We’re number one… in unaffordable electricity

SUGGESTED

Each year, the Government publishes international energy price comparisons. The data is sourced from the IEA and covers industrial and domestic gas and electricity prices. The latest data for 2023 was published a few weeks ago.

The data covers 28 of the countries that are part of the IEA. The data for some countries, such as Italy and Japan, is patchy and charts containing so many lines are difficult to decipher, so the chart analysis focuses on France, Germany, UK, Korea and the USA as well as the median IEA price. The commentary does discuss other countries when appropriate. All prices quoted include taxes.

Time to dig in to find out where the UK stands in the international league tables.

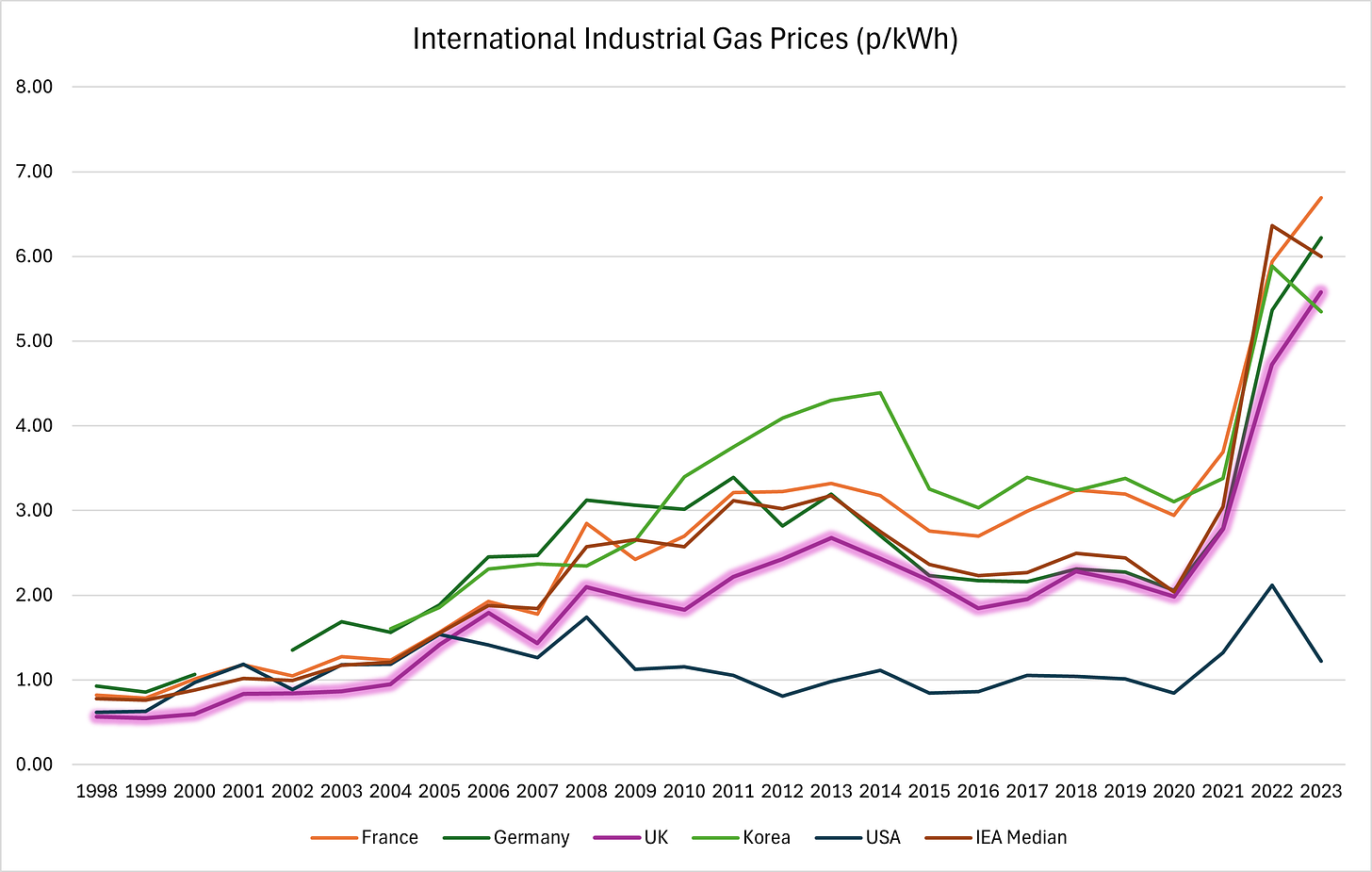

International Industrial Gas Prices Starting with industrial gas prices (Table 5.7.1) as shown in Figure 1.

International Industrial Electricity Prices

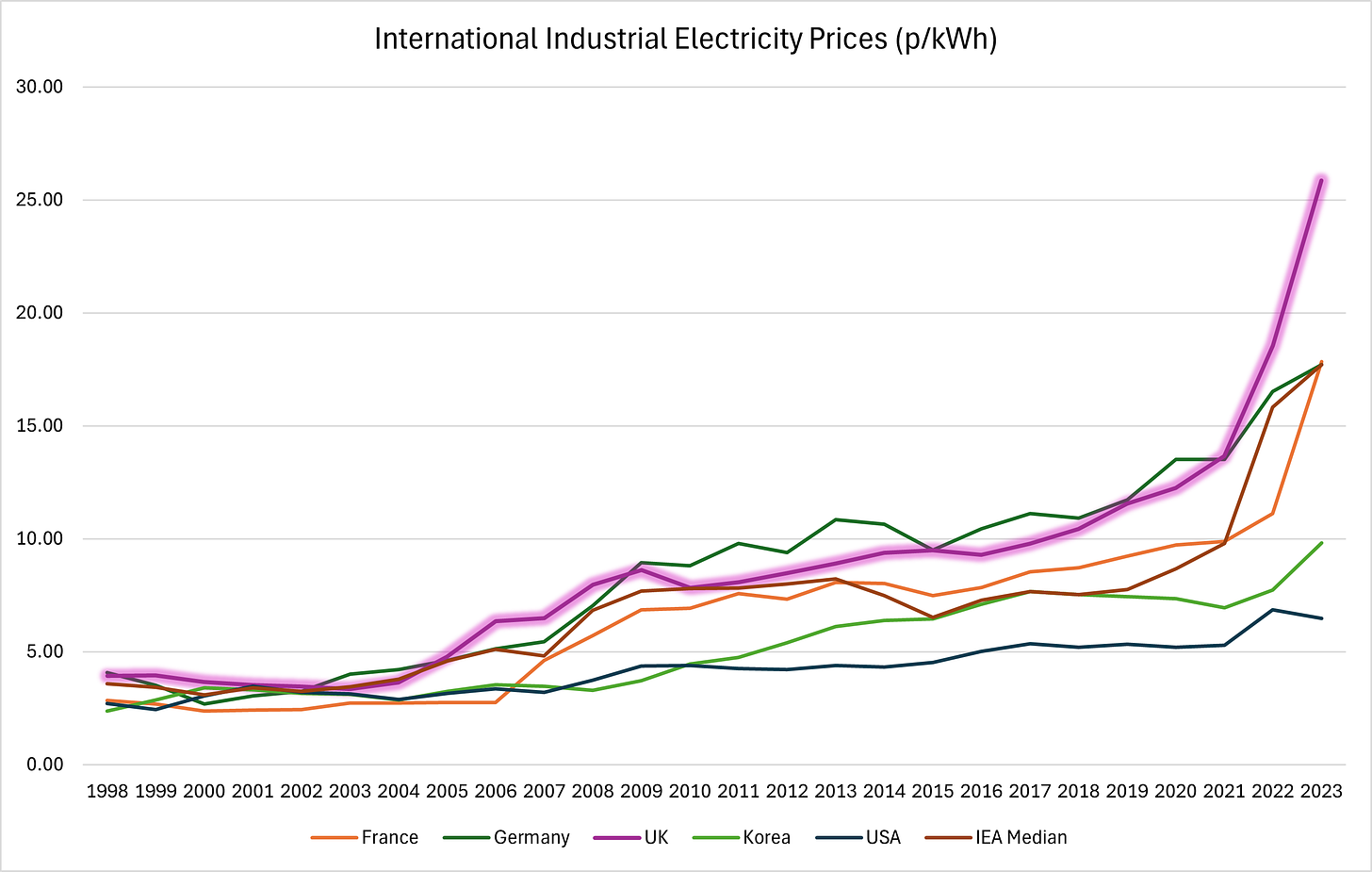

The international industrial electricity price comparison (Table 5.3.1) is shown in Figure 2.

UK industrial electricity prices at 25.85p/kWh are the highest of the 28 countries covered by the IEA report. UK prices are some four times those in the US, 2.6 times those of Korea and 46% higher than the IEA median. Given that UK gas prices are below the IEA median and those of France and Germany it cannot be gas prices that are driving UK electricity prices so much higher than elsewhere. Canada, Norway, Finland, Sweden, New Zealand and Portugal all have industrial electricity prices less than 10p/kWh.

We cannot hope to compete in traditional energy intensive industries or industries of the future like making batteries or AI with such extortionate electricity prices.

International Domestic Gas Prices

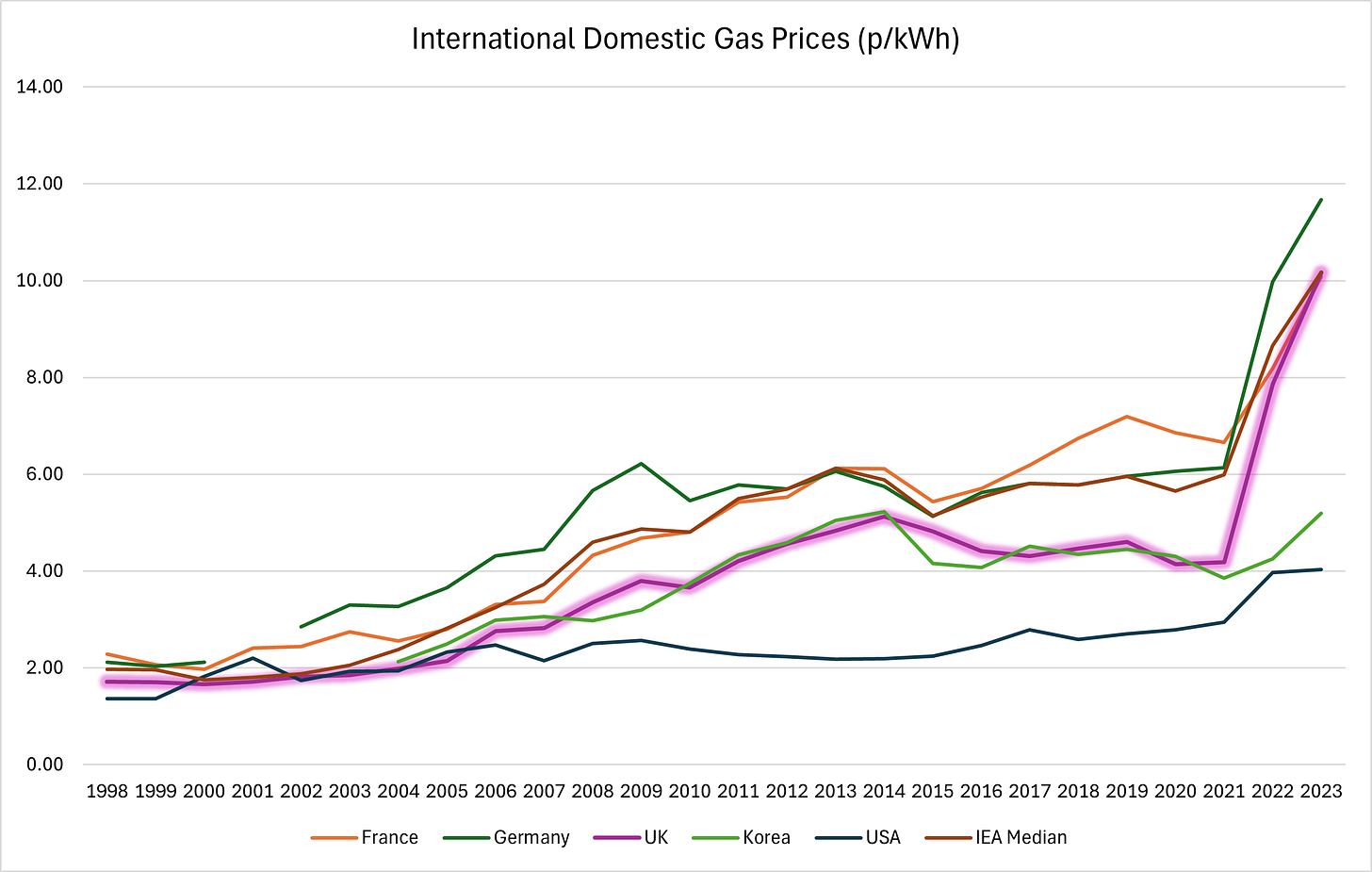

Domestic gas prices (Table 5.9.1) paint a similar picture to industrial gas prices as shown in Figure 3.

Figure 3 – International Domestic Gas Prices (p per kWh)

Figure 3 – International Domestic Gas Prices (p per kWh)UK prices are at the IEA median of 10.17p/kWh, slightly above those in France and a bit below those in Germany. The price differential compared to the US is less pronounced, but domestic gas prices in the UK are still 2.5 times those in the US and roughly double those in Korea.

International Domestic Electricity Prices

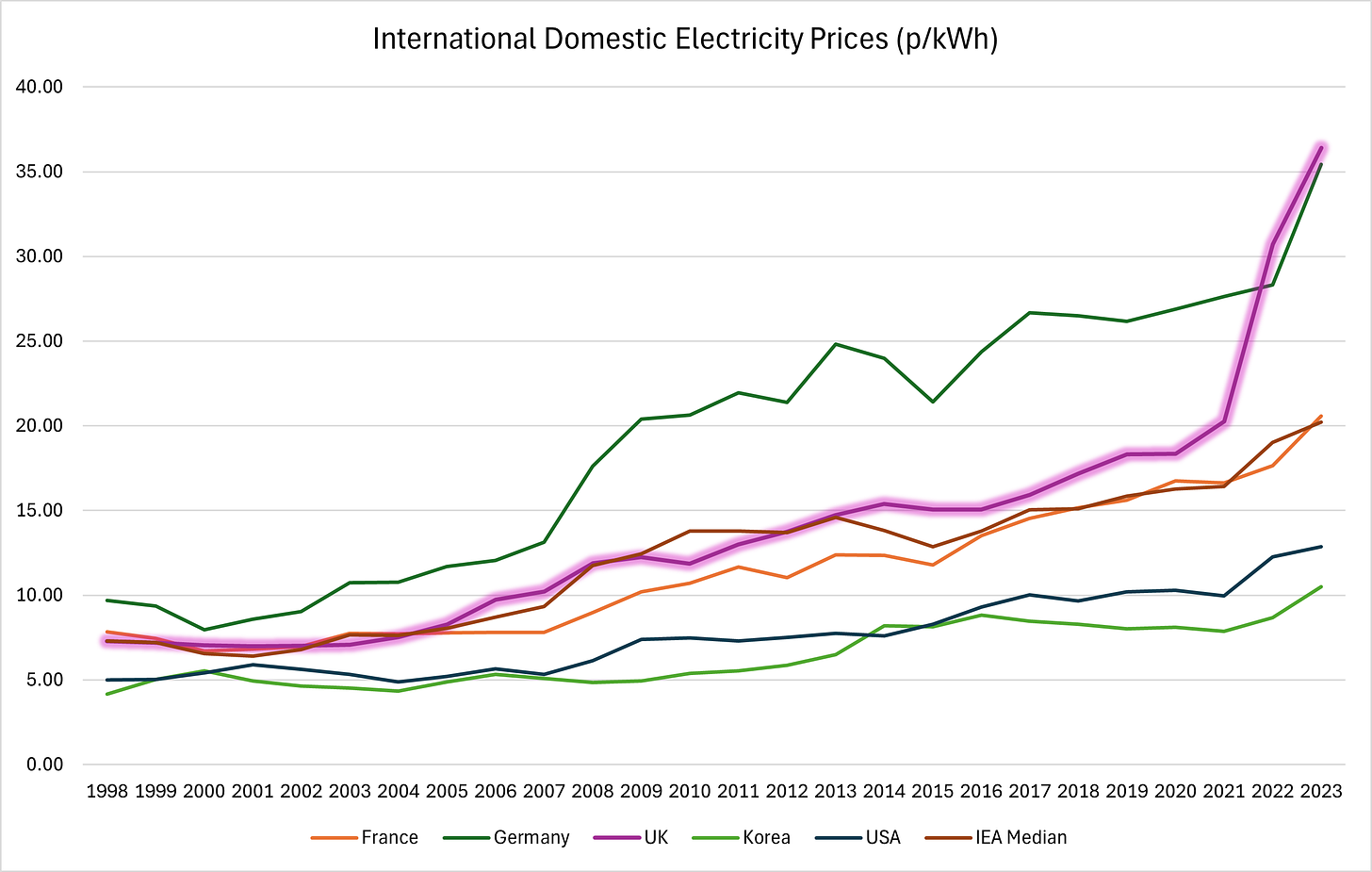

Sadly, UK domestic electricity prices (Table 5.5.1) are even worse than industrial prices when compared to the IEA median, as seen in Figure 4.

Figure 4 – International Domestic Electricity Prices (p per kWh)

Figure 4 – International Domestic Electricity Prices (p per kWh)At 36.39p/kWh the UK has the highest domestic electricity prices in the IEA, some 80% above the median of 20.22p/kWh. UK prices are 2.8 times those of the US and 3.5 times prices in Korea. Prices in Germany are slightly lower than the UK, with France’s prices just above the IEA median at 20.57p/kWh.

Conclusions

What are we to make of all this? When it comes to gas prices, the UK is reasonably competitive compared to the IEA median. However, there are many countries with much lower industrial gas prices, notably the US and Korea.

However, when we turn to electricity prices, the UK is woefully uncompetitive in both industrial and domestic markets with the highest prices among the 28 countries covered by the IEA. This level of price differential is an existential threat to the economy. Moreover, with gas prices around the median level, it cannot be gas that is driving the UK’s electricity prices well above those of international competitors.

As discussed previously (here and here), it is the ~£11bn of renewables subsidies, £4.6bn of carbon taxes in the form of the Emissions Trading Scheme, £2.5bn of grid balancing costs and £1bn of capacity market costs that are driving electricity prices skywards. There is an extra £112bn of transmission network costs in the pipeline to connect remote, intermittent renewables to the grid that will continue to push up prices.

Sadly, the Government has made a decarbonised grid by 2030 one of its five missions for Government. Pushing even more renewables on to the grid is bound to increase electricity costs even further, crushing our competitiveness. This is in direct contradiction to Labour’s number one mission of increasing economic growth. As discussed earlier, these two missions are incompatible; we cannot have top tier growth with the highest electricity prices in the developed world.

Having the highest electricity prices in the world ought to trigger a national emergency response. The Government’s primary mission should be to cut energy prices because cheap energy is the key to unlocking growth. They should focus first on ending subsidies for renewables and cancelling any further auction rounds. This would stop the rot at source. Second, they should abolish the Emissions Trading Scheme to bring down the cost of gas-fired generation. The Government would then need to invest in new sources of gas supply by encouraging more North Sea drilling and lifting the moratorium on fracking. In the longer term, there should be a renewed focus on nuclear in the form of conventional reactors, small modular reactors (SMRs) and advanced reactors. These will need to be supplemented by gas-fired generation for the time being until nuclear is able to respond effectively to rapid changes in demand.

We can but hope that reality dawns on the Government before the economy collapses under the weight of Net Zero.

STOP THE PRESS: We’re going to have to wait a long time for reality to dawn because the Government announced on Friday plans to spend £22bn of our money on carbon capture and storage which will reduce efficiency and push up the costs of gas-fired electricity even further. Will the last person to leave Britain please blow out the candles, because there won’t be any lights left to switch off.

–

David Turver is a retired consultant and CIO who now writes on energy and Net Zero.

–

This article was originally published on David Turver’s Substack, Eigen Values.