BoE falls further behind in the battle to curb inflation, says IEA economist

SUGGESTED

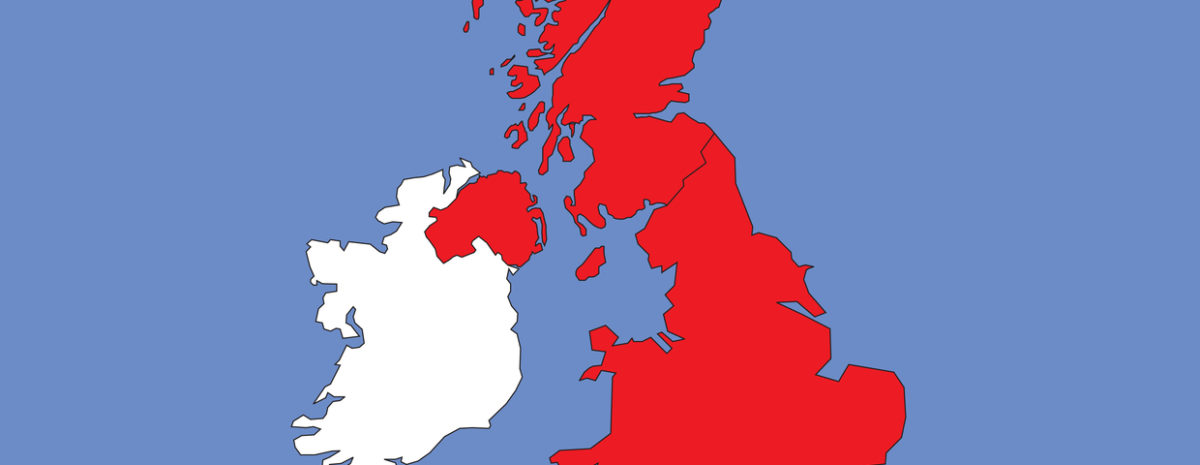

Victoria Hewson comments for the Belfast News Letter

“The Bank of England’s decision to raise interest rates by just a quarter point, to 1.25 per cent, is hard to square with the latest inflation figure of 9 per cent and expectations that this will top 11 per cent in October.

“The Monetary Policy Committee (MPC), by a majority of six to three, has judged that not enough has changed since its last meeting to justify stepping up the pace of tightening. This is despite the additional fiscal support to ease the cost of living crisis, and growing doubts about the credibility of UK monetary policy.

“Headline GDP growth has been a little weaker than anticipated in the last two months, but many other indicators suggest that private sector activity is holding up well. The labour market remains tight and the household sector in aggregate still has ample savings from the pandemic.

“The Bank’s relatively sanguine view contrasts with the Federal Reserve, which raised US interest rates yesterday by a full three-quarters of a point. The US economy is currently stronger, but falling further behind the Fed risks adding to the upward pressure on UK inflation by undermining the pound.

“In short, today’s small move is unlikely to please many people. Some will wonder why the MPC has raised rates at all, if it is so confident that inflation will fall back meekly to target.

“Others will argue that, with inflation so far above the 2 per cent target, a much bigger increase was now needed to restore some credibility and to signal that the Bank is willing to do ‘whatever it takes’ to get inflation back down again.

“A drip, drip of quarter-point increases, when interest rates are so low to begin with, is unlikely to have any significant impact either way. The Bank should either have gone big, or not bothered.”

Notes to editors