The public is dangerously misinformed on energy policy

SUGGESTED

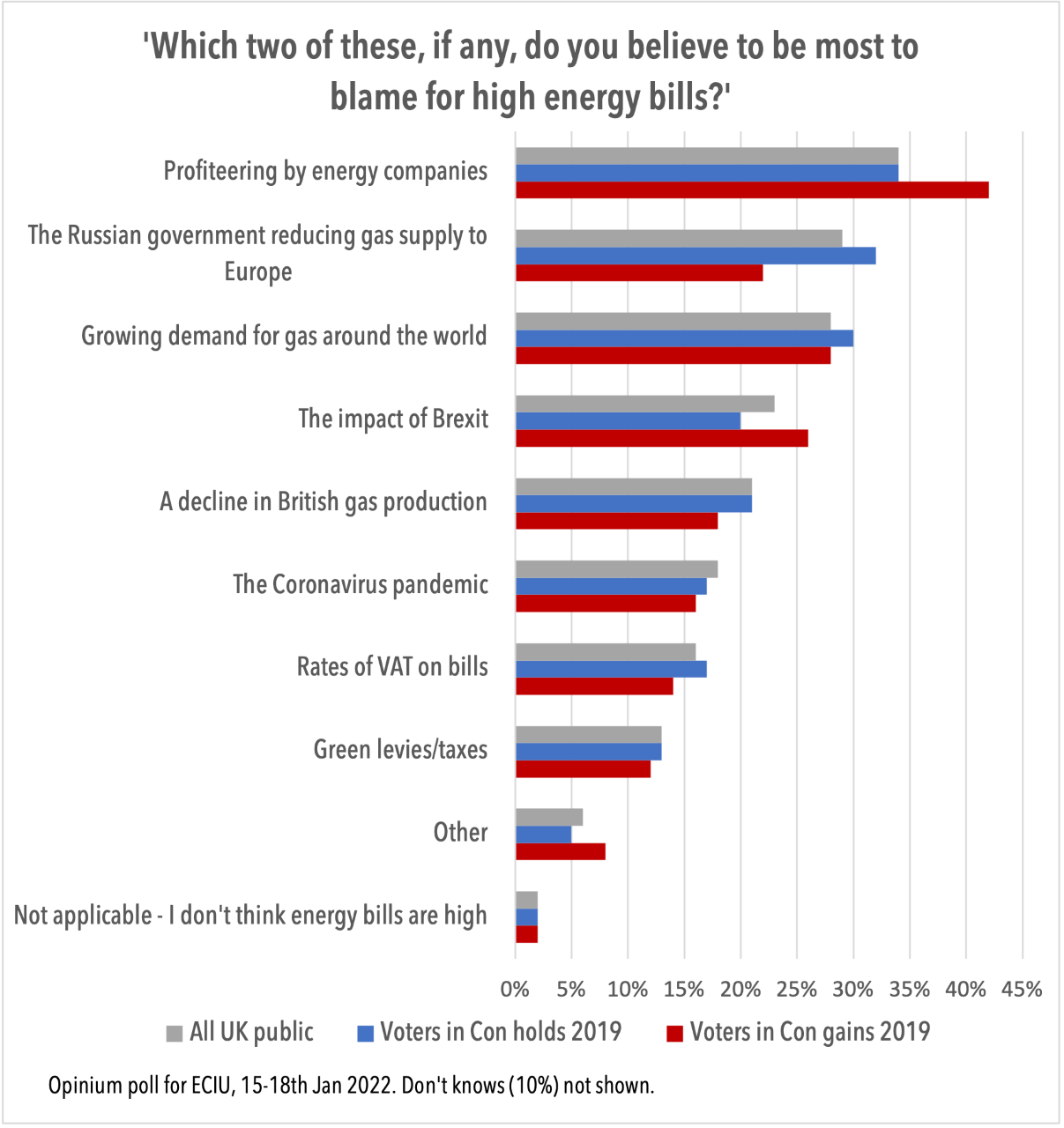

They asked, ‘Which two of these, if any, do you believe to be most to blame for high energy bills?’ The top choice, especially in the ‘Red Wall’, was ‘Profiteering by energy companies’.

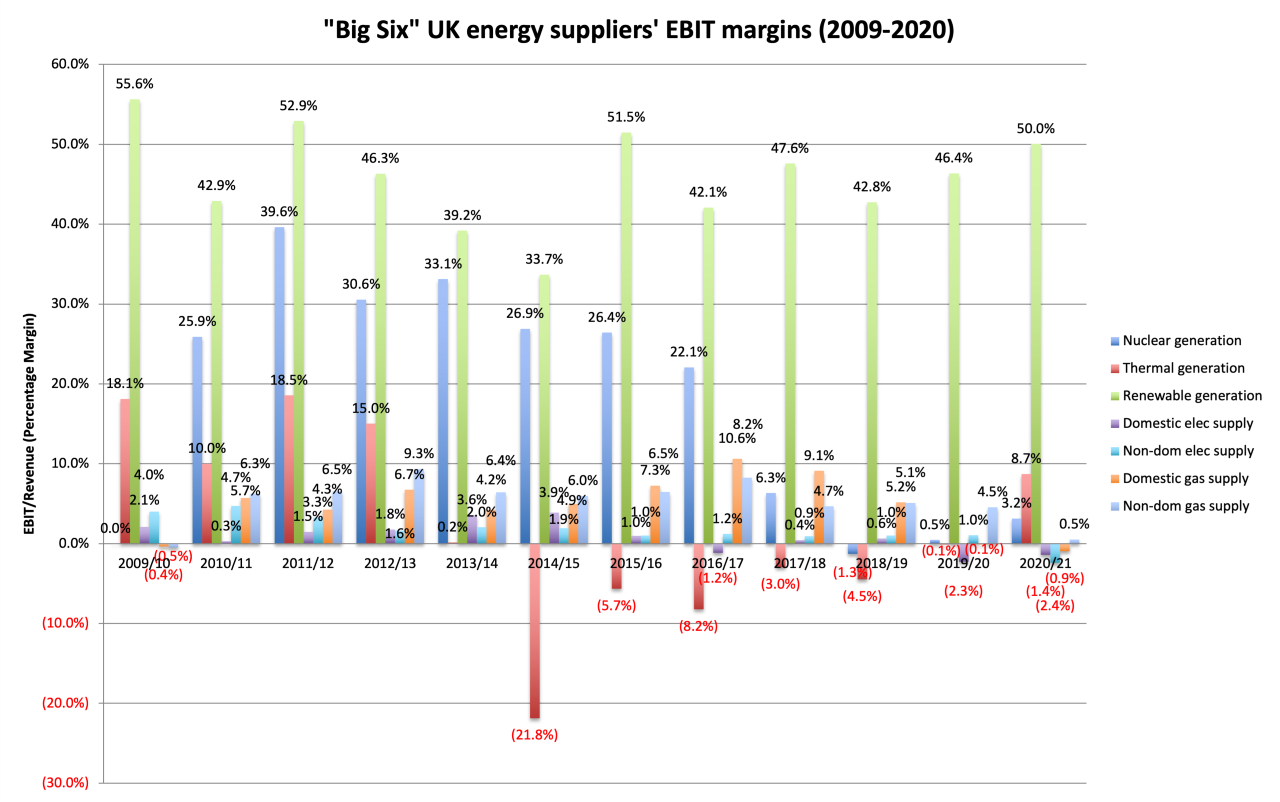

From 2009, Ofgem required the big energy companies (generators and suppliers, not network operators) to provide a summary of their annual accounts in a fairly prescriptive format: Consolidated Segmental Statements (CSSs). There were a number of flaws, some of which Ofgem has recently considered correcting. But in the round, it was a useful contribution to market transparency. Do the published figures (based on audited accounts) correspond with people’s beliefs?

The obvious symptom of profiteering (and of a market with limited competition) would be persistent high margins. The CSSs include figures for EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) and EBIT. We can calculate the overall margin on an activity by comparing these figures with the Total Revenue. The activities for which these figures are given are:

- Electricity Generation

- Nuclear

- Thermal (e.g. coal and gas)

- Renewables

- Electricity Supply

- Domestic

- Non-Domestic

- Gas Supply

- Domestic

- Non-Domestic

EBIT is better than EBITDA for these purposes, because Depreciation and Amortisation are particularly significant for some types of generation. Below is a chart of the EBIT margins by activity over time.

Electricity and gas supply

Energy companies are most often accused of profiteering on the supply of energy. The supply activities actually have pretty low margins.

Electricity supply has very low margins. The margins on gas supply are more normal, but they are under pressure. The average across all companies conceals many losses for individual gas suppliers, out-weighed by Centrica’s (i.e. British Gas’s) fading dominance and reliable profitability in this area to date.

Supply margins were low before the energy price cap was introduced, contrary to the reasons given for the price cap. They have since been driven negative. This is unsustainable. Smaller suppliers have been driven out of business en masse by the squeeze between an inflexible price cap and rising wholesale costs. Larger suppliers were able to lean on the profits from their other activities to allow them to survive this culling of their competition. The price cap has been unjustifiable, ineffective and a disaster for competition.

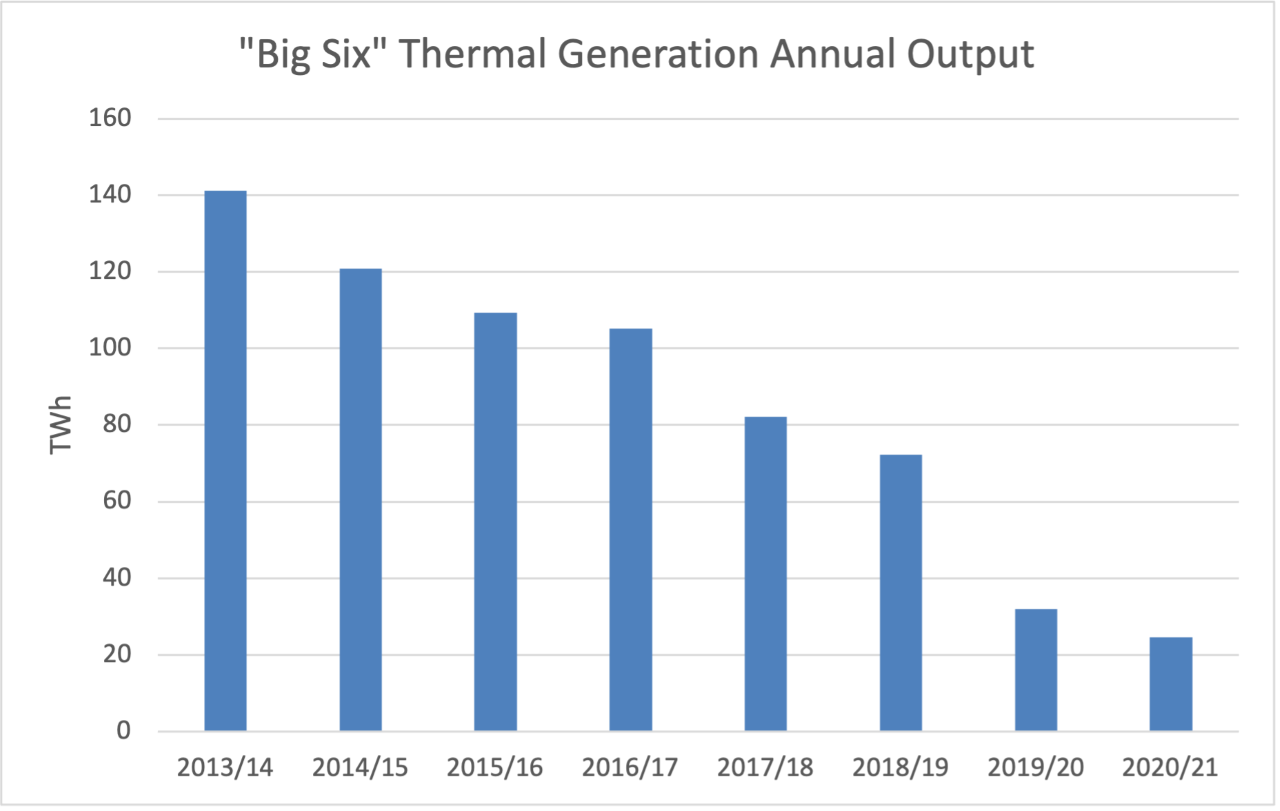

Thermal generation (gas & coal)

There was a sea-change around 2013/14 in the profitability of thermal generation. Before that, the margins were generous (not every company separated their generation into these categories before that, so the figures may be boosted by the inclusion of some renewables). Since then, the activity has been largely loss-making. 2020/21 may be a sign of recovery, or it may have been a blip. Covid-19 and then the energy crisis will make it hard to tell for a while.

Ultimately, this is small beer, because the profitability is a function of the volumes as well as the margin. The system services provided by thermal generation are no longer being supplied primarily by the Big 6. RWE, E.ON and ScottishPower are out of thermal generation altogether (RWE is out of the UK market more generally), and EDF and Centrica have significantly reduced their output. Apart from SSE, and EDF/Centrica’s nuclear contribution, maintaining stable supply on the network is no longer a major role for the Big 6.

Nuclear

Nuclear used to enjoy high margins, but they have faded to very little in the last few years. The performance of the ageing fleet is declining. Several of the nuclear power stations are being closed in the near future.

Renewables

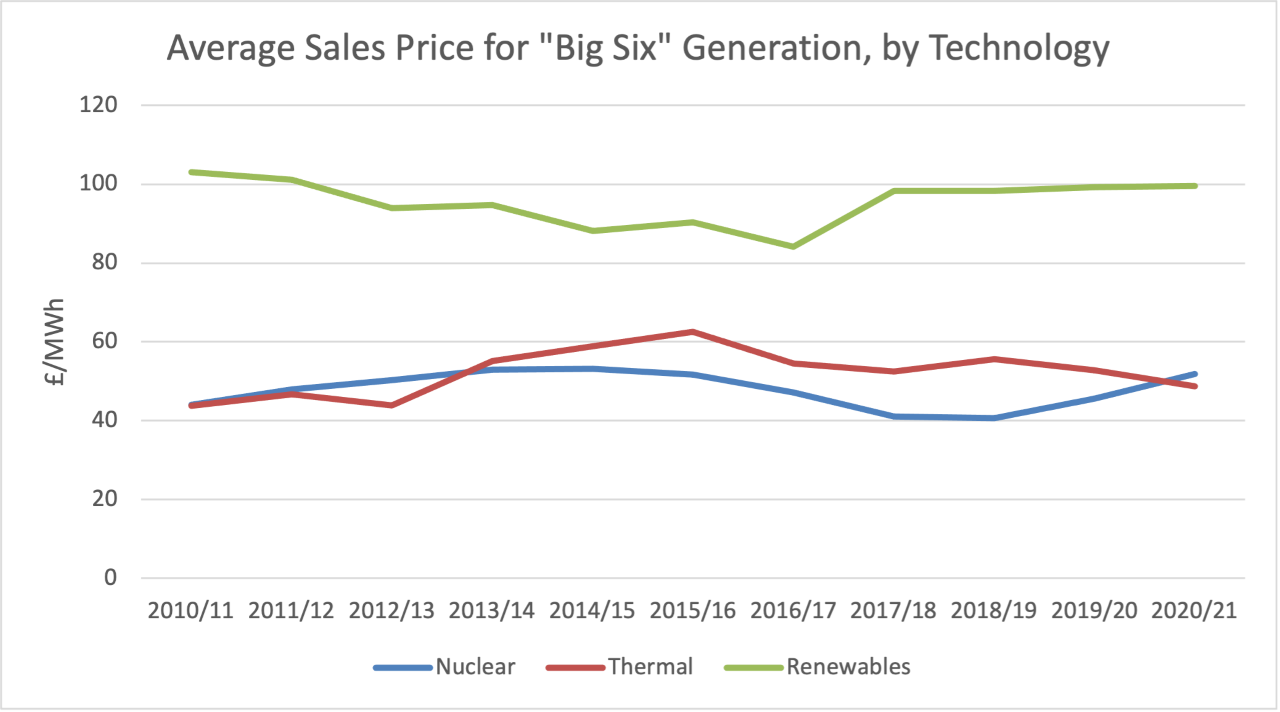

Renewables enjoy a persistent very high margin, implying an absence of competition and a miscalculation of the large subsidies that they receive.

We cannot accurately identify the contribution of subsidies to this margin. The persistently high average sales price indicates that subsidy and wholesale value are wrapped up together in the sales revenue. As some of the subsidy mechanisms give an encompassing price, this is inevitable, but harms the transparency.

However, we can get some feel for the levels of subsidy by comparing the average sales prices for the different technologies.

The wholesale value of the electricity (e.g. excluding environmental and social values) should be similar regardless of technology in each period. There might be a difference in the weighted average between high- and low-value periods (this probably explains the gap between thermal and nuclear generation). This would not favour renewables, because periods of higher production coincide increasingly with periods where the market is long. The difference between the average sales prices for renewables and for thermal and nuclear generation is therefore an understatement of the values attributed to their social and environmental benefits, whether through subsidy or through the market (e.g. REGOs).

The subsidies look grossly oversized. This is a straightforward transfer of rent from energy users to the big energy companies. As renewables have taken a larger share of total generation, this has had an increasing impact on retail electricity prices.

Environmental & social, network and other system costs

Generation values do not reflect the full costs of decarbonisation to the UK’s energy systems. Most of the environmental & social, network and other costs fall on suppliers rather than generators, so that the cost of the electricity produced by the generators can seem relatively low, while the retail costs keep increasing.

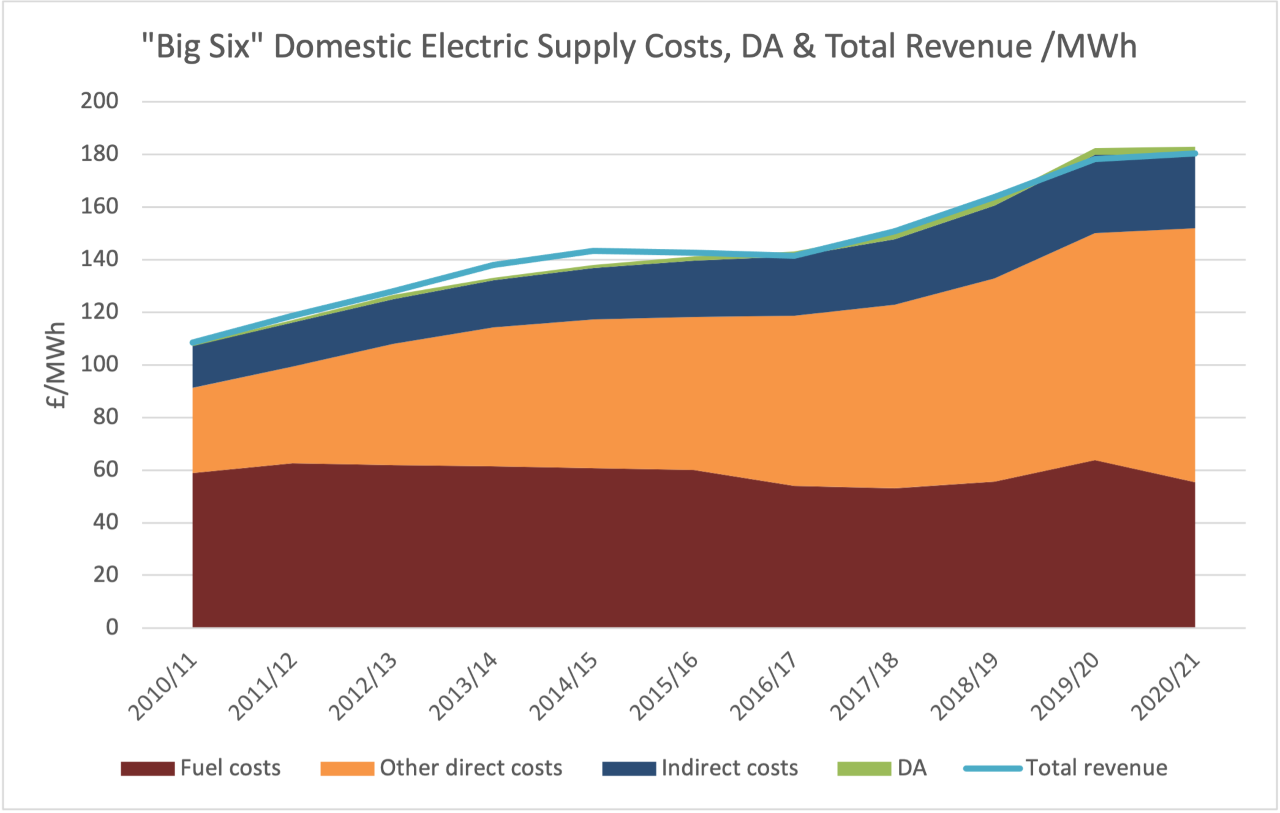

If we look at the Big 6’s costs as suppliers, their fuel costs (i.e. electricity bought from generators including themselves) are flat, but their other (Enviromental & Social, Network, Indirect etc) costs have been going up sharply. Their revenue is barely keeping pace, implying minimal to negative profits.

Some people like to pretend that the system and subsidy costs of the UK’s decarbonisation policies are not high, by cherry-picking the costs that they look at. But in the round, it is clear that the burden has been increasing significantly, long before the energy price crisis. It is hard to attribute this to anything other than the change in the UK’s electricity systems being driven by government policy.

Conclusions

Energy companies are not angels. As their margins on renewable generation illustrate, they will lobby hard for rent, and take it when they can get it.

But competition presses down on profits where government privileges don’t construct a “moat” for them. In all parts of the energy market except for renewables, competition has prevented “profiteering”. It is ironic that they mainly profiteer on the part of the energy system that the public think is the main solution to the energy price crisis.

Competition has not prevented retail costs from rising, from £108/MWh in 2010 to £180/MWh in 2020. But that increase reflects costs passed on from the energy companies to their customers, not increasing margins. Those costs are largely attributable to the changes in our energy systems that the UK government has been driving.

These changes, though substantial, are just the background to the recent increases. Those occurred since the most recent CSSs were published. The proximate cause was the sharp rise in spot gas prices. The underlying reasons are a big subject for another article. But passing those costs on is no more profiteering than was passing on the rising costs of the past decade. Many went bust because they could not.

Nevertheless, there is a risk of future profiteering. The failure of half the energy suppliers (with most of the rest teetering), has radically reduced competition, and increased the pressure on the authorities to control the market.

There is confusion between spot prices and average prices for fuels. The high prices were for the marginal volumes that had not been forward-contracted. The average fuel costs were lower. This confusion creates opportunities for rent if the government can be persuaded to reflect it in an institutional inefficiency (e.g. via the price cap), as they did in the Pool (the original, post-privatisation electricity market)

There is every chance that forward prices will still be lower than spot prices next year. Gazprom increased its production in 2021, honoured all contracted volumes, and supplied roughly the same amount of gas to Europe as in 2020. It is just that Europe underestimated its requirements and needed to buy more than anticipated in the spot market from Summer 2021 onwards. Given the increased competition for the marginal, uncontracted gas (e.g. from China), and the inelasticity of demand (because of systemic gas dependencies that European governments have created through their energy policies), spot prices surged.

Forward contracts will no doubt reflect this market tightness, but (barring major geopolitical upheaval) not to the level of the recent spot prices. The price-cap revision for Spring 2022 seems to be allowing for a disproportionate impact from an elongated price spike, as though energy companies can’t reduce the impact of spot prices next year by buying enough gas forward to avoid a repeat of this year’s tensions. Or is there something in Europe’s energy systems that makes it more difficult to anticipate the demand for gas than it used to be?

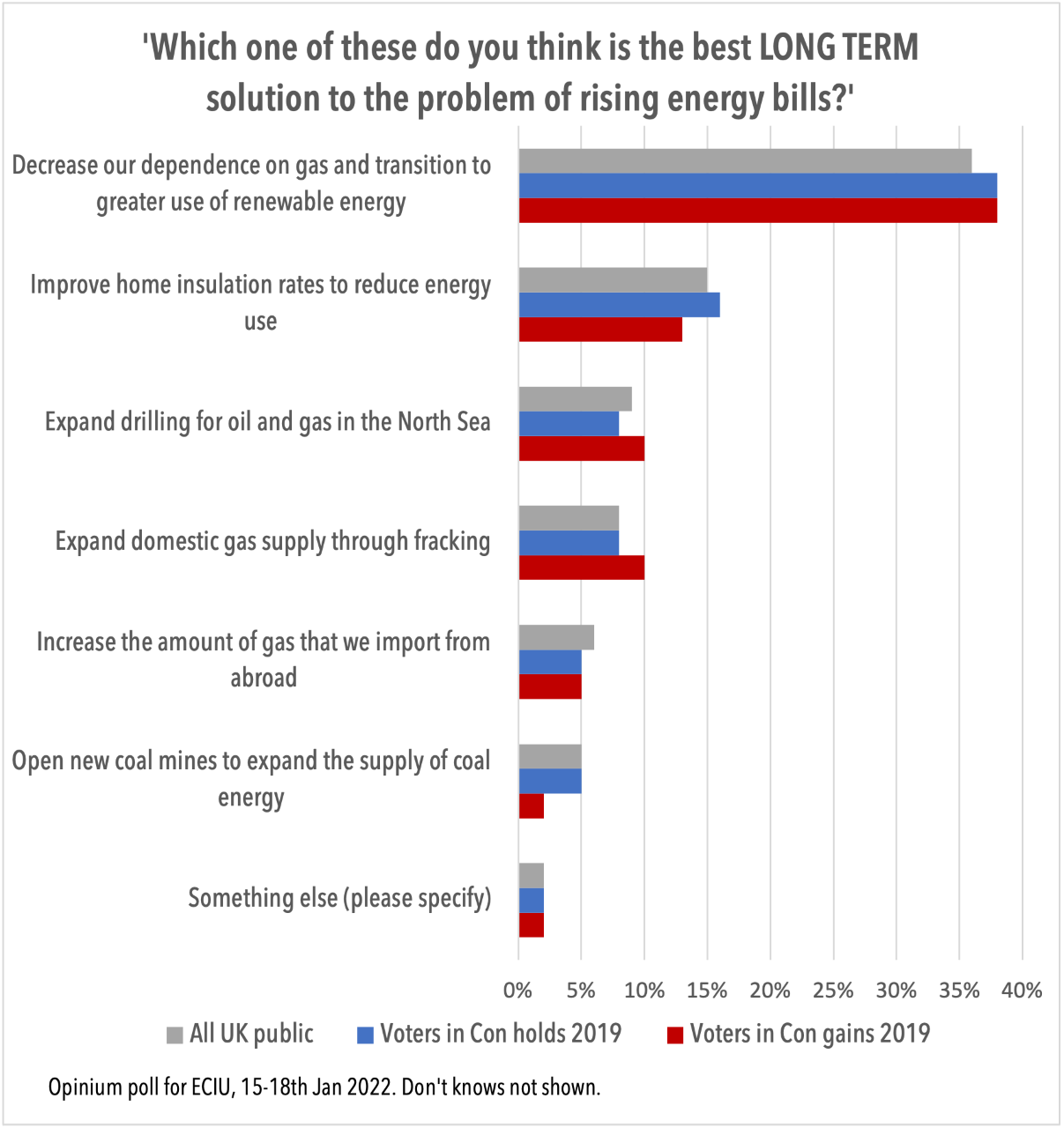

The Opinium/ECIU poll was interpreted by those who favour the UK’s long-term winner-picking approach to decarbonisation as evidence that critics of that policy had misunderstood public opinion. Perhaps those critics understand public opinion, but also understand that it is woefully misinformed.

What this poll really highlights is that political control of economic planning is a disaster.

2 thoughts on “The public is dangerously misinformed on energy policy”

Comments are closed.

I hope to read that full article you allude to on spot prices. It would be very interesting to get a feel for the shift from forward market to spot buying in Europe, how much this might be an increasing trend with the shift to renewables (reading between the lines?), and how much of the price rises this accounts for. If it is an inevitable outcome of the shift to renewables, can we eventually expect the reduction in overall gas demand to offset the effect of greater spot market dependence?

Agree on so much there, Bruno. The profits for energy companies as an issue and the suggestion they should be nationalised really has ignored reality. I also agree on costs for renewables, to a point. They have been subsidised massively, and we all pay for that. (I can’t tell how/if ROCs, etc. are priced in there? FiTs are paid by the suppliers, I think.) Won’t the prices for energy drop in medium term as the ROCs, etc. drop out and the simple and effective CFDs drive competition? The last offshore wind round went at £39 and because it is a CFD, can’t rise. New renewables get cheaper every year and the old ones will have very low costs once their financing and subsidies drop out after 20 years.

This, combined with regulatory changes should make the market more open and energy ever cheaper. By the 2030s, in an increasingly all-electric world, energy prices will be dropping continually. Energy becoming like processing power rather than a fluctuating commodity, unleashing huge economic opportunity. That is an exciting world for free marketeers.

It is not much consolation today, but there is a wonderful future.