Review: Taking Back Control by Robert Jenrick MP, Neil O’Brien MP & Karl Williams

SUGGESTED

The key arguments they make in favour of a more restrictive policy can be summarised as:

- British voters have expressed a clear preference for lower immigration, but politicians have not delivered, thus undermining trust in the UK’s system of government.

- The net fiscal impact of immigration has been negative, particularly for non-EEA migrants, who make up a disproportionate share of immigrants post-Brexit.

- The positive predicted impact of immigration in the wider economy, such as improved productivity, has not materialised.

Their first point is beyond my remit. Thankfully, I am not a politician, so I do not have the unenviable task of reconciling the public’s preferences for lower overall immigration with specific support for most immigrants, including nurses, doctors, care workers, fruit and vegetable pickers and construction workers. I’ll leave debates over this point to others.

Fiscal Impact

Accurately estimating the fiscal contribution of immigrants, or any group for that matter, is frustratingly difficult. As the authors of the CPS report highlight, the government struggles to produce high-quality statistics on the number of immigrant arrivals, visa types, their qualifications, and how much each immigrant contributes and takes from the Treasury.

But the lack of good data is only the first problem. How, for example, do we attribute the cost of true public goods like national defence and debt? How do we compare the contributions of recent migrants to those who have been here longer? If we see some displacement of low-skilled natives in the labour market, is that a fiscal drain, or do we try to measure the longer-run impacts of more specialised, thus more productive, native workers? Should we also include asylum seekers in our calculations? Given that they are barred from working, and the state pays for their living costs, is it fair to lump them in with those who have come here to work?

These questions may seem academic, but the choices researchers make in answering these questions can significantly tilt the ultimate findings. Christian Dustmann and Tommaso Frattini’s 2014 paper on the fiscal impacts of immigration and Oxford Economics’ comprehensive study of the fiscal contribution of new EU migrants in 2016 paint fairly positive pictures. By contrast, Migration Watch’s response to Dustmann and Tommaso paints a more negative picture. The gap between their estimates of immigrants’ fiscal impact can almost entirely be explained by different interpretations of sub-standard data and the way they chose to allocate certain public expenditures.

Both studies – and most other studies on the subject – do have some key findings in common. Firstly, pre-2001 immigrants and immigrants from the European Economic Area had a marginally positive net fiscal impact. The wave of migration that accompanied the EU enlargement in 2004 had a less positive impact and non-EEA migration is net-negative for the Treasury. Crucially, both groups of immigrants are significantly less of a drain on the public finances that UK natives.

Secondly, both studies find a marked reduction in immigrants’ net contribution after the 2008 Great Financial Crisis.

Source: Migration Watch (2014)

Crucially, however, the decline in net fiscal contributions among immigrants is also seen among natives. The GFC shock made everybody poorer, and the UK has since fairly stagnant wage growth, explaining the trend in fiscal contributions across the board. Additionally, the UK’s tax system (including the easily measurable income tax) became more progressive post-2008, reducing the contribution of migrants who are more likely to be on low incomes than UK natives.

Source: Financial Times (2015)

The possibility that immigrants’ net fiscal impact has worsened because of external economic circumstances has a crucial broader significance. Even if migrants were an enormous net fiscal burden, it does not automatically follow that the answer is to reduce immigration. The government could simply change the way we tax and redistribute money. That could mean drastic reforms to lower state spending, put more services in the private sector, and reduce the government’s unfunded long-term liabilities (such as pensions and social care).

While I think that would be a positive step in any case, it isn’t even necessary. The government already denies immigrants access to some welfare benefits. There is no reason why people given indefinite leave to remain (permanent residency) should have parity of access to welfare as UK citizens. We could also require migrants to have ILtR status for longer before opening up applications for full citizenship. Another option is to impose some kind of upfront payment for visas, as the late Nobel Prize winner Gary Becker proposed for the IEA in 2011, immediately addressing concerns about fiscal burdens. Indeed, the government has already increased the ‘NHS surcharge’ to £1,035 per visa year, an arbitrary fee that is paid in addition to all the usual taxes that cover public services.

The key issue with net fiscal contributions is not low-skilled migration or migration writ large, it’s about how governments choose to tax and spend. Whether any person, immigrant or otherwise, is a net contributor or drain on the public finances is a decision for governments alone. Tackling fiscal loss from certain migrant groups can be done without an immigration clampdown.

Immigrants’ impact on productivity

The much more controversial aspect of the CPS’ new research is that it seeks to question the economic consensus that immigration has generally positive effects on the economy.

The authors correctly point out that GDP per capita, productivity, and wages have flatlined over the past 15 years, despite plenty of immigration. They also highlight that this correlation does not equal causation, a fact that is lost on a surprising number of immigration-sceptics.

Nonetheless, they do go on to attempt an argument that immigration has had a direct negative effect on Britain’s productivity. The central pillars of their argument are:

- Migrants have stretched the UK’s publicly-funded services, as well as key infrastructure like roads and housing.

- Immigration has discouraged capital investment and the adoption of labour-saving machinery.

The first objection, again, is one based on how the UK government spends money and regulates certain industries. My colleague Kristian Niemietz has already explained why the housing crisis is primarily caused by the planning system and not immigration. A similar story applied to energy, which the government had overregulated into shortage even before the Russian invasion of Ukraine. Likewise in sectors like public infrastructure and healthcare, which are centrally planned and thus unable to respond properly to demand.

The key point is that immigration has not caused crisis-level shortages or price increases for food or laptops. Why? Because those sectors have relatively free markets which are able to adapt production to increases in demand. The problem is government planning and regulation, not immigration.

The second argument would, however, form a stronger case against immigration itself if it were true. It can be summarised by a study by Daron Acemoglu that the authors quote:

“Freedom of Movement provided a relatively cheap supply of labour that may have incentivised recruitment over labour-saving capital investment or other restructuring activity towards fewer, higher productivity and higher paying jobs.”

In short, immigration holds back productivity because the short-term expenditures of cheap labour could be invested in machinery which boosts productivity per worker. This seems intuitively plausible.

As the authors point out, the UK is a laggard in capital intensity (capital per worker) compared to other developed economies and our productivity has flatlined in recent years. Indeed, they may have a point when it comes to public sector services, which have a clear record of under-investment in capital due to the political nature of their decision making. In this case, the government’s planning of services like health and social care may well be subsidising unnecessary immigration. But when it comes to the private sector, their claim fails for three key reasons.

Firstly, the UK’s high immigration is evidently not the reason for Britain’s lack of automation and capital investment. According to their own figures, countries like the Netherlands, Spain, and the United States, which have some mixture of similar immigration trends and foreign-born populations to the UK, have much higher robot density per 10,000 workers.

Source: CPS (2024)

Indeed, the country with the highest capital intensity in the world, Norway, has had a remarkably similar increase in immigration and foreign-born residents as the UK over recent years.

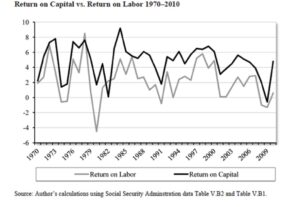

Their argument can further be countered by a more in-depth analysis of economic theory. Capital tends to complement labour, not replace it. As more workers come in, the returns on capital investment rise as employers seek to maximise productivity per worker as the benefit of hiring one additional worker diminishes. As more capital is employed, the returns on labour increase as employers seek to maximise the productivity of new, cheaper capital with skilled workers to operate it. This trend has been seen clearly in the United States for decades, resulting in a consistent growth in capital per worker until the GFC.

Source: Cato Journal (2017): https://www.cato.org/cato-journal/fall-2017/how-immigration-affects-workers-two-wrong-models-right-one#wrong-model-1-fixed-number-of-jobs & Cato Institute (2011): https://www.cato.org/sites/cato.org/files/pubs/pdf/PA689.pdf

Furthermore, capital has to be first created before it is deployed, and labour productivity combined with broader economic growth and a high savings rate is crucial to doing just that.

The second reason that this approach fails is that it assumes too close a relationship between capital intensity and overall productivity. Generally speaking, the two are closely linked but their association is not limitless. Japan, for example, has higher capital intensity than the UK, but its labour productivity is lower.

As a consequence of both of these points, we need to look at whether immigration increases total factor productivity (TFP), not just capital intensity. A thorough empirical study into the effects of low-skilled immigration into the United States found that states with a greater number of low-skilled immigration saw a slight decline in capital intensity, they saw a much larger rise in TFP. Recent research from UK in a Changing Europe shows a small positive correlation between productivity and non-EU migrant workers across different sectors of the economy.

The most important question that the authors should have asked themselves is why their theory implies that businesses hate profit. If labour-saving machinery could increase productivity and lower prices for consumers, employers who currently hire workers instead of investing in that machinery are missing out on huge gains. Technology can be a good thing, if it is economically viable. There is nothing, however, that is inherently good about labour-saving machinery if it is more costly than the labour it seeks to save. With the profit motive and dynamic competition provided by a free market, businesses themselves are far better placed to allocate the comparative rate of spending on capital and labour than any government central planner.

Ultimately, the new report identifies issues that have been caused, for the most part, by poor domestic policy choices by successive governments, not by immigration.

2 thoughts on “Review: Taking Back Control by Robert Jenrick MP, Neil O’Brien MP & Karl Williams”

Comments are closed.

So when’s the last time you saw an automated car wash in London?

Disappointingly poor piece from a supposed ivy league think tank.

I strongly suggest Mr Harrison read the reports he is given to review next time and not apply his own prejudice to his writings. His assertion “there is nothing inherently good about labour-saving machinery if it is more costly than the labour it seeks to save” deliberatly ignores the realities of the hidden subsidies, and therefore incentives, companies receive which encourage them to opt for the cheap-labour option. Suggest who ever is in charge here monitors their own work before criticising another author’s work.