Now is not the time to go soft on globalisation (Part 1)

SUGGESTED

Globalisation is good

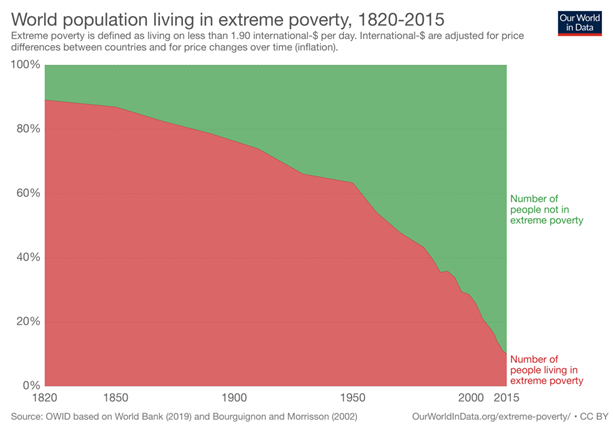

There is substantial evidence to suggest that as countries globalise, their citizens benefit from access to a variety of goods and services, lower prices, increased numbers of better-paying jobs, improved health, and higher overall living standards. As the number of countries which have become more open to global economic forces increases, the percentage of the developing world living in extreme poverty has reduced dramatically.

In 1820 only a tiny elite enjoyed higher standards of living, while the vast majority of people lived in conditions that we would call extreme poverty today. Since then, the share of people living in extreme poverty has fallen continuously. More and more world regions have industrialised and thereby increased productivity, which has made it possible to lift more people out of poverty. In 1950, two thirds of the world were living in extreme poverty; in 1981 it was still 42%. In 2015, the last year for which we have aggregate data, the share of the world population in extreme poverty has fallen below 10%.

Figure 1 – World population living in extreme poverty, 1820-2015

-Source: Our World in Data, University of Oxford

There are a number of factors that underpin the overall improvement in prosperity. One of the key factors has been greater direct foreign investment (FDI). This may include acquisitions, establishment of local manufacturing operations, or other forms of permanent investments made by foreign firms or individuals from one country into business interests located in another country. Other factors include the spread of technology, strong societal institutions, sound macroeconomic policies, an educated workforce, and the existence of a market economy. Fundamentally, however, all these advances are underpinned what can be termed as the “competitive spirit of meritocracy” that has “created extraordinary prosperity and wealth of new ideas.” In the name of efficiency and economic freedom, governments have opened up markets to competition and globalisation has lifted hundreds of millions of people in emerging markets out of poverty.

Globalisation has also opened up unprecedented opportunities for firms to trade internationally. As a result of the removal of trade barriers, deregulation of financial transactions, harmonisation of product standards and legal frameworks, it is now relatively easy for companies to sell what they produce in their home countries to foreign markets, source raw materials and products globally, or even locate their supply and other value chain activities in one or more foreign countries. Globalised trading possibilities present firms with strategic opportunities upon which they can build a competitive advantage and continually bring new innovative products and services to the market, often at a low cost to the consumer.

Siren calls of de-globalisation

While most countries have embraced globalisation and experienced significant income increases, other countries that have rejected globalisation, or only embraced it tepidly, have fallen behind. A similar phenomenon is at work within individual countries, where some people have been bigger beneficiaries of globalisation than others. In fact, rising incomes around the world have been accompanied by widening inequality within individual countries across both developing and advanced economies.

According to The World Bank, between 2008 and 2013 income gaps widened in 34 of the 83 countries as incomes grew more quickly for those in the wealthiest 60 percent of the income distribution than for those in the poorest 40 percent, and in 23 countries people in the poorest 40 percent saw their incomes decline.

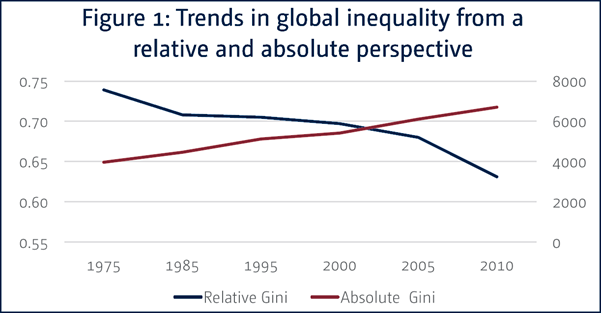

Increases in income have been particularly sharp at the top of the income distribution. Some 46 percent of the total increase in income between 1988 and 2011 went to the wealthiest 10 percent. Since 2000, 50 percent of the increase in global wealth benefited only the wealthiest 1 percent of the world’s population. Conversely, the poorest 50 percent of the world’s population received only 1 percent of the increase. Hence, global wealth has become far more concentrated. The wealthiest 1 percent of the population possessed 32 percent of the total global wealth in 2000. By 2010 this had increased to approximately 46 percent. The super-rich, the wealthiest 0.1 percent, have fared even better. For example, the share of national wealth among the super-rich in the United States increased from 12 percent in 1990 to 19 percent in 2008 before the financial crisis, and to 22 percent in 2012. To put these numbers in perspective we can measure absolute and relative inequality by global Gini-coefficient published by the UN in 2016.

Figure 2 – Global Gini coefficient

-Source: UN Human Development Report, 2016

Although absolute income inequality has risen in many countries, it has narrowed across the world as a whole because the incomes of developing and developed regions have been converging. Relative global inequality has declined steadily over the past few decades, from a relative Gini coefficient of 0.74 in 1975 to 0.63 in 2010 driven by declining inequality between countries. This has arisen from the extraordinary economic growth in, primarily, China and India. This has happened despite an increasing trend towards inequality within countries. By contrast, absolute inequality, measured by the absolute Gini coefficient, has increased dramatically since the mid-1970s.

Some economists worry that widening income disparities may have damaging side effects. On the one hand inequality can boost economic growth as the wealthy save and invest more and because people work harder in response to incentives. On the other hand, wide income gaps can also create inefficiencies as they can bar talented poor people from access to education, or they can feed resentment that results in growth-destroying populist policies. A high Gini coefficient itself should not always be considered alarming as income gaps can arise for good reasons such as when people are rewarded for productive work, or for bad ones if poor children do not get the same opportunities as the rich ones.

Some societies are more concerned about the equality of opportunity, others about the equality of outcome. European countries tend to be more egalitarian where people believe that in a fair society there should be no big income gaps. This, however, can have a stifling effect on aspiration and entrepreneurship especially if this is policy is funded by a punitive tax rates rather than tax revenues resulting from economic growth. Americans and Chinese tend to put more emphasis on the equality of opportunities available to their citizens. Provided that people can move up the social ladder, they believe that a society with wide income gaps can still be fair. Hence, static measures of income gaps expressed by indices such as the Gini coefficient tell only part of the story. However, most people would probably agree that where social mobility is reduced as a result of income disparities, a high Gini coefficient is troubling.

It is against this backdrop of inequality that is perceived to be caused by globalisation that protectionist trade policies promoted by populists from both the left and the right, and perhaps most clearly advocated by the Trump Administration, have come to dominate the current discourse. Such protectionist, de-globalisation calls have intensified as a result of the Covid-19 pandemic.

For workers in globalised industries in Western economies who have experienced stagnating real wages, having been forced to compete with workers in Asia, a de-globalisation trend may seem like a relief. However, this is only a part of the story. The thinking of globalisation where mainly US and European corporations shifted their supply chains to take an advantage of cheaper Asian labour is coming to end as wages in previously cheap labour cost countries are rising steadily. It will still make sense for global firms to relocate some of their manufacturing abroad, but not specifically with the aim of lowering their wage bill. In the 21st Century world, supply chains in Europe, North America, and Asia will be increasingly based on producing goods closer to the home of the customer. In Asia and Europe most trade is already intra-regional such as in the EU and other intra-regional trading blocks. It is especially noteworthy that Asian firms made more foreign sales within Asia than in the US in 2017, indicating a shift in global trade flows.

Whatever form the future globalisation will take in terms of regionalisation and relocation of supply chains as well as political interventions, global trade is here to stay. In fact, it will probably accelerate further with the digitisation of trade and an increasing shift from manufacturing to service production. Digitisation will make it easier for smaller firms and start-ups as “born-global” enterprises to participate in a global economy through e-commerce. These “born-global” firms are often small technology platform-based businesses that have been set up from their very founding to serve global markets. The current economic uncertainty may well see the acceleration of such firms. Think of the little known Zoom video conferencing firm that conquered global public consciousness only a few short weeks ago.

Digital data flows are already estimated to contribute as much as $450 billion to global growth annually. However, this also means that there are workers who will invariably be left behind by the onward march of globalisation. It is suggested that retraining workers who have been affected by trade and globalisation is not a solution on its own. In addition to retraining where that is possible, policy responses will require a concerted effort by both governments and businesses to reinvest in dislocated communities, match smaller firms with foreign markets, match communities with foreign investors, ensure unfettered access for small firms and start-ups to cross-border digital platforms, and provide adequate safety net measures.

Continue to Part 2…