Debt alarmism

SUGGESTED

Many commentators try to fill us with a sense of economic foreboding, basing their reasoning on the amount of debt we are accumulating. They are wrong to do so and are only looking at part of the picture.

2016 was a year when consensus pundits deserved three times to have egg on their faces. Top opinion-formers were shocked when the British people voted to leave the European Union on 23rd June and when the American electorate decided on 8th November that Donald Trump should be their next president. Everyone can remember these upsets. But another of 2016’s surprises has been almost forgotten. At the start of the year influential economists were loud in expressing concern that a recession – perhaps a big recession – was imminent. Like the “experts” on Brexit and Trump, they now look silly. The year enjoyed steady growth of demand and output. Indeed, leading indicators of economic activity still looked good for 2017 in closing weeks of 2016.

Some of the brashest warnings about a slump came from economists with links to the Organization of Economic Cooperation and Development, and the Bank for International Settlements. Perhaps the most prominent of these was William White, then chair of the OECD’s review committee and previously chief economist at the BIS. The International Business Times of 20th January reported that in his judgement, “Global debts have built up to such an extent that the world is facing another financial crash, worse than the one in 2007-08.”

In an interview given to Ambrose Evans-Pritchard of The Daily Telegraph, just ahead of the World Economic Forum meeting in Davos in late January 2016, White used lurid phrases. To quote, “in the next recession […] many […] debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something […] The only question is whether we are able to look reality in the eye and face what is coming in an orderly fashion, or whether it will be disorderly. Debt jubilees have been going on for 5,000 years, as far back as the Sumerians.”

Yes, it is true over the last 5,000 years many debts have not been honoured in full or even at all. But it is also true that the activities of lending and borrowing, and of incurring debt and worrying about it, have grown enormously since the dawn of civilisation. Indeed, in the last three centuries the Industrial Revolution has been accompanied by a no less remarkable Financial Revolution. People have converted debts into marketable securities, and then bought and sold these securities to their mutual benefit, while banks have been established with the explicit purpose of making profits by creating new debt.

Astonishing though it may seem, for many centuries most debts have been serviced properly and repaid. There was in fact nothing special about early 2016 to justify White’s alarmism. But the debt anxieties that now seem to figure regularly in BIS and OECD commentary need to be subjected to more general criticism. The underlying assumption behind “debt-ism”, as the relevant body of ideas might be called, is that people borrow only to consume. As debts pile up in this sort of world, the debt-to-income ratio rises and serves as an index of financial unsustainability. The debt-ists surely have common sense on their side when they say that, sooner or later, creditors will want their money back. At the least, creditors will demand that the rise in indebtedness comes to a stop. If so, borrowing must be reversed and spending reduced. The high debt-to-income ratio does then presage a downturn in demand and a recession.

Such reasoning is misguided, on two grounds. First, most people do not borrow in order to consume, but to acquire a capital asset. The principal assets in question here are houses, but people also borrow to finance the purchases of cars and other consumer durables, and even to start new businesses. The debt-to-income ratio ceases by itself to be an index of financial unsustainability; the ratio of assets to income must be brought into the picture. If assets are well above debt, there ought to be nothing to worry about.

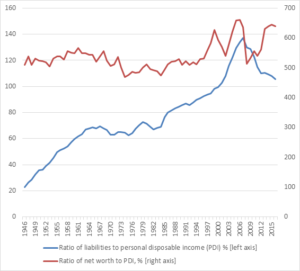

Good data on the household sector balance sheet are available for the USA back to 1946, when debt amounted to a mere 23 per cent of personal disposable income and assets were many times larger at just over five times income. Between 1946 and 2007 the debt-to-income ratio soared to 137 per cent. At least superficially this was a vast deterioration which, in accordance with debt-ist theory, created the background conditions for the Great Recession. However, it must be emphasised that in 2007 the American household sector held assets equal to more than eight times income, much above the ratio of five times in 1946. Over the six decades from the end of the Second World War, debt had risen explosively relative to income, but the value of assets had gone up as well. Looking at debt in isolation was misleading.

Indeed, a remarkable feature of the numbers must be highlighted. The historical experience is that assets increase by amounts so much larger than debt that the net-wealth-to-income ratio and the debt-to-income ratio can and usually do rise together! This is clear from the figure. Just before the Great Recession Americans were ostensibly in a curious position. Relative to their incomes, they had more debt than ever before. Yet they were also wealthier, again relative to incomes, than in any previous epoch! The net-wealth-to-income ratio for 2006 was 6.6 times, which was above the previous peak of 6.3 in 1999, comfortably ahead of the high values of well over five seen during the 1960s and noticeably above the 1946 value of 5.1 when our analysis started.

The second difficulty with White’s thesis is logical. Some people can borrow only if others can lend. When a nation’s debt-to-income ratio is cited, the tendency is to suppose that everyone in the nation has some debt. This may be an excusable mental habit, but it is lazy and wrong. Many people have no debt at all, whereas others may have debt that is a high multiple of – say, four or five times – their income. (Think of young people just after they have used mortgage debt to buy their first home.) Any assessment of sustainability must investigate the specific and particular financial position of borrowers, and accept that most individuals are forward-looking and rational.

The wider messages of this article are straightforward. When economists try to forecast, they are right to look at how much debt people have, but debt must be set within the context of the balance sheet as whole. The behaviour of asset prices is critical, justifying further research on the determinants of asset price movements. High levels of debt did not by themselves signal a global downturn at the start of 2016, and neither do they give that signal in early 2017. Further, when scary tittle-tattle is reported in the Financial Times and The Daily Telegraph and attributed to the World Economic Forum, don’t expect it is anything more than gossip about guesses.

This article first appeared in EA Magazine.