Graphic Content: How Red Tape is Fuelling the Cost of Living Crisis

SUGGESTED

Contents

Summary

- Red tape significantly contributes to the higher cost of living in the United Kingdom.

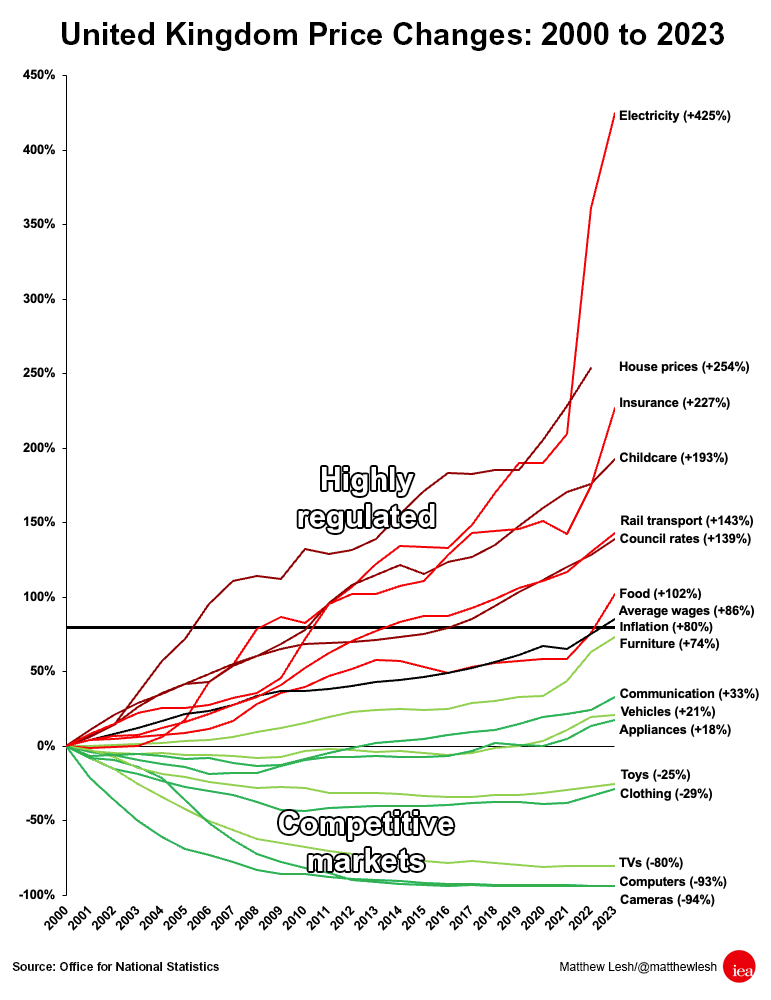

- The Consumer Price Index increased by 80% between 2000 and 2023. However, there is significant price variability across sectors, with prices of many goods having decreased due to competitive markets and innovation.

- Sectors with extensive state intervention, such as electricity, housing, and childcare, have seen the most rapid price increases due in part to excessive regulation and distortionary subsidies.

- Overregulation can hinder innovation, damage economic growth, and disproportionately affect lower-income households, contributing to increased poverty rates and inequality.

- Factors beyond regulation, like international trade dynamics and Baumol’s cost disease, also influence price changes but don’t fully explain the scale of price increases in certain sectors.

- Reducing regulatory burdens in areas like housing, energy, and financial services could lower business costs, increase supply, and ultimately reduce consumer prices.

The Chart1

Introduction

Prices have risen significantly faster than wages in the United Kingdom over recent years. The result has been a falling quality of life and significant hardship for tens of millions of households. Real household disposable incomes are now expected to be 3.5% lower in 2024-25 than their pre-pandemic levels, according to the Office for Budget Responsibility (2023). The immediate causes of the cost of living crisis are well understood: excessively loose monetary policy from the Bank of England, COVID-related supply chain issues, and Russia’s invasion of Ukraine, and now the Red Sea crisis. There are also, however, structural factors that have driven prices higher in the longer term and undermined living standards. Analysing these factors helps to better understand Britain’s poor economic performance and paint a useful way forward for policymakers.

A useful starting point is considering which products have, and which have not, risen in price over recent years. Inflation is most often quoted as a single figure: the change in the Consumer Price Index, which is the average change over time in the total cost of a basket of goods and services. The Consumer Price Index increased by 80% between 2000 and 2023. We also sometimes hear about individual products, like food and housing, that have increased in price. There is, however, far less attention paid to the significant variability in the cost of goods and services over time. There is even less attention paid to products that have declined in price and improved in quality over recent decades. This contrast is quite telling.

The prices of many manufactured goods such as cameras (-94%), computers (-93%), TVs (-76%), clothing (-29%), and toys (-25%) have experienced substantial decreases, with the largest falls partly also reflecting substantial improvements in quality.2 For example, cameras are smaller and more powerful, and TV screens are bigger and better defined with many add-on services, so that consumers get a lot more for their money. There have also been significant price increases in services and costs the government more directly controls, such as rail transport (+143%) – where the government sets around half the fares and heavily controls the sector – and council rates (+139%).3 The prices of other products, including appliances (+18%), vehicles (+21%), and communication (+33%), have risen significantly more slowly than inflation (+80%) or average wages (+86%).4 These are largely, but not entirely, tradeable goods most susceptible to international competition and a dynamic process of technological innovation that has pushed down prices while increasing quality. The products that have gone up most rapidly in cost include electricity (+425%), housing (+254%), and childcare (193%).5 Notably, these are sectors that have extensive state intervention through regulation and subsidies. Regulation pushes up the cost of delivery, reduces market supply, and creates barriers to entry for new firms, which, in turn, reduces competitive pressures and increases prices. Subsidies, such as ‘help to buy,’ have also contributed to higher prices by pushing up demand. Together regulation and subsidies have created a price-spiral effect, with the government ratcheting up demand subsidies because of consumer hardship that, in the context of restrained supply, only end up further pushing up prices.

The Cost of Regulation

Regulation is often created with the best of intentions and can be entirely justified when it tackles specific harms, such as correcting negative externalities. There is significant evidence, however, that overregulation can also have detrimental impacts. Regulators often fail to properly assess the costs and benefits of the rules they are imposing, let alone the impact of regulatory accumulation over time. An excessive build-up of regulatory burdens can hinder innovation, damage growth, and push up prices (Dawson and Seater 2013; Chambers and Collins 2016; Coffey, McLaughlin, and Peretto 2020; Fullenbaum and Richards 2020). Regulatory build-ups also have a disproportionate effect on unskilled workers and low-income households.

A previous study indicated that a 10% increase in regulation is associated with around a 0.7% increase in prices (Chambers and Collins 2016). Lower-income households bear as much as six to eight times the cost of regulation compared to higher-income households, as highly regulated products like housing or electricity make up a larger proportion of their total expenditure (Thomas 2012; Bailey, Thomas, and Anderson 2018). A World Bank study found that a 10% increase in a nation’s regulatory burdens slows annual economic growth per capita by 0.5% (Loayza, Ovíedo, and Servén 2005). A 10% increase in regulation is also associated with a 2.5% increase in the poverty rate (Chambers, McLaughlin, and Stanley 2019) and a 0.5% increase in income inequality as measured by the Gini coefficient (Chambers and O’Reilly 2022; Stanley and McLaughlin 2016). A separate study found that a 1% increase in federal regulation is associated with a between 0.53% and 1.35% increase in mortality (Broughel and Chambers 2022).

Many IEA publications have established that regulations impose significant costs across sectors:

- Niemietz (2012) wrote that liberalising Britain’s planning system could reduce housing costs by around 40% and retail costs by 25%.

- Bourne and Shackleton (2017) highlight how strict staff-to-child ratios, qualifications and training requirements, and the Ofsted inspection regime have significantly increased childcare

- Rickard (2016) finds that excessively precautionary agricultural regulations covering food standards, animal welfare, and the environment have increased the cost of farming by a little more than 5% in England, or £590 million a year in 2016, negatively impacting the affordability of food.

- Stagnaro (2015) highlights how poorly designed regulatory policies to promote green energy have pushed up electricity and decarbonisation costs; this is contrasted with the success of the UK’s privatisation and liberalisation in the 1990s that reduced costs and emissions. Between 1990 and 1999, electricity prices fell for consumers by 26% and between 1990 and 2010, energy-related greenhouse gas emissions fell by 12%.

- Shackleton (2017) highlights the role of employment regulations, which impose significant costs on businesses, finding that just the cost of running human resources departments is over £15 billion per year, with much of their role related to compliance with employment law.

- Hewson (2022) highlights how trade barriers, including regulatory or non-tariff barriers, such as testing and certification requirements or inspections at borders, impose significant costs on businesses and reduce competitive pressures.

- Benston (1998) shows how financial services regulation intended to protect consumers incurs costs that are borne by consumers that exceed benefits, including creating barriers to entry that reduce the number of institutions and prevent innovation; Booth (2015) shows that financial regulation has significantly grown from one regulator for every 11,000 people employed in finance in 1979 to one regulator for every 300 people employed in finance in 2010, with compliance costing the sector £673 million by 2014 (with additional costs from reduced innovation and competition).

- Chittenden, Foster, and Sloan (2010) find that the regulatory cost associated with collecting tax in the United Kingdom is around £15-20 billion, which is particularly damaging for smaller businesses.

- Byatt (2012) says that water prices have risen too quickly as a result of poor regulation that has focused on environmental enhancement rather than consumer outcomes.

Other Factors

There are undoubtedly many other factors that have also contributed to price increases over recent decades. Firstly, the products that have experienced the largest price declines are tradeable and therefore more open to international competition, while price increases are seen in largely untradeable sectors. It is well understood that international trade, by increasing competition, spreading ideas, and enabling comparative advantage, lowers prices and increases choice for consumers. Secondly, prices have tended to go up fastest for services, which are labour-intensive and thus sensitive to growing wages, compared to goods that have gone down in cost and are capital-intensive and therefore more susceptible to productivity growth. This situation is further aggravated by Baumol’s cost disease, wherein employees in service sectors characterised by stagnant productivity growth insist on wage increases to match earnings in more productive industries. This leads to escalating service costs, as these higher wages are reflected in increased prices for consumers, without more quality. Thirdly, there are clearly some direct international factors, namely the impact of Russia’s invasion of Ukraine on global gas prices, that have contributed to the recent surges in electricity and food prices.

These other factors alone, however, cannot fully explain the relative magnitude of the price changes over recent decades. If it were purely a matter of service costs going up because of wage increases, then the price rises of the likes of childcare would be proportionate to wage growth, but in fact the magnitude of price rises is much faster. Furthermore, the likes of housing and electricity, which have seen some of the biggest price increases, are tangible goods not services. There are of course labour costs associated with both, but the price of a house is significantly higher than construction costs due to land use restrictions. There is clearly a significant regulatory factor that helps explain the dysfunctional nature of the markets that have experienced the largest price rises. Secondly, not every sector with large labour costs has seen real price rises, for example communications (e.g. telephone, internet, postal, and television) that include a significant labour component have not substantially increased. Finally, as mentioned above, labour cost increases that impact the service sector are also a function of industrial regulation.

In any case, to the extent that factors outside of regulation have impacted price changes, they are less susceptible to public policy influence. It is difficult and inadvisable, for example, for the government to try to limit wage increases in the service sector. Nor can the government do much about global factors, such as the Ukraine war. On the other hand, governments can and should change their approach to regulation. Cutting red tape in areas such as housing, energy, and financial services could reduce business costs and increase supply, resulting in lower costs for consumers.

About the Author

Matthew Lesh is the Director of Public Policy and Communications at the Institute of Economic Affairs. His papers include Breaking the News? Should digital platforms be required to fund news publishers?, Expanding the Web: The case against net neutrality and An Unsafe Bill: How the Online Safety Bill threatens free speech, innovation and privacy. He often appears on television and radio, is a columnist for London’s City A.M. newspaper, and has written for dozens of publications including The Times, The Telegraph and The Spectator. He is also a Fellow of the Adam Smith Institute and the Institute of Public Affairs. Matthew graduated with First Class Honours from the University of Melbourne with a Bachelor of Arts (Degree with Honours) and completed a Master’s in Public Policy and Administration at the London School of Economics, where he received the Peter Self Prize for Best Overall Result.

PDF Viewer

Fullscreen Mode

References

Bailey, J.B., Thomas, D.W. and Anderson, J.R. (2018) Regressive effects of regulation on wages, Public Choice, pp. 1–13. Available at: https://doi.org/10.1007/s11127-018-0517-5.

Benston, G. (1998) Regulating Financial Markets: a Critique and Some Proposals. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/regulating-financial-markets-a-critique-and-some-proposals/ (Accessed: 1 February 2024).

Booth, P. (2015) Thatcher: the Myth of Deregulation. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/thatcher-the-myth-of-deregulation/ (Accessed: 1 February 2024).

Bourne, R. and Shackleton, J.R. (2017) Getting the State out of Pre-School & Childcare: Ending the Nannying of UK Parents. SSRN Scholarly Paper ID 3852894. Rochester, NY: Social Science Research Network. Available at: https://doi.org/10.2139/ssrn.3852894.

Broughel, J. and Chambers, D. (2022) Federal Regulation and Mortality in the 50 States, Risk Analysis, 42(3), pp. 592–613. Available at: https://doi.org/10.1111/risa.13774.

Byatt, I. (2012) Water: Supply, Prices, Scarcity and Regulation. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/water-supply-prices-scarcity-and-regulation/ (Accessed: 1 February 2024).

Chambers, D. and Collins, C.A. (2016) How Do Federal Regulations Affect Consumer Prices? An Analysis of the Regressive Effects of Regulation. Mercatus Center. Available at: https://www.mercatus.org/research/working-papers/how-do-federal-regulations-affect-consumer-prices-analysis-regressive (Accessed: 30 January 2024).

Chambers, D., McLaughlin, P.A. and Stanley, L. (2019) Regulation and poverty: an empirical examination of the relationship between the incidence of federal regulation and the occurrence of poverty across the US states, Public Choice, 180(1), pp. 131–144. Available at: https://doi.org/10.1007/s11127-018-0603-8.

Chambers, D. and O’Reilly, C. (2022) Regulation and income inequality in the United States, European Journal of Political Economy, 72, p. 102101. Available at: https://doi.org/10.1016/j.ejpoleco.2021.102101.

Chittenden, F., Foster, H. and Sloan, B. (2010) Taxation and Red Tape: The Cost to British Business of Complying with the UK Tax System. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/taxation-and-red-tape-the-cost-to-british-business-of-complying-with-the-uk-ta/ (Accessed: 1 February 2024).

Coffey, B., McLaughlin, P.A. and Peretto, P. (2020) The cumulative cost of regulations, Review of Economic Dynamics, 38, pp. 1–21. Available at: https://doi.org/10.1016/j.red.2020.03.004.

Dawson, J.W. and Seater, J.J. (2013) Federal regulation and aggregate economic growth, Journal of Economic Growth, 18(2), pp. 137–177. Available at: https://doi.org/10.1007/s10887-013-9088-y.

Fullenbaum, R. and Richards, T. (2020) The Impact of Regulatory Growth on Operating Costs. SSRN Scholarly Paper ID 3697453. Rochester, NY: Social Science Research Network. Available at: https://doi.org/10.2139/ssrn.3697453.

Hewson, V. (2022) Trade restrictions and the cost of goods, in Cutting Through: How to address the cost of living crisis. London, UK: Institute of Economic Affairs. Available at: https://iea.org.uk/publications/cutting-through-how-to-address-the-cost-of-living-crisis/.

Lesh, M. and Niemietz, K. (2022) Cutting Through: How to address the cost of living crisis. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/cutting-through-how-to-address-the-cost-of-living-crisis/.

Loayza, N.V., Ovíedo, A.M. and Servén, L. (2005) The Impact of Regulation on Growth and Informality: Cross-Country Evidence. Washington, DC: World Bank. Available at: https://doi.org/10.1596/1813-9450-3623.

Niemietz, K. (2012) Redefining the Poverty Debate: Why a War on Markets is No Substitute for a War on Poverty. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/redefining-the-poverty-debate-why-a-war-on-markets-is-no-substitute-for-a-war-.

Office for Budget Responsibility (2023) Economic and fiscal outlook – November 2023. Office for Budget Responsibility. Available at: https://obr.uk/efo/economic-and-fiscal-outlook-november-2023/.

ONS (2023) UK house price data: quarterly tables. Office for National Statistics. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/housepriceindexmonthlyquarterlytables1to19 (Accessed: 8 February 2024).

Rickard, S. (2016) Ploughing the Wrong Furrow. 75. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/ploughing-the-wrong-furrow/ (Accessed: 18 January 2022).

Shackleton, L. (2017) Working to Rule: The Damaging Economics of UK Employment Regulation. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/working-to-rule-the-damaging-economics-of-uk-employment-regulation/ (Accessed: 1 February 2024).

Stagnaro, C. (2015) Power Cut? How the EU Is Pulling the Plug on Electricity Markets. Institute of Economic Affairs. Available at: https://iea.org.uk/publications/research/power-cut-how-the-eu-is-pulling-the-plug-on-electricity-markets/ (Accessed: 1 February 2024).

Stanley, L. and McLaughlin, P.A. (2016) Regulation and Income Inequality: The Regressive Effects of Entry Regulations. SSRN Scholarly Paper ID 3191390. Rochester, NY: Social Science Research Network. Available at: https://doi.org/10.2139/ssrn.3191390.

Thomas, D. (2012) Regressive Effects of Regulation. Arlington, Virginia: Mercatus Center at George Mason University. Available at: https://www.mercatus.org/students/research/working-papers/regressive-effects-regulation.

Footnotes

- This chart first appeared in Lesh and Niemietz (2022) and has been updated to reflect 2022 and 2023 data.

- Cameras is CPI Index 09.1.2: Photographic, Cinematographic & Optical Equipment; Computers is CPI Index 09.1.3: Data Processing Equipment; TVs is CPI Index 09.1.1: Reception and Reproduction of Sound and Pictures; Clothing is CPI Index 03.1: Clothing; Toys is CPIH Index 09.3.1: Games Toys and Hobbies.

- Rail transport is CPI Index 07.3.1: Passenger Transport by Railway; Council rates is CPIH Index 04.9 Council Tax and Rates.

- Appliances is CPI Index 05.3.1/2: Major appliances and small electric goods; Vehicles is CPI Index 07.1: Purchase of Vehicles; Communication is CPI Index 08: Communication; Inflation is CPI Index 00: All Items; Average earnings refers to the ONS’ Employee earnings in the UK’s Median gross annual earnings (£).

- Electricity is CPI Index 04.5.1: Electricity. House prices is the ONS (2023) UK house price data; Childcare is Family and Childcare Trust’s Childcare costs report (full time, 50 hours, under 2, England) over various years.