The Case For Markets in Defence: Driving efficiency and effectiveness in military spending

SUGGESTED

Contents

Preface

The conflict in Ukraine shows that, yet again, we do not live in a peaceful world. Defence economics studies the costs of war and peace. The Ukraine conflict illustrates the costs of conflict and the economic benefits of peace. The costs of conflict in Ukraine are seen directly and indirectly. They involve the deaths and injury of military and civilian personnel and the use and destruction of military and civil equipment and infrastructure. The direct costs are shown on TV nightly in the form of the destruction of cities, towns and villages, roads, bridges, communications, houses and public buildings. Some of these conflict costs are shown in the Data Appendix. But there are further costs of this conflict felt by the Ukraine population through the loss of their freedom and liberty, the continued Russian air strikes, the need for protection and their starvation. The Ukrainian population is forced to live in shelters without lighting, heating and water supplies. There is more, reflected in the large-scale migration of refugees who have sacrificed their lives, families and friendships and have had to leave their nation state and move to foreign nations. These constitute the costs of conflict which are not new.

Similar costs arose in World War II during the Nazi Germany occupation of much of Europe. The occupied countries were treated as slave states whose populations lost their freedoms and liberties; they were starved; and some were used as forced labour compelled to work overseas in inhospitable conditions (e.g. in Nazi Germany underground rocket factories). The occupied countries also suffered the destruction of their infrastructure and housing as well as deaths, injury, torture and prison sentences of both military and civilian personnel. All these formed the real costs of the War most of which were never quantified and cannot be ignored.

This study has a more limited role. It shows how economics can be applied to defence by focusing on the opportunities for creating defence markets and improving efficiency in the armed forces. It shows how the application of economics provides new and different insights into defence policy. Whilst the focus is on the UK, the analysis is general and can be applied to all countries with armed forces and a defence policy. It explores options suggested by economics without necessarily making recommendations. Some options are controversial and are not always suggested as appropriate solutions; but the aim is to show how economics can be used and to clarify its approach and implications allowing a more complete evaluation of alternatives.

Defence and economics are uneasy bedfellows: Admirals, Generals and Air Marshals believe that they are the guardians and custodians of all matters related to defence and security. They do not take kindly to economists, their theories and their interference in their specialist military domains. This is unfortunate and regrettable since both parties have much to offer. Economists continue to point out that the military uses scarce resources which have alternative uses reflected in the classic ‘guns v. butter’ choice. Military personnel have to accept that they have to work with limited resources and that choices cannot be avoided. Also, they might find that economists are not the ‘enemy’ but provide advice which might help the military in their ‘battles’ with the national Treasury. Hopefully, this study helps to bridge the gap between military staff and economists. It focuses on the opportunities for outsourcing all military activities extending to combat missions. Such an extension is presented as a logical possibility designed to provide insights and understanding to identify the limits of outsourcing. What, if any, are its boundaries and why do they exist? Are the boundaries determined by political or military factors; what precisely are such factors; and can they be removed at reasonable cost?

Transaction costs and public goods

Introduction: setting the scene

Armed forces are not usually presented as models of efficiency; they are characterised by inefficiency. Typically, they make rather than buy a variety of goods and services, such as accommodation, training of personnel and repair of equipment (e.g. aircraft, vehicles, tanks, warships). The ‘making’ activity is undertaken by public sector monopoly ‘in-house’ units owned by the armed forces, where these activities are not subject to competition. For example, traditionally the RAF trained its pilots at Flying Training Schools; it provides military personnel to repair and maintain its aircraft; and it accepts complete responsibility over the life cycle for providing and maintaining aircraft for a variety of roles (e.g. air defence, attack roles, maritime patrol, and transport missions). These activities are not competitively tested.

For many years, the UK armed forces were amongst the pioneers in outsourcing many of their ‘in-house’ military activities. Various alternative terms were used, such as privatisation, contracting-out and competitive tendering, where competition was used to award contracts to private firms. Elsewhere, such initiatives were known variously as Private Finance Initiatives (PFIs) and Public–Private Partnerships (PPPs). PFIs were introduced in 1992, but in 2018, the government announced that they were no longer to be used. This study will review the decision to abandon PFIs and assess the opportunities for making greater use of contracts in the armed forces. Defence outsourcing is not limited to the armed forces: it can also embrace activities undertaken by and within the Ministry of Defence. Examples include procurement, finance, personnel and accommodation.

The notion of markets in defence is not widely accepted. An alternative view suggests that defence as a public good should be state financed and state provided, rejecting the suggestion that markets have any role in defence. This study takes the opposite position and argues that the armed forces represent a major opportunity for introducing markets into the provision of military activities. It will be argued that market solutions in defence offer substantial efficiency improvements, cost savings to taxpayers and benefits to the armed forces.

Relevant economic concepts

The study applies simple economic analysis comprising concepts of markets, competition, monopoly, public goods, entrepreneurship, contracts, transaction costs and public choice analysis. The approach provides new and novel insights into defence policy and the armed forces.

Markets are central to economics; they are mechanisms for achieving the efficient allocation of scarce resources between different parts of the economy. Economists start from their model of perfect competition, which is characterised by large numbers of buyers and sellers together with free entry and exit into and from the market, all of which result in an efficient allocation of resources. Such ideal and theoretical markets have only one role for entrepreneurs, namely, deciding which market to enter. All other choices are made by the perfectly competitive market (e.g. choice of product and production techniques, etc.). Examples of perfectly competitive markets include agricultural markets and foreign exchange markets. These markets also identify opportunity costs, such as the price of the nuclear deterrent in the form of the sacrifice of alternatives such as fewer schools and hospitals, and higher taxes (guns v. butter trade-offs).

Real-world markets depart from the competitive ideal in that they recognise that real entrepreneurs are faced with a variety of choices about which products to produce, using which production techniques, and what price to charge, all in the pursuit of profits in situations of uncertainty. If they are successful in identifying new market opportunities, they achieve their profit goals; otherwise, they lose money and move on to other activities.

Transaction costs are central to understanding defence markets. They determine the presence or absence of markets, with the armed forces having to decide whether to undertake activities ‘in-house’ or use markets (i.e. make rather than buy).

Transaction costs are the costs of running the economic system: the costs of doing business. They consist of the costs of searching to find products and suppliers, the costs of negotiating a contract for exchange and the costs of policing and enforcing contracts, including after-sales activities. High transaction costs prevent markets from working, and low transaction costs encourage transactions (e.g. the Internet promotes transactions).

Transaction costs are reflected in the institutions that emerge to undertake business. Examples include various forms and sizes of firms (e.g. vertical integration; small and large firms; different types of business organisation) and the choice between ‘make’ or buy. Firms can decide to make an item or buy from existing suppliers in the market, with contracts being a central part of this choice. Contracts determine the terms of trade between buyers and sellers: they determine what is produced, when and what happens in the event of default by one party to the agreement (e.g. legal sanctions and penalty payments). As a result, contracts range from extremely simple to highly complex; for example, from a simple transaction such as buying an ice cream or a carton of milk to a more complex purchase such as buying a space rocket. Obvious defence examples include equipment procurement, especially of high-technology weapons, where costs and delivery dates usually rise substantially above the original estimates. For example, the US F-35 combat aircraft is costly ($78 million for the F-35A in 2021) and has been characterised by continued cost growth and delays (GAO 2022). Other instances of make or buy choices include the armed forces’ decision to maintain and repair its equipment, to train military personnel and to provide accommodation for armed forces personnel. In reality, publicity often focuses on the cost overruns, delays and failures of highly complex defence equipment (e.g. advanced combat aircraft, missiles, warships, submarines, and UK Ajax tanks). These are lethal pieces of equipment whose actual use involves deaths and injuries. However, there is a vast range of items that are bought off-the-shelf in civilian markets. Examples include motor vehicles, office stationery, food, catering, taxi/transport services and specialist services such as accountancy, consultancy and computer advice.

Defence as a public good

Defence has a unique feature: it is a classic example of what economists call a public good. Such goods are best explained by considering the features of the opposite case of private goods. These are goods whose purchase conveys property or ownership rights. For example, my purchase of a motor car denies you ownership of that car; we are rivals for ownership. Also, my purchase of the car allows me to exclude you from ownership. These features of rivalry and excludability are central to understanding the difference between private and public goods.

Public goods are characterised by non-rivalry and non-excludability. For example, my consumption of the air defence of London is not at the expense of the protection offered to you by it (non-rivalry). Similarly, as a citizen of London I cannot be excluded from its air defence (non-excludability). An international military alliance such as NATO also provides a public good in the form of protection provided by the strategic nuclear deterrent. Protection provided by the nuclear deterrent to one member nation is not at the expense of such protection for other members, and once a member of the NATO club, a member state cannot be excluded from protection provided by the alliance nuclear deterrent.

Private goods are bought and sold in markets, which reveal society’s money valuations of various goods and services. No such market valuations exist for defence as a public good. Instead, in democracies, defence choices become political choices made through the voting system. Voting means that individual voters express their preferences for defence and other publicly provided goods and services through the voting mechanism, with different policies offered by different political parties. Parties can be viewed as vote maximisers. Parties that achieve a majority of votes form the government, which is further influenced by bureaucracies such as the Ministry of Defence and the armed forces. These various agents in the political market are often assessed using public choice analysis. They comprise voters, political parties, bureaucracies and producer interest groups, which combine to form the military-political-industrial complex (MPIC). Each agent in this complex has specific objectives, such as vote maximisation for political parties, budget maximisation for bureaucracies in the form of the Ministry of Defence and the armed forces, and income or profit maximisation for producer groups (e.g. major defence contractors in the UK and overseas, suppliers, local areas where contractors are located; more details of the MPIC are outlined in Chapter 5).

The outcome of the various choices made by agents in the military-political-industrial complex is reflected in national defence policy. The phrase defence policy is a broad term that encompasses the size of the defence budget and its allocation between nuclear and conventional forces, between air, land, sea and space forces, between equipment and personnel (capital and labour), between national and NATO forces and between different geographical areas of the world (e.g. UK, Europe, Middle and Far East, between the Arctic and Antarctic and between earth and space). Each of these defence policy options can be analysed as an economic choice problem. The classic choice problem is that between guns and butter, namely, the choice between defence spending and spending on civil goods and services (e.g. schools, hospitals and roads).

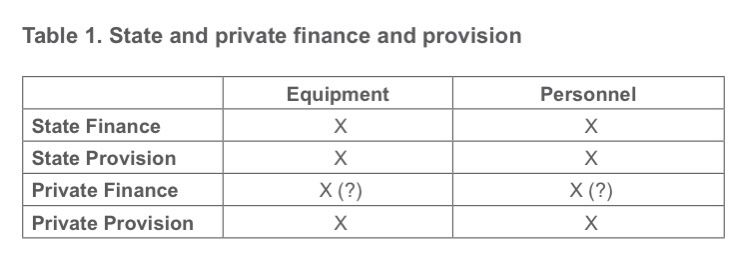

There is another aspect of public goods that is central to understanding defence markets. Here, a distinction is needed between state and private finance and provision. Finance focuses on who pays, and provision is about who provides the goods and services. The framework identifies two possible general providers, namely, state and private. Often, defence is state financed and state provided. Governments pay for defence through various forms of taxation and provide national armed forces either through state provision or markets. Armed forces comprise equipment and personnel, and both can be provided by the state through state-provided and state-financed arms manufacturers, with military personnel provided through voluntary labour market transactions and/or conscription (e.g. draft versus an all-volunteer force). Table 1 shows the options for finance and provision for the acquisition of equipment and personnel, where X signifies a possible option. The symbol X (?) indicates that an option is possible but problematic. For example, some but not all defence equipment is privately financed. Lethal equipment, which is costly with limited markets, is less likely to be privately financed. Similarly, privately financed personnel might be restricted to mercenary forces, which are unlikely to be acceptable to many nation states (these options are explored in Chapter 6).

Conclusion

Accepting defence as a public good does not mean that there are no opportunities for market solutions. The armed forces provide substantial opportunities for buying goods and services from private contractors; they have to choose between make or buy and this choice is represented by military outsourcing. Whilst outsourcing is the focus of this study, it also considers other opportunities for applying market principles to defence. Examples are taken from UK defence policy but the general principles can be applied to other nations.

Make or buy choices

The policy problem: an inefficient defence sector

The armed forces undertake many of their activities ‘in-house.’ For example, they usually own and manage their military bases, such as army garrisons, air force bases and naval dockyards; they own, repair and maintain their equipment, such as aircraft, tanks and warships; they provide accommodation, food and transport for their military personnel; and they train their personnel, such as army drivers and air force pilots. These are ‘make’ choices where the armed forces decide to undertake the activities themselves rather than buy the services from outside contractors through outsourcing. In-house provision for the armed forces has an economic dimension: they are public monopolies, which are not subject to competition and rivalry. Economics predicts that in-house public sector monopolies lead to monopoly prices that are higher than competitive prices and result in inefficiency and a failure to innovate. In-house units in defence do not earn monopoly profits. Instead, their managers and workers ‘consume’ monopoly inefficiency in the form of ‘organisational slack’ and on-the-job leisure, staff expenditures, together with managerial emoluments and perquisites. Other benefits for staff might include job security, power, status, prestige and discretionary investment expenditures.

These outcomes reflect a broader problem known as the ‘principal–agent’ problem. This arises when the principal, in the form of the owner, relies on agents such as managers to pursue their objectives. For example, shareholders as owners desire maximum profits but their agents might pursue other aims, such as a quiet life. Similar situations arise in the military sector. During World War II, the commander of RAF Bomber Command (Arthur Harris) often ignored orders from his seniors in the air force to select industrial targets rather than his preference for the area bombing of German cities (Hartley 2011).

There are further reasons why the public sector is likely to be inefficient. It lacks the efficiency incentives of the private sector in the form of competition, rivalry and contestability, where incentives comprise both the profit motive and the capital market with its threat of takeover and bankruptcy. These incentives and institutions are reflected in property rights, which are absent in the public sector, which is why the public sector has problems achieving efficient outcomes. Defence has only a single army, navy and air force, each with a monopoly of land, sea and air capabilities.1 Military commanders operate on military criteria reflected ultimately in their ability to win wars; they are not entrepreneurs rewarded or penalised through profits and losses. Unlike private sector firms, military units are not subject to capital market incentives and penalties: they cannot be taken over or suffer bankruptcy. Such comparisons with the private sector identify the causes of inefficiency in public sector in-house units (see Chapter 6).

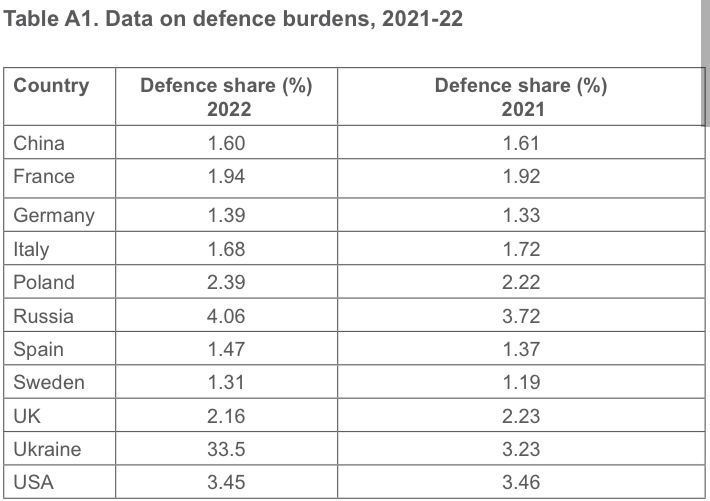

Critics might question whether efficiency criteria are relevant to defence. But defence is a major user of society’s scarce resources, so it is relevant to question the efficiency with which it uses these resources and whether efficiency can be improved to provide more resources for defence and alternative uses (e.g. more hospitals, schools and roads, or lower taxes: see the Data Appendix for examples of defence burdens for a sample of countries). Defence lacks the entrepreneurship, profit and capital market incentives of a private competitive economy, but this does not mean that proxies for these cannot be created in the defence sector (e.g. outsourcing, fixed budgets). After all, the defence sector is involved in various forms of transactions reflected in make or buy choices, each with different cost and contractual implications. In a world where resources are scarce, efforts to economise on their use are necessary and unavoidable, and the defence sector is no different from the rest of the economy. If there are alternative methods of completing a defence transaction, why not choose the method that uses the fewest resources? Such a search for efficiency improvements means that the current organisation of defence activities needs to be subject to critical appraisal. Is the current organisation of defence activities efficient, and how do we know? Some critical elements are provided by parliament and its committees, by the National Audit Office, by universities and by independent ‘think tanks’.

Defence and transaction costs

The UK Ministry of Defence undertakes numerous of its activities ‘in-house’. These are public sector monopolies, which economic theory predicts will be inefficient, reflected in higher prices and monopoly profits. For defence, this prediction has to be modified to allow such ‘in-house’ units to pursue organisational slack and on-the-job leisure instead of profits; in defence, monopoly profits are redistributed to staff in greater leisure and a quiet life. However, there is an alternative explanation of ‘in-house’ production, namely, transaction cost economics. This explains monopolies and other market failures in terms of transacting in an efficient way. For example, vertical integration is often explained as a monopoly problem but transaction cost theory explains it as an efficient transaction. Transaction cost economics distinguishes between markets, which are represented by the ‘buy’ choice, and hierarchies, which are represented by the ‘make’ choice.

Transaction costs are the costs of trading and exchange and are additional to production costs. They provide a basis for understanding the make or buy choice and hence decisions about the selection of in-house defence activities. Transaction costs involve search and information costs, bargaining and decision costs, and policing and enforcement costs. There are five determinants of transaction costs: asset specificity, uncertainty, frequency, limited rationality and opportunistic behaviour. Asset specificity involves physical and human capital, such as specialised naval dockyards for the repair and maintenance of warships or specialised labour for the design of nuclear-powered submarines. Uncertainty focuses on the risks of market exchange and imperfect knowledge about future events and their outcomes. Defence involves major uncertainty in that you never know who might wish to attack and invade your nation. Frequency concerns the frequency of transactions; a higher frequency leads to higher transaction costs. Limited rationality recognises that when making choices and decisions, agents in markets have only limited information and knowledge (they do not have perfect information and knowledge). Opportunistic behaviour means that agents have opportunities to pursue their own objectives (e.g. a quiet life).

Critics of transaction economics claim that it offers no refutable predictions; it resembles a tautology where all economic actions and organisations reflect efforts to economise on transaction costs. Anything can be rationalised by transaction cost economics. But supporters of transaction cost economics focus on asset specificity, which is measurable and the most important empirical determinant of the transaction. Asset specificity refers to the alternative use value of any asset: high specificity means that the asset has only value in one use and has no value in alternative uses, all of which favour hierarchies (make choices). Between the extremes of low asset specificity, which leads to market transactions (buy choices) and hierarchies, there are hybrid or intermediate cases reflected in various forms of long-term contracting and franchising (but the exact forms of business organisations in the intermediate cases are not specified by the transactions model).

Defence offers various examples of asset specificity. The strategic nuclear deterrent is highly specific and has value only as a nuclear deterrent, whereas conventional forces have many alternative uses (e.g. defence of cities, policing, occupation of foreign territory, emergency and disaster relief). A key prediction of transaction cost economics is a positive relationship between governance costs and asset specificity. For a range of asset specificity, markets have the lowest governance costs, but greater asset specificity leads to hierarchies in organisations with lower governance costs than markets. Governance costs include the costs of administrative control and coordination, incentive arrangements and ownership.

Transaction costs suggest that the costs and difficulties of market transactions favour hierarchies or in-house production. For example, a complex, risky and recurring transaction might be too costly for a standard buyer–supplier relationship, so internalising the transaction (e.g. via vertical integration) might be more efficient than market exchange. Effectively, this is a contract choice. Transaction economics is ‘…relentlessly comparative maintaining that the merits of one particular organisational arrangement can only be assessed relative to the performance of the relevant alternatives constrained by the same human frailties and propensities, technologies and information’ (Masten 1999: 54).

Definitions and scope of analysis

The UK has considerable experience with the military outsourcing of non-combat activities (Davies et al. 2011). The process has various definitions including market testing, contracting-out, contractorisation, privatisation, Private Finance Initiatives (PFIs) and Public–Private Partnerships (PPPs). These involve activities traditionally undertaken ‘in-house’ by the armed forces being transferred to private firms. Examples include the armed forces providing housing, education, transport and catering services; training pilots and the drivers of its military vehicles; and repairing military equipment. Private firms or contractors undertaking these armed forces activities leads to the transfer of economic activities from the public to the private sector and the substitution of private firms for ‘in-house’ public sector organisations. This study provides an economic evaluation of military outsourcing but recognises the relevance of other perspectives, namely, legal, historical, political, strategic, military and moral-ethical. For instance, legal perspectives arise with military outsourcing where contracts have to be agreed upon with contractual agreements involving transaction costs. Also, there might be military factors that require that the armed forces undertake specific activities ‘in-house.’ In such cases, the forces need to explain these military factors, whether they involve additional costs and their willingness to pay the extra costs.

Military outsourcing involves issues of public (state) versus private finance and provision (see Table 1). The extremes range from government-funded and government-provided activities, such as the national army, navy and air force, to privately financed and provided activities, such as computers, mobile phones and motor cars. As a public good, defence has traditionally involved both public finance and public provision of all defence activities. Military outsourcing has demonstrated the opportunities for private finance and private provision of some defence activities, leading to the armed forces shifting from ‘make to buy.’ This study examines the economics of outsourcing all military activities, including combat missions. This is not to suggest the desirability of outsourcing combat missions; it is simply recognised as a logical possibility that needs to be evaluated carefully and critically (see Chapter 6).

The study addresses two major questions. First, why do governments outsource some military activities and undertake others ‘in-house’? Second, what are the boundaries or limits of government and private sector activities in defence? Answers to these questions involve a choice between private and public sector agencies, each with different efficiency incentives. Private firms in competitive markets offer high-powered efficiency incentives, with such firms seeking profits, facing competitive threats from rival firms, and capital markets providing further threats of takeovers and bankruptcy. But there are costs associated with contracting in the form of negotiation, bargaining, monitoring and enforcement. In contrast, public agencies have low-powered efficiency incentives but are good at loyalty and trust (e.g. loyalty shown by the national armed forces).

But they lack the efficiency incentives of private competitive markets, as reflected in the profit motive, competition and capital markets. Nor are public agencies able to ignore the costs of contracting: they have to hire, fire and train staff.

A brief history of UK policy on military outsourcing

The UK Ministry of Defence’s (MoD) competitive procurement policy was introduced in 1983 as part of the Conservative government’s defence policy aimed at improving efficiency and achieving value for money. It involved competition for both equipment and support services. Contracting-out support services became part of MoD competition policy where such services could be provided more efficiently in the private sector, offering benefits to taxpayers without damaging operational capability. The result was that defence support functions were undertaken by the private sector unless it was operationally necessary or more cost-effective to keep the work in-house (Cmnd 675-1 1989: 35).

By 1985, most accommodation cleaning and laundry services had been contracted-out to private firms. Other services that were contracted-out included catering, grounds maintenance, security guarding and the use of civilian driving schools for training RAF drivers. Further examples were aircraft servicing, air traffic control, some management tasks and support for ranges and training areas. By 1989, the MoD claimed cost savings from its contracting-out policy of some £50 million a year. Even where tasks remained in-house, cost savings of between 20 per cent and 30 per cent were reported, reflecting the impact of introducing contestability into traditional monopoly defence markets.

The policy of market testing had its critics. These expressed concerns about its impact on operational capability, the contractor’s obligations in war and transition to war, maintaining quality of service with private contractors, the need for a ‘level playing field’ allowing in-house units bidding to retain the service and the need for re-tendering at regular intervals. The estimates of cost savings from market testing also need to be evaluated critically. Do the savings reflect changes in the quality of services? Are they achieved when the contract is re-tendered? And whilst annual savings of £50 million per year appear substantial, they are only a small share of the total defence budget.

In 1992, the MoD introduced an expanded programme of market testing as part of its Competing for Quality initiative. The policy encouraged in-house units to bid against private contractors for MoD contracts as part of the MoD’s policy of achieving cost savings of 20 per cent in support areas. The next new MoD policy venture was the Private Finance Initiative (PFI), which involved private finance replacing state finance for capital projects. Instead of purchasing and owning capital assets, MoD agreed that the private sector would provide the finance for the asset, with MoD leasing it through annual rental payments. PFI committed the private sector to financing the often large up-front capital costs of a project and to the provision of services of an agreed standard over future years. Initially, six areas were identified for defence PFIs, namely, training, property and accommodation, information technology, equipment, support services and utilities (Cmnd 3223 1996: 89; Davies et al. 2011). Only where a PFI is shown to be inappropriate or uneconomic will the use of MoD capital resources be considered. Whilst dedicated war-fighting equipment may be beyond the scope of a PFI, little else was ‘off-limits’, including support for frontline units.

In 1997, under the Labour government, the PFI policy was developed and re-launched as Public Private Partnerships (PPPs). These extended the concept of partnership with private industry to embrace other approaches, especially opportunities for revenue raising from the commercial use of MoD assets and innovative forms of partnership between the MoD and the private sector.

Many of the MoD’s PFI/PPP projects have involved buildings (e.g. accommodation, refurbishment of the MoD Main Building) and training services. There have also been some novel developments, including air tankers, strategic sealift, heavy equipment transporters and military satellite communications. Another novel example was UK search and rescue missions (S&R). Traditionally, this task was undertaken ‘in-house’ by the MoD with helicopters provided by the RAF and Navy, but the fleet needed replacing at a substantial up-front cost. In 2013, Bristow was awarded a 10-year contract for £1.6 billion for the SAR mission. Under the contract, Bristow acquired a new fleet of helicopters, established some new bases and provided S&R services to the UK Maritime and Coastguard Agency; a privatisation that shifted a service from the MoD to a private contractor and a different Government Department (Transport rather than MoD).

By 2021, there were 39 PFI projects at an annual cost of £2.3 billion, equivalent to 9 per cent of total MoD Core Departmental expenditure. Examples are shown in Table 2.

The PFI contract for the RAF’s future strategic tanker aircraft (FSTA) was large and innovatory. Total procurement and support costs (whole life costs) were estimated at £10.5 billion for a 27-year fixed-price contract with price variations based on output indices (2008 prices), but including a substantial firm component and opportunities for gainsharing. This contract replaced the traditional solution whereby the RAF owned, operated and serviced its fleet of tanker aircraft. The aircraft are owned, managed and maintained by a private contractor, the Air Tanker consortium, which also provides training facilities and some personnel. The Air Tanker consortium was owned by Cobham, EADS, Rolls-Royce, Thales UK and the VT Group and supplied a mix of new and used Airbus A330 aircraft. Final bids for the contract were received from two competing consortia at the end of April 2003. The contractor provides capability during peacetime and transition to war and conflict. A total of fourteen aircraft are available, comprising a core fleet of nine aircraft with access to a ‘surge capability’ of a further five aircraft if needed by the RAF. The surge aircraft are available to Air Tanker for release to the civil market or release to partner nations for military use.

A NAO Report on FSTA concluded that despite taking five years longer than planned to sign a contract, the MoD’s progress in delivering the capability had improved since contract signature. Interestingly, the MoD maintained competition on the FSTA programme for five years by contributing to the losing bidders’ costs (NAO 2010: 6).

Another novel defence PFI contract involved military flying training (MFTS) with a 25-year contract awarded to Ascent, which is jointly owned by Lockheed Martin and Babcock International Group. Ascent supplies Phase 2 aircrew training for fixed-wing aircraft, helicopters and rear crew, including the provision of aircraft. The MoD provides Phase 1 elementary flying training (NAO 2015). The economic logic of outsourcing military flying training is that the armed forces simply want trained pilots and aircrew at the required standard regardless of whether they are trained by the public or private sector. A similar situation arises with the private sector instruction of car and lorry drivers.

Conclusion

The next phase of PFI was announced in late 2012 and was known as the Private Finance Initiative 2 (PF2) and was the successor to the PFI for the delivery of infrastructure and services. PF2 responded to the problems of PFI, which included windfall gains and excessive profits for equity investors, a slow procurement process and the transfer of inappropriate risks to the private sector leading to a higher risk premium charged to the public sector (HMT 2012). Soft services such as food, catering and transport were excluded from PF2 projects and were to be provided by shorter term contracts. In the event, only twelve PF2 projects were awarded in over five years and in 2018, the government announced the end of PFI and PF2 due to their decreased use, inflexibility and fiscal risk to the government (HMT 2018; Hodge 2022). Without further explanation and clarification, these reasons for ending PF2 leave much to be desired. There remain considerable opportunities for military outsourcing.

Overall, the NAO concluded that most MoD PFI projects (over 50 such projects) had been delivered successfully on time and on budget. However, mention was made of examples of contractors incorrectly reporting performance, which would otherwise lead to payment deductions (e.g. BT on its contract for the Defence Telecommunications System: NAO 2008). Overall, the government’s decision to end PFI and PF2 can be questioned. Have the limits of outsourcing been reached? What are the limits and what is the evidence? And does the decision reflect the power of interest groups opposed to change? These questions are addressed in the rest of this study.

International experience

Introduction

There is little published information or data on the extent of military outsourcing in other nations. Some information is available for the USA, and limited information is available for other nations. International comparisons are helpful in identifying the extent of outsourcing and any innovative examples that might be applied in the UK and elsewhere.

This chapter considers experiences in the USA, European countries and a few other nations, namely, Australia, Canada and Israel. Most nations use private contractors to undertake some military activities. A key question is: does international experience identify the limits of military outsourcing?

US experience

US experience with outsourcing can be divided into pre- and post-Iraq. Pre-Iraq, the USA had limited experience with outsourcing. A comparison of UK and US experience in 2000 concluded that the US Department of Defense had ‘…lagged behind the MoD in outsourcing and privatisation initiatives’ (Rand 2000: vii). Pre-Iraq, the US emphasis on outsourcing focused on such areas as depot maintenance, military base commercial activities, material management, finance and accounting functions, data centres and education and training. Claims were made that US outsourcing and privatisation had led to cost savings of some 30 per cent in annual operating costs.

The Iraq conflict led to outsourcing becoming ‘big business’ in the USA with suggestions of ‘privatising war.’ In Iraq, private defence contractors provided base support functions and security services such as guarding installations, acting as bodyguards and protecting convoys. Armed guards for security roles meant that civilians were used to provide frontline services traditionally undertaken by military personnel. Using private contractors in conflict zones raised issues over their legal status and accountability and the rules governing the use of force, especially lethal force (e.g. legal position of foreign armed guards killing local civilians whilst on guarding duties).

The US experience also identified novel areas for outsourcing, one of which was rail operations. A Rand study found that the US Army may be able to ‘obtain modest cost savings by privatising rail operations at installations with low rail activity that currently have Government-Owned, Contractor-Operated business models’ (Pint et al. 2017: 35). Cost savings were estimated at $300,000 per year at each installation. Critics of military outsourcing have claimed that there are many grounds, both theoretical and actual experience of outsourcing, for questioning the claim that private provision necessarily entails better value for money (Perlo-Freeman and Skons 2008).

In the USA, the growth of military outsourcing has been reflected in the growth of large private military outsourcing firms (e.g. Blackwater, Computer Sciences Corporation, KBR, Halliburton). Military outsourcing is likely to continue being a growth market as defence firms seek to protect themselves from cuts in weapons programmes and from the budgetary pressure for the armed forces to extend the in-service life of existing projects.

Europe, Australia and Canada

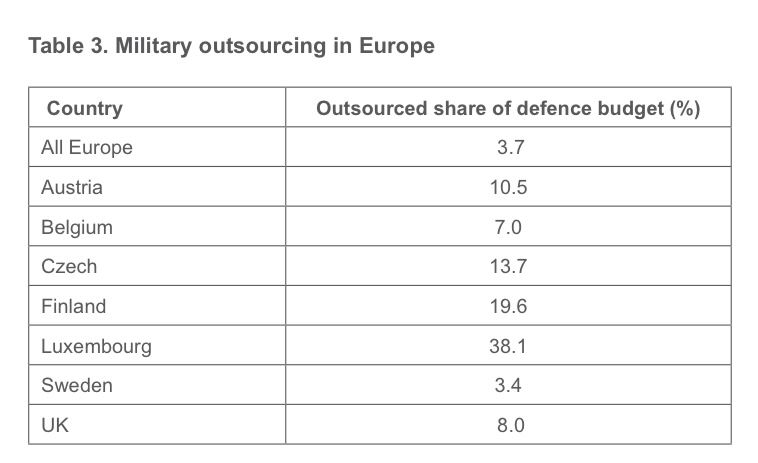

European data shows relatively low levels of military outsourcing. The UK was amongst the top nations for the shares of outsourcing in its defence budget, with France, Germany and Italy amongst the nations that did not appear in the listings (see Table 3).

Notes:

i) All of Europe comprises Member States of the European Defence Agency.

ii) Data for 2014, the series was discontinued after 2014.

ii) Outsourcing is defined as defence spending on services contracted at central level with service suppliers outside the MoD and/or armed forces.

Source: EDA 2014.

France has used private contractors in support activities such as catering, hospitality and leisure, infrastructure, office software, equipment maintenance, including vehicle support, training, clothing and surface transport. There are PPPs such as equipment repair: when equipment is beyond repair, it is returned to industry for repair and resale, with the resulting revenue shared between industry and government.

Germany has restricted outsourcing to non-military services, such as clothing management, the maintenance of heavy equipment, administrative services and IT services. In choosing outsourcing, France has focused on the need to maintain a minimum base of capacity for operational independence. Its policy position is that losing a competency is a very long-term loss; winning it again and in-sourcing it again are processes that are more costly than the initial benefits of outsourcing. France aims to make budget savings and increase quality without adversely affecting the operational capability of its armed forces.

Other nations have filled various military capability gaps with contracted service alternatives. Australia has outsourced maintenance work on its patrol vessels (to the Serco company), weapons systems contracts, simulator-based training and medical and dental logistics services. Canada has used contracted services to cover gaps in its military force structure and platform capability. It has outsourced air traffic control, navaids, logistics services, security, engineering, telecoms and IT. Also, it has outsourced basic pilot training, where the contractor provides and maintains the aircraft and runs training administration.

Israel is an interesting exception of outsourcing combat missions. It uses the Aeronautics Defense Systems company (ADS) to provide unmanned air vehicles (UAVs) for operational missions for the Israeli Defence Force.

Conclusion

Nations differ in their use and extent of outsourcing. The UK and USA have major amounts of outsourcing compared with some European nations, which have only limited roles for outsourcing. The differences might reflect different political philosophies and views about the role and extent of state involvement in the economy. Market economies will favour policies based on privatisation, competition and market testing whilst state-type economies will prefer government-type and public-sector interventions. Budget pressures are also a factor. Continued cuts in defence budgets will eventually force all armed forces to confront efficiency issues. Outsourcing allows the armed forces to retain their frontline combat roles. Outsourcing is about contracting and the costs of contracting. Comparisons of outsourcing with in-house provision encounter methodological problems. Critics of outsourcing readily point to the problems of using private contractors, reflected in firm failures and bankruptcy, excessive profits and poor performance. Criticisms of in-house provision are all too often ignored, namely, performance failures by in-house units, soft budget constraints and inefficiencies. Sometimes, in-house failures are ignored on the basis that ‘we do not criticise colleagues who are part of the team.’ Overall, international experience shows military outsourcing limited to various support operations but does not add to our knowledge of the limits of outsourcing.

The political economy of outsourcing defence support

Introduction: the policy problem

The armed forces are involved in a substantial defence support business. This involves support for logistics, engineering and equipment. Defence support was subject to a review in 2022 (MoD 2022b). The review identified a series of problems in defence support, namely, poor availability, productivity and efficiency, finance and the costs of ownership, together with a culture promoting risk avoidance. Defence support employs about 60,000 personnel and involves the management of the Strategic Base, which encompasses airports and seaports and a range of military bases in the UK and around the world. The Review of Defence Support recognised a role for ‘more effective commercial arrangements’, but military outsourcing was not identified as a specific solution. This chapter explores outsourcing as a possible policy solution for defence support. It starts with an outline of the economics of outsourcing.

The economic case for outsourcing

Military outsourcing allows private contractors to bid for defence activities traditionally undertaken ‘in-house’ by the armed forces. Economics predicts that ‘in-house’ activities and services are public monopolies, which are likely to be characterised by higher prices, monopoly profits and inefficiency. Introducing competition into such monopoly situations will lead to lower prices, reduced profits, greater efficiency and innovation. One fallacy needs to be addressed. Simply transferring resources from the public to the private sector has no effect on efficiency if identical resources are used. There is a further complication since the government can always borrow more cheaply than the private sector (1-3 per cent in the UK). So, if military outsourcing is to lead to cost savings, the extra financing costs for the private sector must be offset by savings elsewhere over the life cycle of the project.

Outsourcing leads to cost savings from competition for the work, from contractual efficiency incentives and from innovation. Rivalry through competition should lead to lower costs for both construction and life-cycle costs, with risks transferred to the private sector. Also, contractors are encouraged to be innovative in project design, construction, operation and maintenance. Further efficiency incentives are provided by contracts that offer incentives to control and reduce costs (e.g. fixed-price contracts).

Outsourcing is not costless. The long-term nature of PFI/PPP and other outsourced contracts requires a clearly specified procurement policy with provisions for change, contract pricing, risk management, performance incentives, procedures for resolving disputes and exit strategies. These aspects involve complex negotiations reflected in transaction costs. The MoD’s outsourced contracts involve various transaction costs, and these comprise:

- A public sector comparator (PSC). Value for money requires that the net present value of a PFI or outsourced contract, including its risks, be lower than the PSC. The standard discount rate is recommended at 3.5 per cent in real terms. Applications of the PSC provide opportunities for ‘optimism bias’, which is the tendency of appraisers to be over-optimistic about a project and its costs and benefits (HMT 2022).

- Competition requires at least two and ideally three bidders at the stage of invitation to negotiate. MoD contracts are either competitive or non-competitive, with non-competitive contracts involving negotiations with single-source suppliers (see Chapter 5).

- Contract prices vary between firm prices, fixed prices with price variations for inflation, target-cost incentive fee contracts (gainsharing) and cost-plus contracts. Contracts need to specify clearly the levels of service or performance standards required by the private contractor and the consequences of failure (i.e. penalty clauses). Performance standards require reliable measures of output.

- Contract duration. Long-term contracts (e.g. up to 40 years) are designed to encourage contractors to undertake costly investments. But such lengthy contracts create a long-term monopoly and scope for ‘hold-up’ (willingness to invest). Uncertainty means that long-term contracts cannot be specified completely, making them difficult to monitor and enforce legally. These contract features mean that both the principal and the agent have to rely on partnership, trust and reputation. In the absence of output indicators, agents have opportunities to pursue their own interests rather than those of the principal.

- Procedures are needed for resolving disputes. The right of the MoD to step-in and intervene in the contract and exit strategies.

- Ownership rights and end-of-contract arrangements. The MoD has to decide whether to retain ownership of any assets for defence purposes and what happens to the asset at the end of the contract. Either the asset will be transferred to the MoD or to any new supplier, requiring payment for its residual value (estimated on some agreed basis). Further complications arise at the end of a contract where the transfer of an asset to a new contractor might involve intellectual property rights (e.g. management records and information needed to organise a new competition).

- Overall, it has to be accepted that no contract is truly complete since contracts cannot anticipate all events in an uncertain world, nor can they prevent opportunities for cheating (i.e. circumventing the contractual obligations).

The economic case against outsourcing: a public choice perspective

Like all policies, outsourcing is applied in the political market place, where its implementation will be determined by the behaviour of agents in this market. Vote-sensitive government ministers need to demonstrate that outsourcing is successful: hence, public sector comparisons can be made to appear costly; competition can be limited to the selection of preferred bidders; and cost savings can always be achieved by sacrificing quality, especially where quality is difficult to measure. Where external advice on outsourcing is provided by management consultants, their evaluations will respond to the wishes of their clients and their need to be paid. Overall, it is likely that government personnel undertaking economic evaluations of outsourcing will pursue projects that do not adversely affect their job security, income and status. They will also favour efficiency improvements that offer personal benefits, such as better office buildings and accommodation. Similarly, public sector agents opposed to outsourcing will use their knowledge and skills to be selective in their choice of comparators, they can impose restrictions on competition and make the terms of a competition unattractive to private firms; hence, firms will be discouraged from bidding for a contract.

Any evaluation of outsourcing has to ask who gains and who loses from the policy? Taxpayers should gain from cost savings, but they will lose if the cost savings fail to materialise. Other gainers include private contractors who win the contracts, banks, which provide funds, shareholders and lawyers who advise both the government and industry on the legal aspects of contracts. There are also possibilities for inter-generational welfare shifting. Current generations of voters and taxpayers benefit from the assets provided by outsourcing, but they bequeath to future generations an older public asset base and contractual commitments to buy outputs from private contractors. Before 2006, losers included public sector workers who lost their jobs or received lower pay as the ‘in-house’ unit was acquired by a private contractor. This changed in 2006 with the Transfer of Undertakings Regulations (TUPE), which provided public sector workers with protection when services were acquired by a private contractor. These concerns are not confined to outsourcing, and the counterfactual has to be considered. The alternative of a public sector solution leads to state monopolies and higher prices, inefficiency, a failure to innovate, a failure to invest in new capital stock and outcomes determined by trade unions.

Uncertainty is a major challenge for long-term contracting in defence. Unforeseen and unforeseeable events are difficult to include in a legally enforceable contract. The armed forces are confronted with a range of unknown and unknowable future contingencies, ranging from peace to war with a variety of enemies and threats over long time horizons. The result is that long-term contracts require trust, commitment and partnership between both parties. Trust is based on expectations about future behaviour whilst reputation is based on past behaviour and performance. Partnering involves the choice of one or a few long-term suppliers based on reputation and trust instead of competitive contracting. However, where there are few contractors, as is typical of defence, there are risks of collusion and small numbers bargaining. But again, the counterfactual cannot be ignored. The alternative to the challenges of long-term contracting is a public sector ‘in-house’ unit that is not subject to such contracts but whose behaviour is determined by ‘soft budget’ constraints resembling cost-based ‘blank cheque’ contracts.

Once a long-term contract has been awarded, a firm will seek to exploit its monopoly power (it will have an information advantage: opportunism) and earn monopoly profits. It might, for example, economise or default on those parts of the contract, such as quality, which might not have been specified completely. Default can have serious implications for military capability (the ability to fight on the battlefield). Here, the government has some safeguards since, typically, firms will be concerned with their reputation and the desire for future government contracts. Further sanctions are available. For example, governments can impose penalties on private contractors for poor performance, cancel contracts or refuse to renew a contract. But firms are not passive agents and in response to penalty payments, they will recover these costs from their other business activities. These problems need to be compared with ‘in-house’ units, which are not subject to penalty payments, contract cancellations or the opportunity to award a contract to a new private contractor.

Concerns arise that long-term contracts might impair the adaptability of the armed forces to respond to new threats, new technology and a changing world security position. Here, it has to be recognised that long-term contracts are not new in the defence sphere; they are characteristic of weapons markets and of the employment contracts offered to volunteer military personnel (see Chapter 5). Similarly, it might be claimed that rapid technical change, which is a characteristic of defence, means that long-term contracts are inappropriate and need frequent renegotiation, incurring costs. Examples of technical changes in defence include the jet engine, missiles, nuclear weapons and unmanned air vehicles (UAVs). But technical change is an example of the challenges of contracting under uncertainty. Procurement agencies have a choice in determining contract duration, and this choice will have a cost dimension reflecting the contractor’s willingness to supply and the buyer’s willingness to pay.

Competition and competitive tendering also have their limitations. Losers in the competition can acquire the winning firm. However, takeovers are subject to the sanctions of the capital market, which promote efficiency through further takeovers (e.g. involving managerial job losses) with the ultimate sanction of bankruptcy.

Outsourcing is believed to promote efficiency in its two forms. First, it promotes technical efficiency by seeking least-cost solutions; competitive pressures mean that firms have to adopt lowest-cost methods to survive. Second, it can promote allocative efficiency, which is more difficult to achieve. Allocative efficiency requires procurement agents to seek information on the benefits and costs of different levels of service provision, embracing both the quantity and quality of various levels of service. Such efficiency requires complex contract specifications. Contractors need to be invited to tender for both different amounts of service and different levels of quality so that their bids reveal the marginal benefits and costs of extra quality and quantities of service. For example, a building cleaning contract might require firms to provide cost data on cleaning options, say, cleaning five, six or seven times a week (the quantity aspect of the contract) with, say, 10, 20 or 50 staff for each cleaning session (the quality aspect of the contract). In principle, such marginal cost and benefit data should allow procurement agents to obtain ‘best value for money’ from outsourcing. The contrast with ‘in-house’ units is revealing since these units are not subject to technical and allocative efficiency incentives. There are no competitive tendering pressures to supply at least cost, nor are there cost estimates for different quantities and qualities of service provision subject to competition. However, the UK National Audit Office has opposed efforts to achieve allocative efficiency. Its view is that giving bidders complete freedom might complicate procurement, making it difficult for Government Departments to make fair and thorough comparisons of rival bids; it recommended that Departments limit the range of options before seeking competitive bids (HCP 2008). This is a surprising recommendation from a public-sector audit agency and one that reduces the opportunities for public-sector efficiency improvements.

Cost savings are claimed to be a major benefit of outsourcing. Evidence is needed on the magnitude of such savings. The MoD estimated cost savings of 5 per cent to 40 per cent. In some cases, cost savings were exaggerated and overestimated, and some private contractors were criticised for earning ‘excessive’ profits on public-sector contracts. Also, it is difficult to assess the reliability of MoD’s estimates of cost savings. They might involve quality reductions; there is no indication of the cost base to which the savings apply (e.g. a 40 per cent saving on £50,000 or on £10 billion); and the savings cannot be verified until the contract has been completed, which might be in the long run (e.g. 30-40 years).

Competition means the loss of military capability. In order to win at competitive bidding, a contractor will tender the lowest price, which might be ‘too low’, so failing to provide normal profits. This is known as the winner’s curse, where the winning bidder pays too much and is awarded the contract (the winner is the real loser). The winner’s curse can reflect emotion, incomplete information and errors in the bidding process. The result can lead to disputes over the contract and the need for contract renegotiation. But such behaviour might be a ‘strategic game’ where the contractor aims to eliminate the military in-house unit and renegotiate the contract as a monopoly with rival contractors unable to enter the market quickly to provide the service. The MoD will need to assess such risks of contractor strategic behaviour and the costs and time required to re-create its military in-house capability. Cases can arise where the loss of in-house capability might involve other output losses not immediately apparent in outsourcing. For example, outsourcing military flying training means that the MoD will lose its internal capability for flying training and the ability to re-allocate training resources to the front line in emergencies and conflicts (i.e. surge capability). It is also feasible for in-house military units to engage in strategic behaviour against private contractors.

Personnel issues under conflict

Further uncertainty arises over the willingness of private contractors and their staff to serve close to the frontline during conflict. Whilst efforts are made to ensure that ‘key personnel’ are made ‘sponsored reserves’ (i.e. can be called-up in conflict and serve subject to military command), it is not known whether other contractors’ staff will be willing to supply their labour in a conflict or potential conflict situation. In these circumstances, consideration needs to be given to the various alternative labour supply options, which broadly range between the extremes of using either contractors’ staff or specialist military personnel. Using contractors’ staff means relying on voluntary labour supply and wages to compensate for the net disadvantages of conflict; or there are opportunities for generating ‘higher purpose feelings’ in private-sector employment contracts. However, not all outsourced contracts involve working near the frontline, so that whilst it is a relevant concern, it only applies to a limited number of outsourced contracts (see Chapter 5).

Obstacles to change

Greater use of outsourcing involves change, and there are major obstacles to change in the MoD. Its procurement policies and procedures are often too detailed, bureaucratic, complex, lengthy and slow. For example, a private-sector commercial contract might require four months from start to contract award; a similar MoD contract might take almost 30 months to contract award. Furthermore, MoD procedures can be barriers to innovation and cost savings: it prefers to ‘micro-manage’ contracts and often requires that any new proposals from industry be included in a revised bidding competition (meaning that a firm’s property rights in its new ideas are revealed to their rivals). Public accountability and possible criticism from HM Treasury, the NAO and parliamentary committees also create problems for MoD procurement policy, which requires that standard procedures are followed. Overall, there is a view that the MoD needs to be more flexible on innovation and risk (e.g. an attitude of ‘tell me what you want and not how to do it’); it focuses on low prices and audit trails rather than value for money in its wider definition; and MoD staff have problems with understanding and accepting profitability (e.g. it is regarded as a ‘dirty word’). The MoD also needs to recognise that competitive bidding involves costs (it is not costless) and that increasing costs delay the returns on a firm’s investment in competing for defence projects.

MoD barriers to innovation can be illustrated. Defence equipment contracts might be too rigid to allow for mid-life upgrades and spiral development as technology develops. Defence contracts tend to assume the same rate of innovation for all sub-systems and components for combat aircraft, tanks and warships. In reality, sub-systems develop at different rates, which could be leveraged by lower tier suppliers to provide better technological solutions. However, to do so would require the MoD and the tier 1 supplier to amend the contract mid-life or whilst it is being fulfilled, possibly depriving the tier 1 supplier of opportunities to supply its own sub-system. Sometimes, both the MoD and its key defence prime contractors perpetuate risk aversion, stifling innovation. The challenge for policymakers is to develop a procurement system that will improve the situation and lead to a better outcome.

Parliamentary perspective

The UK House of Commons Defence Committee reported on military outsourcing (HCDC 2022). The Report made a number of criticisms. It found that outsourcing was a relatively unscrutinised area and that the MoD’s outsourcing practice was ‘not exemplary’, with little consideration given to providing services in-house. Contractors were criticised for reducing wages and employee benefits, lowering standards and squeezing staff to raise their profit margins. Nor was the MoD willing to intervene and enforce the expected standards. Also, EU rules prevented any consideration of a contractor’s previous performance when assessing bids (this restriction should change with Brexit). Furthermore, there was a view that outsourced staff felt excluded from the wider defence community. The MoD’s contract awarded to Capita for Defence Fire and Rescue Services was used as a case study. This contract was valued at £525 million for twelve years, and the Defence Committee was critical of Capita for reduced standards and a potential reduction in manning levels. Overall, the Committee concluded that the MoD should give more consideration to providing services in-house if doing so gave better value for money; it claimed that in-house services are not properly appraised.

The Defence Committee’s criticisms need a response. The main criticism was the apparent lack of evaluation of in-house alternatives. No evidence was presented for such a lack of appraisal, and only assertions were made. If true, the claim suggests that MoD agencies were failing to apply the Treasury’s Green Book guidance on project appraisal. This requires an economic evaluation of alternatives using the Treasury’s suggested criteria. It would have been more satisfactory if the Defence Committee had provided actual case study evidence of the apparent failure to properly evaluate the alternatives of outsourcing versus in-house provision.

Conclusion

Comparisons of outsourcing and in-house provision raise methodological issues: are we comparing like with like? Too often there is a tendency to compare perfect socialism with actual imperfect capitalism, or perfect capitalism with actual imperfect socialism. Inevitably, the comparison is between two imperfect institutional arrangements: imperfect socialism versus imperfect capitalism.

Weapons procurement: arms markets

Weapons markets have distinctive characteristics. They supply lethal equipment comprising artillery, guns, tanks, combat aircraft, helicopters, missiles, rockets, warships, submarines and nuclear weapons. Within the market, the national government is a major buyer or, in some cases, the only buyer (monopsony). As a major or monopsony buyer, the government can select a protected or open market, each involving procurement choices. There are challenges in introducing market incentives into weapons markets, which can be described as state-dominated imperfect markets. The whole process of managing defence and procurement has been called ‘managing the unmanageable’ (Sapolsky et al. 2009: 108).

The procurement problem

When purchasing arms, governments are faced with three choices:

- Choice of project: what to buy? Decisions are needed on whether to buy aircraft, tanks or warships, and within each type of weapon, further choices are needed. For example, for combat aircraft, decisions are needed on its type (e.g. fighter, strike, multi-role); its technical features (e.g. physical form: swept wing, delta, swing wing, stealth); and its speed, altitude, range and capability

- Choice of contractor: which firm to buy from? This apparently simple choice is really complex: should there be a competition for the contract, and if so, should it be restricted to UK firms or open to foreign firms?

- Choice of contract: which type of contract to award? There are various options, such as fixed-price, cost-plus or target-cost contracts.

The UK’s procurement of major defence projects is costly, at £26.6 billion in 2019-20. Even with such large expenditure on equipment procurement there was an expected funding shortfall of £7.3 billion for the period 2020-2030, which could be as high as £17.4 billion. A 2022 NAO Report concluded that the MoD’s equipment plan was unaffordable with frequent delays, cost increases and programme shortfalls (NAO 2022: 20-22). One explanation was that contractors and the armed forces have incentives to understate costs in the early stages of projects.2 More importantly, would a procurement agency that continuously recorded cost overruns, delays and poor operational performance survive in a private market?

The UK is not alone in encountering procurement problems reflected in cost overruns, delays, reduced numbers and performance failures. Similar problems arise in the USA with its largest procurement programme for the acquisition of the F-35 strike aircraft, which has been subject to cost overruns, delays and quality failures. The total programme acquisition cost for the F-35 is $374 billion (2019 prices: GAO 2019), with unit recurring flyaway costs ranging from $68.1 million for the F-35A version to $98.4 million for the F-35B version. More widely, an overall assessment of major US weapons systems found that 67 per cent of DoD contracts were awarded without full and open competition and that almost 50 per cent of contracts were awarded to five corporations: Boeing, Lockheed Martin, UTC, Northrop Grumman and General Dynamics (GAO 2019).

Once the sheer complexity of the weapons acquisition process is recognised, it is not surprising that the US and UK weapons acquisition processes encounter problems. Weapons involve solving major technical problems characterised by uncertainty about their technical feasibility, price and delivery schedules as well as political uncertainty about whether governments will continue to fund a costly project. The technical and political uncertainties encourage agents to be excessively optimistic about a new military project: it will be claimed that the new weapons will be superior to the existing ones, and they will be developed quickly and cheaper. In the circumstances, it is perhaps amazing that major weapons are actually delivered and operated by each nation’s armed forces! Compared with less technically demanding private and public sector civilian projects, military projects compare quite favourably (Sapolsky et al. 2009: ch. 6).

The UK defence equipment market: make or buy?

As a major or monopsony buyer, the UK government has to decide whether to buy all its defence equipment from national suppliers or from foreign firms. These policy options can be expressed as a buy British or make option versus an import or buy option. As a major buyer, the government can determine the size, structure, conduct, performance and ownership of the national defence industry. The government also finances defence projects through various forms of defence contracts. The supply side of the national defence market is often monopolistic or oligopolistic, with one or a few large suppliers. One buyer and one supplier, or a small number of suppliers, means that market solutions are determined by bargaining in a small numbers environment: the large numbers competitive industry is absent.

The UK warship building programme

The UK warship building programme is a classic example of the MoD’s efforts at managing competition. Policy is committed to ‘buying British’ for all UK surface warships using competition within the UK market. For example, selection of the new Type 31e UK frigate involved a competition between three UK groups, namely, a Babcock team, a Cammell Laird/BAE consortium and Atlas Elektronic, with Babcock winning the competition and the award of a contract for five Type 31e frigates for the Royal Navy. A distinctive feature of the Type 31e contract was the involvement of multiple UK yards in a block building contract for the new frigate. A further feature was the MoD’s acceptance that it was too risky for one UK yard to be the lead yard for two major warship designs, which meant that BAE Systems would not be allowed to be involved in developing both the Type 26 and the new Type 31e (Parker 2016). Elsewhere in the UK market, all other naval vessels (e.g. tankers, tugs) were subject to open competition, but defence procurement allowed wider factors to be included in the procurement choice. Nuclear submarines are regarded as a different market sector and are built by BAE at its Barrow yard.

There is a UK National Shipbuilding Strategy (Parker 2016; NSO 2022), which identified the problems facing UK warship building and was the basis for UK policy. Problems were identified with UK warships characterised by cost growth and delays in delivery. The Strategy found that there were no precedents for building two first-class frigates in one yard or one location; hence, the need for a separate lead yard for the new UK naval Type 31e frigate. BAE would undertake work on the Type 26 frigate and on the submarine deterrent, which would allow it to protect the UK’s Sovereign capability. The new Type 31e represented a considerable production opportunity for the UK’s regional shipyards.3 Interestingly, the UK Shipbuilding Strategy involved the government taking decisions that would usually be left to markets: for example, whether one yard in one location could build two new frigates.

A case study: Ajax

Ajax is an armoured fighting vehicle programme for the British Army that illustrates all the problems of UK arms acquisition: cost overruns, delays and unsatisfactory equipment performance. The contract was awarded in 2010, with an estimated delivery date of early 2017. By mid-2022, initial operating capability had not been achieved. The contract was awarded to General Dynamics, UK, and was for the delivery of 589 vehicles at a firm price of £5.5 billion. But the vehicle suffered from major noise and vibration problems, and the UK Public Accounts Committee concluded that the programme ‘…has gone badly wrong…and was flawed from the outset…’ (PAC 2022: 3). Further, the Committee stated that the MoD must determine ‘…whether noise and vibration issues can be addressed by modifications or whether they require a fundamental redesign of the vehicle’ (PAC 2022: 3). By May 2022, the MoD had paid General Dynamics £3.2 billion and had received 26 vehicles. By that date, General Dynamics had built 324 hulls and assembled and tested 143 vehicles. The MoD owed General Dynamics £750 million for the completed work but had not paid the company since December 2020 (PAC 2022). Some of the programme problems arose because the Ajax design was based on an existing vehicle for which the MoD specified 1,200 additional operating requirements. In late 2022, the programme was under review, with only five out of 27 critical reviews having been resolved. Critics claim that the MoD is often unwilling to cancel a major contract, their argument being that cancellation of major projects would deliver a ‘shock effect’ to the defence industry and the armed forces. Ajax has been labelled the Army’s Nimrod aircraft, a reference to the cancellation of the RAF Nimrod MRA4 anti-submarine aircraft in 2010.

The RAF ordered the Nimrod MRA4 maritime patrol aircraft from BAE in 1996 with a fixed-price contract for £2.2 billion and an in-service date of 2003. The original plan was to convert 21 Nimrod MR2 existing airframes to MRA4 standard. The first flight was scheduled for 2004, with an original order for 21 aircraft later reduced to nine aircraft. The aircraft was cancelled in 2010 after spending £3.4 billion on the project. Nimrod’s cancellation was due to it being over budget with cost overruns of £789 million; it was over nine years late and remained flawed, being unable to achieve its operational requirements. It was replaced in 2015 with an order for nine US Boeing Poseidon maritime patrol/anti-submarine aircraft. The MRA4 contract showed the limitations of fixed-price contracts. In February 2003, BAE Systems took a charge of £500 million on the contract, following an earlier charge of £300 million on the MRA4 contract.

Over the period since 1945, a number of major UK defence projects have been cancelled, with the MoD experiencing cancellations involving a complete range of air, sea and land systems. An early casualty was the Swift fighter aircraft with service entry in 1954 and cancellation in 1955 due to a series of accidents. Four major air systems were cancelled in 1964-65, including the Hawker Siddeley P139B AEW aircraft, the AW 681 transport aircraft, the P1154 fighter/strike aircraft and the TSR-2 light bomber. Later, the Nimrod AEW3 aircraft was cancelled in 1986 to be replaced by the Boeing AWACS Sentry aircraft. Amongst sea systems, the aircraft carrier CVA-01 and its Type 82 destroyer escort were cancelled in 1966, and the Type 43 destroyer was cancelled in 1981. Cancellations of land systems mostly involved rifles and machine guns rather than major systems such as armoured fighting vehicles and tanks. Overall, major defence projects were cancelled due to rising costs, defence reviews, the need for savings in defence expenditure (affordability), new technology, as well as changes in operational requirements. A recent major cancellation in 2010 was the Nimrod MRA4 aircraft, which was over budget, over nine years late and remained flawed.

So, why the reluctance to cancel major UK defence projects? A possible explanation is the role of interest groups in the military-political-industrial complex. Predictably, the armed forces will be unwilling to cancel a project that is viewed as the latest equipment aimed at filling an ‘urgent’ operational requirement. Air force staff derive great satisfaction from flying the latest ‘state-of-the-art’ fighter aircraft; admirals enjoy commanding large aircraft carriers with the latest naval aircraft; and generals love to operate modern tanks, which appear to offer command of the battlefield. The preferences of the armed forces are reinforced by producer groups in the defence industry, who will lobby the government to continue the contract, claiming that it offers ‘major’ economic benefits in the form of jobs, technology and exports. Rarely are these economic benefits subject to critical appraisal with supporting evidence. The opportunity cost question arises: what is the alternative use value of the resources allocated to the defence project? Would other uses of the resources generate more jobs, more socially desirable technology and more exports? Cost overruns and delays are the main reasons for project cancellations.

Causes of cost overruns and delays?