The government’s ‘temporary’ energy price cap is bad economics

SUGGESTED

Is the price cap justified? The main accusation is that customers on standard variable tariffs often find themselves on higher rates than they could find if they shopped around and switched regularly. To which, free-market commentators have already responded: so shop around then.

It is a fallacy that markets necessarily reward loyalty. They may well reward those whom suppliers cannot take for granted. Are these customers loyal or apathetic? I don’t switch regularly, and I know that is not out of loyalty to my current supplier. Where I have a genuine loyalty to a supplier, it is because I know I get things from them that I am not confident of getting from others, and am consequently willing to pay a premium. Apple have made a very successful business out of this kind of loyalty. Should we cap the prices of Apple products because too few of their customers switch to cheaper alternatives? Loyalty that is contingent on cost competitiveness is not loyalty.

In effect, the higher tariffs for apathetic customers reflect (a) their valuation of the opportunity cost of the time required to shop around, (b) their high personal discount rates, and (c) uncertainty. The savings may appear to exceed the value of the time required to achieve them, but many people subjectively value their present time more highly than future savings, particularly if they think there is a fair chance that better deals will be available in future.

Consumer protection legislation that limits price or product undermines differentiation and competition. If government promises to ensure consumers get the best deal, it kills caveat emptor. The value of differentiating on service, quality or other features is diminished, and the market tends towards a lowest common denominator. “The ultimate result of shielding men from the effects of folly, is to fill the world with fools.” Government’s role in protecting consumers should be limited to ensuring that they get what they were promised (i.e. trading standards and tort law).

“That’s all well and good in theory in an efficient market”, comes the reply, “but this market isn’t working. It’s not competitive.”

Really? Ofgem counted 54 domestic energy suppliers in March 2017, up from 10 in December 2006.

-Ofgem

“But domestic energy is expensive. If there is competition, it isn’t working.”

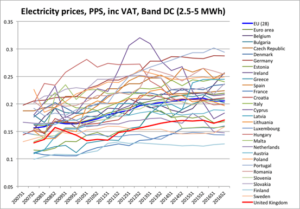

Really? According to Eurostat data, our domestic electricity is 6th cheapest in the EU.

–Eurostat

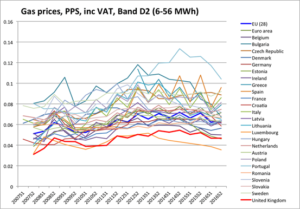

And our domestic gas prices are third cheapest in the EU.

–Eurostat

Other bands, of different annual consumption volumes, would show similar results for both gas and electricity.

The UK’s prices are particularly low including all taxes and levies, because we apply particularly low rates of VAT to domestic energy. But (a) the price including taxes and levies is the cost that matters to consumers, and (b) excluding taxes and levies, we are still below the EU average for most bands.

“But prices are still more expensive than necessary. The Big Six are profiteering at the expense of domestic consumers.”

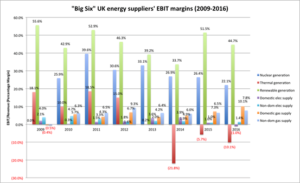

Really? The Big Six have to submit “Consolidated Segmental Statements” annually to Ofgem, showing the outline financials of the different aspects of their businesses. From these, we can see that their profit margin on the supply of domestic electricity over the past 7 years has been 1.5%.

They have done a little better on domestic gas – around 5% margins – and those margins have risen over the last couple of years. When viewed in detail, British Gas, and to a lesser extent the two Scottish suppliers, have been the main beneficiaries, i.e. the incumbents. There appears to be some stickiness. But the combined margins on domestic energy supply are around 3% – not exactly ‘profiteering’.

It’s not that there is no profiteering. The chart makes it clear where that is occurring – on the generation of renewable and nuclear electricity. Not coincidentally, these are the areas where the Big Six are in receipt of significant government subsidy. Most of those subsidies go to technologies, such as nuclear and offshore wind, that smaller companies could not realistically invest in. These are examples of magnificently successful rent-seeking by the vertically-integrated large energy companies. But as any economist could have predicted, ongoing excess profits depend on naive interventions by government. Without government intervention, profits attract competitors that reduce margins in due course.

If the Big Six energy companies retain a large (if falling) proportion of the market and enjoy low margins on supply to domestic customers, how do we square that with tariffs for apathetic customers that are significantly above tariffs for active switchers? The majority of customers are apathetic, so those low margins cannot conceal high margins on the static majority and low margins on an active minority. The low tariffs for switchers look like loss-leaders, aiming to attract enough new customers to hold market share against the inevitable churn in the market.

Can price controls drag the tariffs of the majority down to the levels of the loss-leaders available to the active minority? Clearly not on a sustainable basis, given the minimal margins. One would expect the effect to be a levelling, where (by weight of numbers) the standard tariffs are reduced only a touch, while the tariffs for switchers are increased significantly.

The Big Six, with protected profits on their renewable and nuclear assets (and some stickiness amongst their gas customers), will be able to lean on their profits in the rest of the business to squeeze margins on domestic supply if they want to. The government may want them to, in order to show results from the cap. What should other suppliers, without subsidised profits, do in that case, as margins get squeezed from minimal to non-existent? The perverse effect of energy price controls is likely to be a reduction in competition, and a retrenchment of the market power of exactly the companies that the government believes to be at fault.

What will be the structure of this market when this “temporary” measure expires in 2023? Probably fewer suppliers, and a greater investment aversion because of the heightened regime uncertainty fostered by this measure. The government may have to choose between ending the price controls and unleashing the enhanced market powers of an entrenched oligopoly, or perpetuating the “temporary” measure. Nothing is so permanent as a temporary government program.

1 thought on “The government’s ‘temporary’ energy price cap is bad economics”

Comments are closed.

This is a live argument in Australia as well as the UK. There has been a public loss of faith in the market to deliver promised benefits. Mr Prior’s economic arguments (and cute quotes) don’t do justice to the problem. The arguments put forward are all unexceptional in the context of ‘normal’ markets. But this is not a normal market. It is a market for an essential service. The best definition I have for an “essential service” is one where demand is involuntary, largely inelastic (at least in the short run) and there are no substitute services. These conditions impose little competitive discipline on the supply side which can continue to incur inefficient costs which are simply passed through in prices. Competitors become caught-up in out-spending their rivals (eg. marketing costs) rather than focusing on lowering their own costs. It becomes an arms race which benefits no-one — least of all, customers.