ESG constraints placed by fund managers on listed corporations see investments in fossil fuels switch to private equity and corporations from parts of the world that are less constrained by ESG strictures?

Classical liberals should not react to the hubris of policy wonks with excessive certainty of their own. We should not view fracking and offshore drilling as magic bullets. On- and offshore production in the UK is probably more expensive than many other sources. We do not know what price and output UK production would settle at. We do not know how it would compare with the rest of the market. It might be relatively expensive and relatively limited. But producers should not be prevented from finding out, nor should the UK be the sort of place where people fear to invest because of regime uncertainty.

Similar uncertainties apply to all the other options in the market. Do we really know that electrification, powered by “cheap” renewables, backed by nuclear and storage is “the only viable option”? So many assumptions wrapped up in one master plan. It would take pages to demonstrate the uncertainty that this “inevitable” model ignores. And that is before we get to the unknown unknowns.

But there is no need. If we trust markets, they also will deliver “the only viable option” if it is the only viable option. But if by any chance there are blind spots in this 20:20 foresight, unhindered markets will help to encourage innovation (everyone’s, not just the armchair experts’ approved options) and to discover the best options in reality rather than theory, whereas planned-outcome policy would be stuck trying to deliver the broken model.

The Department for Business, Energy and Industrial Strategy (BEIS) has accumulated one of the largest budgets in Whitehall. If we leave innovation to the innovators rather than to bureaucrats and politicians, we can free not only the market, but also some of BEIS’s budget. It can go towards those short-term welfare measures necessitated by an energy-price crisis that those brilliant policy wonks (with their perfect vision to 2050) failed to anticipate a year ago.