The Daily Mail’s “energy mercantilism” is deeply misguided

SUGGESTED

“UK gas exports sourced from the North Sea and the Irish Sea double in a year… even as millions of British families face soaring bills amid record high wholesale gas prices” shrieked the Mail headline.

“So what?” a classical liberal is inclined to reply. “The oil producers are free to sell the gas to whomever wants it most, reflected in the price they are willing to pay. If continental consumers were willing to pay more for some of our gas, they probably needed it more. The gas goes where it’s most needed, and the profits pay corporation tax and supplementary charge to the UK government.”

But you don’t have to be a classical liberal to see through the Mail’s mercantilism. John Baldwin of CNG Services has highlighted key fallacies in the narrative spun by Richard Black of the Energy and Climate Intelligence Unit (ECIU), who seem to have been the Mail’s source . They are not telling the full story.

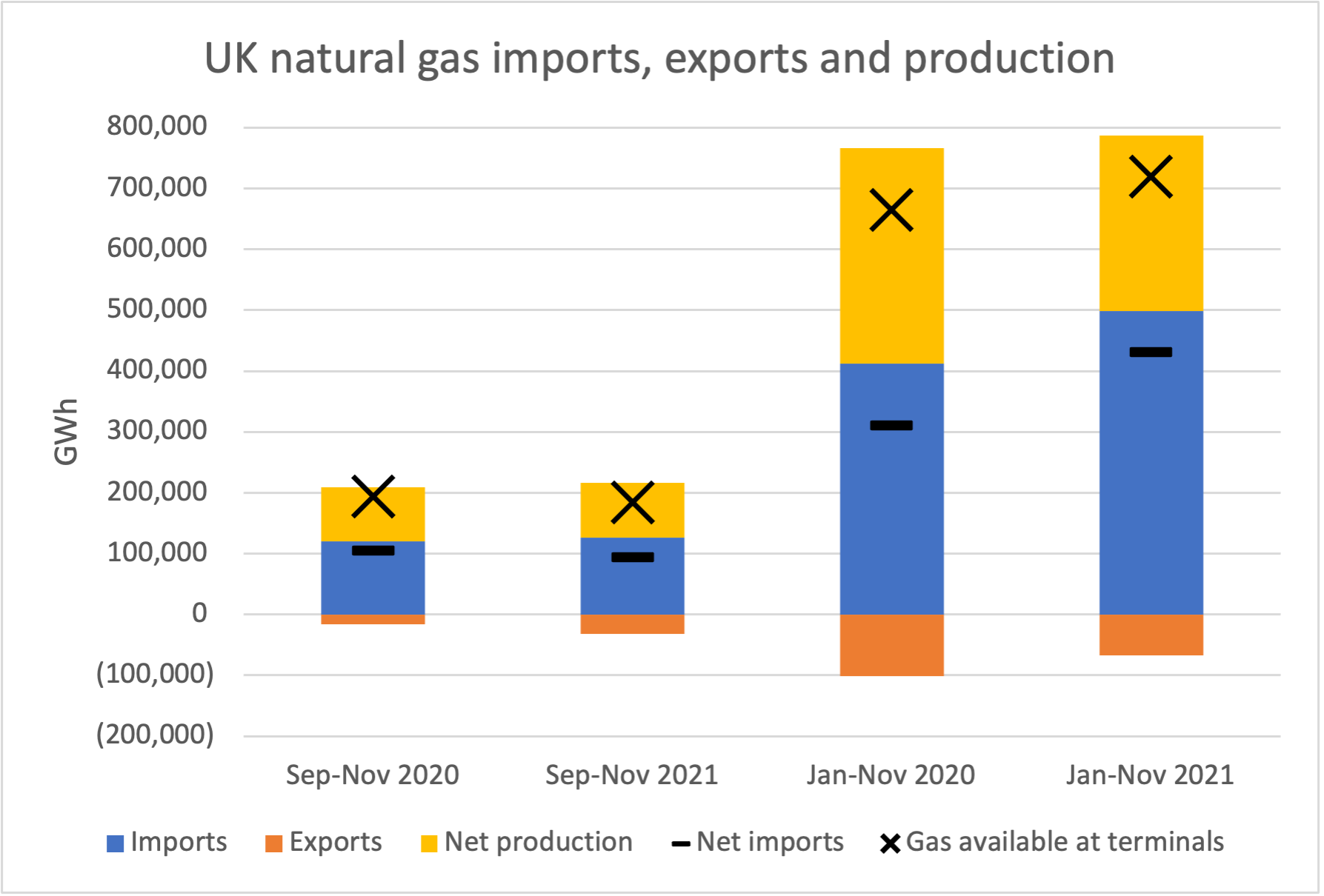

The UK produces a lot less gas than it uses. It imports gas to make up the difference, either via pipelines with the continent, or via LNG terminals. The pipelines with the continent flow both ways. Some gas is exported. However, our imports greatly outweigh our exports. It is misleading to focus on the exports without considering imports, production and the net position.

| Jan-Nov 2021 | GWh |

| Imports | 498,979 |

| – via pipelines | 357,698 |

| – via LNG terminals | 141,281 |

| Exports | 67,319 |

| Net imports | 431,660 |

| Gross production | 326,534 |

| Producers’ own use | 38,327 |

| Net production | 288,207 |

| Gas available at terminals | 719,867 |

In the three months (Sep-Nov) considered by the Mail and the ECIU, while exports increased from 15,830 in 2020 to 31,964 GWh in 2021, imports increased respectively from 120,361 to 125,723 GWh. Net imports therefore declined by 10,741 GWh, but the UK was still clearly a net importer. Production increased marginally from 100,494 to 102,296 GWh. Gas demand from the transmission network fell by 13,853 GWh. In other words, allowing for other minor factors (biogas, system losses, stock adjustments, etc), the UK marginally adjusted its balance of production, import and export to match the level of demand, and had a bit to spare to sell to the continent. Shock, horror!

Two-way flows benefit both ends of the pipeline, allowing the gas to flow to where it is most needed. As it happens, in the year to end November 2021 (the most recent data available), we imported more gas (42,710 GWh) over the two main continental pipelines (with Belgium and the Netherlands) than we exported (28,894 GWh). At other times, the balance flows the other way. If we were to take the attitude that we shouldn’t sell them any gas if the market is tight, what are the chances that they would (a) agree to build interconnectors in the first place, and (b) sell us their excess when we needed it more than them?

All of this is dwarfed by our imports from Norway (314,989 GWh) and via the LNG terminals (141,281 GWh). These imports are not balanced by exports. Do the ECIU and the Mail object similarly to Norway and the LNG producers sending us so much gas in a tight market? Or do they like trade in that case, but hope somehow we can trade in only one direction when it suits us?

So would a windfall tax be justified, then?

Actually, the level of imports, exports and production has little to do with it. A tax on the production of something is a disincentive to produce it within that country. But it is not a disincentive to consume within that country, so what a production tax does is skew the market to favour imports over native production. That is not usually a desirable outcome, so governments should normally avoid production taxes whatever the state of play in the industry. It is particularly undesirable to discourage native production in a tight market that has driven up the price of the product. A windfall tax on UK oil and gas production to claim some of the benefit of rising prices for the government coffers is intuitive but wrong.

If the government thinks it should raise money from oil and gas and discourage their use, it would be more sensible to tax the consumption of oil and gas. Or it might tax production and imports equally, which amounts to roughly the same thing, but with some practical advantages (it captures exports too) and disadvantages (it is complicated by trade rules and agreements). Either way, money is raised equally from native production and imports, and does not discourage the former more than the latter.

The UK does that already, of course – a lot on oil and a little on gas. That imbalance is also irrational, and skews the relative incentives to economise on oil (primarily vehicle efficiency) and gas (primarily building efficiency). It could usefully be eliminated, but through equalising consumption taxes, not by a windfall tax on UK gas production.

Windfall taxes have another negative impact, regardless of the rationality of the established tax regime. When you invest, you face risks that the value or output of your product will disappoint. If you take the risk, it is because you think the good periods are likely to outweigh the bad. If a government is seen as one that might levy arbitrary taxes when times are good, the risk calculation is altered. Investment is deterred. This is regime uncertainty – arguably one of the biggest factors in the productivity puzzle. Interventionist governments increase the likelihood that the business model is undermined before the investment is recouped, regardless of (in fact, exacerbated by) any “pro-business” measures that they typically also implement.

It’s hard to feel too sorry for the oil and gas industry, though. They have been as guilty as any of lobbying for special treatment based on the economic conditions. If you argue that certain tax burdens should be lifted because market conditions have worsened (rather than because they were simply irrational all along), you cannot really complain when governments believe the reverse is also true, and that additional taxes can be levied when conditions improve. We should avoid windfall taxes because they are bad for the economy, not out of sympathy for the fossil-fuel producers.

The main lesson of this statistical abuse is nothing to do with windfall taxes. It is a reminder that we should be careful what we believe. We should be deeply sceptical of howling headlines in the Mail (or other media). We should not fool ourselves that an organisation like the ECIU is somehow more independent, impartial or trustworthy because it tends to conform with the bien pensant narrative. If anything, that is the most motivated and well-resourced narrative, and therefore deserves the most scepticism.