Bangers and Cash: Cutting red tape to put Britain at the centre of the cultivated meat revolution

SUGGESTED

Contents

Listen

Subscribe to the IEA Publications podcast feed on Spotify, Apple Podcasts or your chosen podcast provider.

Summary

- Meat production has grown significantly in recent decades. It provides a source of protein and enjoyment to billions of people.

- Livestock farming raises significant issues for the environment, including greenhouse gas emissions, expansive land and water use, polluted ecosystems, and lost biodiversity; animal welfare from industrial practices; and health security, including infectious diseases.

- It will be difficult to reduce consumption of conventional meat, considering its popularity, through exposing the benefits of veganism or a ‘meat tax’. The most effective response to the challenges associated with conventional meat is likely to be innovation that provides customers with a quality and affordable alternative.

- Cultivated meat is an alternative protein product produced in vitro using animal cells. It can taste the same, look the same and smell the same as conventional meat; presenting a solution to many of the challenges raised by conventional meat.

- Cultivated meat is different from plant-based products such as the Impossible Burger or Beyond Meat, which do not contain animal cells.

- In 2013, the first cultivated meat product, a burger, was presented to the world’s media in London. In 2020, Singapore became the first country in the world to approve a cultivated meat product for sale to consumers, a chicken nugget from San Francisco-based start-up Eat Just.

- Cultivated meat start-ups have received substantial funding while, like other fast-moving innovations, the cost of production has declined by 99 per cent since the first demonstration a decade ago.

- The technology, however, could be held back by overregulation in the European Union and the United Kingdom. This is because of the EU’s novel food regulations and their retention in UK law.

- The novel food regulatory process risks being too slow, creating significant uncertainties, and too cumbersome, resulting in producers seeking approval elsewhere.

- Brexit provides the opportunity for the UK to diverge from the EU’s approach and introduce a regulatory regime that is more welcoming of food innovations such as cultivated meat. It could:

- clarify and consult on requirements by establishing a Food Standards Agency (FSA) Advice Unit;

- update the existing regulatory framework to prioritise innovation;

- introduce a ‘food sandbox’; and

- recognise overseas approvals.

Foreword

‘Don’t judge each day by the harvest you reap but by the seeds that you plant’. Robert Louis Stevenson said this over a century ago, yet it’s a concept I subscribe to as the founder of a company creating a revolutionary new product – cultivated meat.

Innovation starts with a big idea, but to turn this into a reality requires continuous effort, focus and action – laying the groundwork for progressive change.

And change is badly needed. Globally, intensive farming is having a devastating impact on the environment, animal welfare and human health.

Not only this but in the UK we are currently importing £4.5 billion of meat every year – hampering both the country’s economic potential and its food security.

So why don’t we just eat less meat? Encouraging the uptake of plant-based alternatives looks reasonable on paper but doesn’t translate in reality. The majority of people love the taste of meat, and behaviour change is far more likely to occur when consumers are given greater choice that caters for their needs, not more restrictions.

This is why cultivated meat truly offers a better alternative – it’s real meat, just made differently. At Ivy Farm, we’re using technology developed at Oxford University to grow pork mince that’s a good source of protein, low in saturated fat and free from antibiotics.

The environmental benefits are hugely compelling – cultivated meat is estimated to cause up to 92 per cent fewer carbon emissions and use 95 per cent less land than intensively farmed produce – as are the economic predictions: the product has the potential to add £2.1 billion to the UK economy by 2030.

It almost sounds too good to be true, so what’s the catch? No catch – but there are some challenges to overcome.

The novel food regulations in the UK are outdated and lack the agility to keep pace with current innovation. The legislation itself is over 25 years old, dating back to an era before mobile phone and email usage became ubiquitous in the UK (not everything stays as relevant as Robert Louis Stevenson).

Today, other forward-thinking countries, such as Singapore, have already approved the product for sale and there’s no reason why we can’t do the same, to become a frontrunner in this exciting new industry.

The following report gives an overview of the massive potential for cultivated meat in the UK and offers practical, straightforward steps to remove barriers to entry and support the journey of this game-changing product to market.

Change can be daunting, but it’s important to stress that as cultivated meat producers we are not ‘anti farming’. Our mission is to work alongside those who care about people, animals and the planet to provide sustainable, healthy and tasty meat that’s 100 per cent harm free.

With pressure mounting on the UK government to prove its commitment to ambitious net zero targets, cultivated meat offers a unique opportunity to create a significant, lasting impact. We’ve had the big idea – now it’s time to bring the product to the plates of UK consumers.

Every step counts, no matter how small, and we invite you to play a part.

Russ Tucker

Co-Founder

Ivy Farm Technologies

Introduction

‘With a greater knowledge of what are called hormones, i.e. the chemical messengers in our blood, it will be possible to control growth. We shall escape the absurdity of growing a whole chicken in order to eat the breast or wing, by growing these parts separately under a suitable medium.

‘The new foods will be practically indistinguishable from the natural product from the outset, and any changes will be so gradual as to escape observation.’

Winston Churchill, Fifty Years Hence,

The Strand Magazine, December 1931

A future in which humans do not rely on animals for protein is no longer the realm of science fiction. It is being built today by hundreds of innovative companies, developing alternatives such as plant-based products, the ‘Impossible Burger’ to name but one, and using unconventional ingredients such as insects and fungi. The most promising alternative is cultivated meat (also referred to as cultured, lab-grown, cell-based, synthetic, animal-free or clean meat). Cultivated meat can taste the same, look the same and smell the same as conventional meat while limiting the negative effects associated with livestock agriculture relating to the environment, animal welfare, health and food security.

The technology has transitioned from a purely theoretical concept to a prototype at extraordinary speed. Edelman et al. (2005) proposed the idea in a 2005 journal article for Tissue Engineering. Article co-author Jason Matheny speculated to BBC News (2005) that ‘with a single cell, you could theoretically produce the world’s annual meat supply. And you could do it in a way that’s better for the environment and human health.’ Mosa Meat cooked the world’s first cultivated meat burger in 2013 at the cost of £215,000. People for the Ethical Treatment of Animals (Peta) celebrated the achievement: ‘[Lab-grown meat] will spell the end of lorries full of cows and chickens, abattoirs and factory farming. It will reduce carbon emissions, conserve water and make the food supply safer’ (BBC News 2013).

The demonstration kicked off an entirely new industry seeking to overcome the technological hurdles and achieve societal and regulatory acceptance for mass-producing cultivated meat. The next major leap came in December 2020 when Singapore became the first country in the world to approve a cultivated meat product for sale, a chicken nugget from San Francisco-based start-up Eat Just. The dish costs £18 (US$23) and includes a bao bun, phyllo puff pastry, and a crispy maple waffle (Scipioni 2020). ‘It tastes like a nice, greasy, fast-food nugget,’ BBC reporter Regan Morris (2020) explained. ‘It just happens to be grown in a bioreactor.’

Cultivated meat has come at an opportune time. The significant challenges associated with livestock farming are well known. They include extensive land use, carbon and methane emissions, risks posed by disease, and the animal cruelty. Nevertheless, global meat consumption is expected to grow as countries become more affluent, and humanity still needs more protein, not less. This protein would ideally not come from animals.

Many consumers often say they want an alternative to meat. Yet the existing approaches, such as soy and pea, have not achieved widespread popularity. Meanwhile, taxes and prohibitions on meat risk being excessively burdensome and are unlikely to be politically viable. Ideally, consumers would have the option of an alternative quality protein at a reasonable price. Cultivated meat could be just that alternative.

Cultivated meat is receiving substantial investment, while entrepreneurs are making extraordinary strides in improving the production process. But there remain significant regulatory barriers to making this a reality. The UK’s ‘novel foods’ regulations have been dictated by the EU. These rules have the potential to undermine innovation. They risk, if not reformed, slowing the development and commercialisation of cultivated meat in the UK.

It is now possible, following Brexit, for the UK to take a more pro-innovation approach to food regulation while continuing to protect consumer safety. Indeed, the government has committed to reviewing the novel foods regulations to ‘support innovation in the sustainable protein sector’ (Cabinet Office 2022: 63). The National Food Strategy further commits the government to work with the Food Standards Agency (FSA) to develop guidance for ‘new alternative protein products’ as well as ‘reviewing our novel food regulations’ (DEFRA 2022: 20).

This paper (1) describes the potential of cultivated meat to overcome the challenges presented by conventional meat; (2) considers the regulatory hurdles to cultivated meat posed by the novel food regulations; and (3) outlines potential regulatory reforms that could help make cultivated meat, along with other novel foods, more accessible in the UK.

The potential of cultivated meat

Cultivated meat could help alleviate the concerns associated with conventional meat. It has transformed from a purely theoretical idea to proof of concept, and approaching commercialisation, in less than a decade. Yet there remain technical and regulatory obstacles.

What is cultivated meat?

Cultivated meat is an alternative protein product produced in vitro using animal cells. There are a variety of methods to produce cultivated meat – see Arshad et al. (2017) for a scientific review. The typical process involves using a biopsy procedure to acquire a small piece of tissue stem cells from an animal – such as a cow, chicken or pig. The muscle and fat cells are then isolated and multiplied in a bioreactor. Sugars, salts, amino acids, growth factor proteins, nutrients and other organic components are added to enable the cells to grow. It may also be possible to use genetic engineering or gene editing to produce stem cells that can replicate themselves indefinitely. The additives used during the production process mean cultivated meat is not necessarily chemically identical to conventional meat. Nevertheless, the use of animal cells makes it possible for the final product to have a very similar structure to animal tissue and the same sensory and nutritional profile as conventional meat.

A range of companies, across the UK and the rest of Europe, as well as in Singapore, Japan, Israel and the United States, are attempting to transform cultivated meat into a commercially viable product. The Good Food Institute (Byrne 2021) found that US$366 million was invested in over 70 cultivated meat companies in just 2020 – six times more than 2019. The initial commercially viable cultivated meat products are expected to be minced meat, hamburgers and sausages, which are the easiest to produce in vitro. Companies are also developing other cultivated products, including steak, chicken, pork, lamb, duck, fish, shrimp, foie gras, kangaroo, mouse and horse – as well as cultivated dairy products including milk and cheese, though this paper will primarily focus on meat-related applications.

The UK is home to cultivated meat start-up firms including Higher Stakes and Ivy Farms. Ivy Farms is aiming to raise £16 million to construct a pilot production facility, to produce 12,000 tons of cultured pork by 2025 (Bayes-Brown 2021). That would be the equivalent of 170,000 pigs. Other British companies are developing products to support the industry, including Multus Media, which is working on growth media, and Unicorn Biotechnologies, which is developing a cultivated-meat manufacturing platform.

What are the benefits of cultivated meat?

Cultivated meat has a plethora of potential benefits over livestock farming, most clearly in respect to the environment and animal welfare, and also potentially human health and food safety.

The environment

Food production is a significant barrier to limiting global warming to meet the Paris targets of 2°C or 1.5°C. The Food and Agriculture Organization of the United Nations estimates that livestock is responsible for 14.5 per cent of human-induced greenhouse gas emissions, with beef (41 per cent) and milk (20 per cent) making up the most significant contributions (Gerber et al. 2013). An important point about this is that it is the production, not the transportation, that counts for the vast bulk of these emissions. Ritchie & Roser (2020) report that just 6 per cent of carbon emissions from European diets come from transport while 53 per cent are associated with livestock and fish, with the remainder coming from other parts of the supply chain (such as packaging and processing) and crops.

Farming also contributes significantly to habitat loss and reduced biodiversity through extensive land use, the effects of fertilisers and pesticides, and deforestation and land degradation. Machovina et al. (2015) links food to ‘soil loss, water and nutrient pollution, and decreases of apex predators and wild herbivores, compounding pressures on ecosystems and biodiversity’.

Consequently, there could be large environmental benefits from cultivated meat. Most clearly, cultivated meat would free up a significant amount of land for other uses such as rewilding, thereby increasing biodiversity, and housing, which could lower the cost of living and boost productivity. It would reduce the need for fertilisers and pesticides.

The production process could also result in less energy use and associated carbon emissions, presuming the electricity required for the production process is less than used in conventional farming. Tuomisto & Teixeira de Mattos (2011) compared the environmental impact of cultivated meat with that of conventional European meat. It found that, depending on the production process, cultivated meat could reduce energy use between 7 per cent and 45 per cent, greenhouse gas emissions by 78 per cent to 96 per cent, water use by 82 per cent to 96 per cent and land use by 99 per cent. Odegard & Sinke (2021) used primary data from cultivated meat start-ups to undertake a full life cycle assessment, looking at the total environmental impact from production process to raw materials. They found that cultivated meat could have a 2.5 to 4 times lower carbon footprint. The precise environmental impact, particularly in respect to energy use, will not be known until the product is being produced at a commercial scale.

Animal welfare

There is considerable concern about cruelty to animals in livestock farming, as well as broader philosophical questions about eating sentient beings – bought to popular attention by Singer (1975). Ritchie & Roser (2019) report that each year over 80 billion animals are slaughtered in industrial livestock, and Anthis & Anthis (2019) say that many animals spend their lives in battery cages and gestation crates that closely confine their movement and prevent exercise. Worldwide, estimates suggest over 90 per cent of animals are factory farmed. It is perhaps no surprise that the FSA (2019a) found that 50 per cent of British adults are concerned about animal welfare. Cultivated meat, by no longer necessitating the mass production and slaughter of animals, could almost entirely alleviate animal suffering.

Health and food security

Conventional meat is an essential part of a healthy diet for billions of people. Nevertheless, there are concerns about overconsumption of red and processed meat. Ekmekcioglu et al.’s (2018) meta-analysis finds meat consumption is correlated with an increased risk of type 2 diabetes, cardiovascular diseases and cancers, likely due to issues such as high fatty acid content – albeit these associations may be unreliable due to self-reporting errors and confounding variables. Meat production also raises health security risks. Jones et al. (2013) find that livestock farming is associated with food-borne disease and zoonotic infectious disease, while Perreten et al. (1997) highlight the risk of antimicrobial resistance from antibiotics used for farm animals. The Intergovernmental Panel on Climate Change (IPCC) also warns that climate change could undermine global food security by negatively affecting crop yields in some parts of the world, though positively in other regions, and accordingly impacting livestock (IPCC 2020).

Additionally, Bhat et al. (2017) discuss the potential for cultivated meat to reduce the risk of food-borne diseases, such as swine flu or avian flu, and antimicrobial resistance by not requiring antibiotics. It could even be made healthier by adding more vitamins or by reducing fatty acid content. The technology could also be used to ensure food security by providing continued food supplies during climate-related disruptions and in challenging locations such as Antarctica or a future space colony.

Is cultivated meat the best alternative to conventional meat?

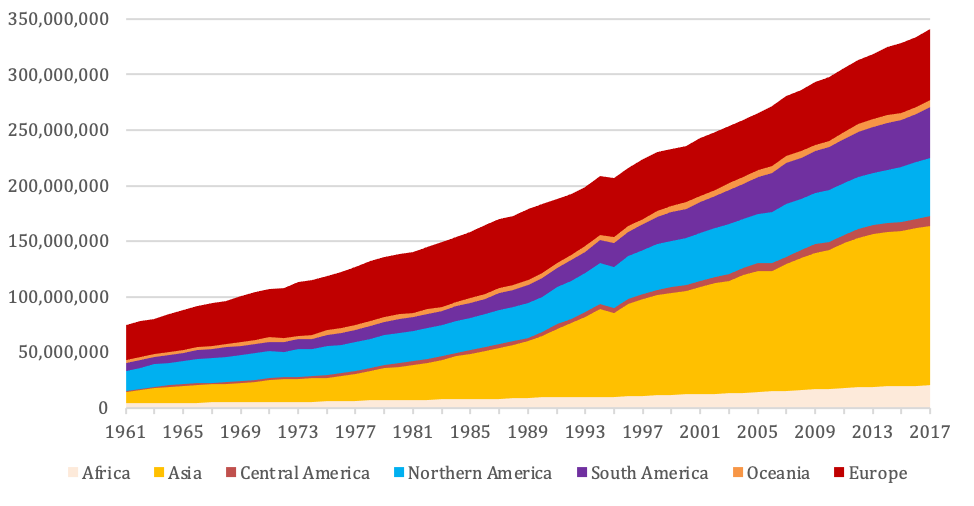

Cultivated meat is on the horizon at an opportune time. Conventional meat production has either remained stable or, according to Stewart et al. (2021), marginally declined in the UK in recent years. Globally, however, Ritchie & Roser (2019) report that meat production quadrupled between 1961 and 2017 to 340 million tons annually, with the most dramatic increases coming from Asia (see Figure 1). Godfray et al. (2018) find that this upwards trend has been driven by higher incomes and urbanisation. Conventional meat production, in the absence of an alternative, is only likely to increase over the coming decades as countries climb up the development ladder. This trend can be understood as part of a broader story about human progress, declining malnourishment and rising living standards. However, it also exacerbates the aforementioned challenges associated with conventional meat.

Figure 1: Global meat production, 1961–2018

Meat includes cattle, poultry, sheep/mutton, goat, pig meat and wild game. Source:

Our World in Data/Food and Agriculture Organization of the United Nations (FAO) (2020) (Ritchie & Roser 2019)

Concerns about conventional meat have contributed to the emergence of the vegan and vegetarianism movements and plant-based alternatives to conventional meat, such as KFC’s vegan fried chicken, ‘Beyond Fried Chicken’ (Patton & Larkin 2022). So far, however, these products make up a small proportion of the overall meat market while few consumers entirely eschew meat. This could be explained by Hartmann & Siegrist’s (2017) finding that most consumers are unaware of the issues with meat, unconcerned about their meat consumption and unwilling to change behaviour. Indeed, fewer than one in twenty people in Britain identify as a vegan or vegetarian (Food Standards Agency 2019b: 6). Stubbs et al. (2018) find that even the intention to reduce meat consumption does not often translate into behaviour change. This is likely to be because millions of people enjoy meat as part of a healthy – or perhaps even an unhealthy – diet every single day.

In response to the continued high levels of meat consumption, some, such as plant-based meat company chief executive Ethan Brown (Josephs 2021), have called for a ‘meat tax’ to reduce consumption. However, the Dimbleby food review, despite recommending a salt and sugar tax, concluded that a ‘meat tax’ would be ‘politically impossible’ while raising cost-of-living issues:

It was – by a long way – the least popular of any measure we discussed with citizens in our ‘deliberative dialogues’. It would also have the consequence of penalising poorer households, because the tax would have to be imposed by weight. The price hike on cheap cuts or mince would be proportionally much bigger than on, say, steak. (Dimbleby 2021: 11)

These considerations suggest a more effective approach to reducing meat consumption may be the development of a quality and cost-effective alternative. Indeed, this is the experience with other products. The development of intensively farmed chicken – which has reduced prices substantially – has led to a substitution away from beef over the last fifty years. Because chicken is less carbon intensive than other meat (Gaillac & Marbach 2021), the shift has reduced the environmental impact of diets. Similarly, Freinkel (2011) discusses how plastic replaced ivory, saving many elephants, and Shellenberger & Nordhaus (2015) discuss how petroleum replaced whale oil, likely saving whales from extinction, by providing a viable affordable alternative.

The existing meat alternatives have not yet reached the point of quality and price effectiveness to substantially replace conventional meat. By contrast, cultivated meat, by replicating the experience of eating conventional meat, stands a strong chance of changing behaviour, and thus becoming a viable alternative.

What are the challenges facing cultivated meat?

Cultivated meat has significant technical and societal obstacles. The primary technical challenge is to scale up production, to an industrial-sized production line, such that it lowers the cost for consumers and ensures profitability for producers. In practice, this means figuring out what to feed the cells and how to grow them in large quantities. There is also the ongoing need to ensure the product is tasty, mimics the texture of meat, and is safe from contaminants in the production process.

There are some, such as Hocquette (2016), who are highly sceptical that the technical issues can be overcome. Nevertheless, there does appear to have been progress. The cost of production has declined by 99 per cent since the earliest prototypes. Mosa Meat, the company that made the first cultured beef burger in 2013 at the cost of £215,000, believes it will shortly be able to make the product for £8 (González & Koltrowitz 2019). An Israeli start-up, Future Meat Technologies, claims to have produced a chicken breast for £2.80 and own a factory that can produce 5,000 burger patties per day (Ramirez 2021). McKinsey projects that cultivated meat could reach cost parity with conventional meat by 2030 with improved manufacturing and R&D (Brennan et al. 2021).

Even if the technical issues are overcome, there are open questions about whether consumers will be willing to purchase the product. Verbeke et al. (2015) find, from focus groups, that the initial public reaction to cultivated meat is often feelings of disgust and unnaturalness. A survey from the FSA found around one-third of British consumers (34 per cent) are currently willing to try lab-grown meat; this is more than would try edible insects (26 per cent), but fewer than would try plant-based proteins (60 per cent) (Jarchlo & King 2022). This survey demonstrates an initial market while also indicating many do not welcome the prospect of cultivated meat.

There are questions as to whether cultivated meat could be considered kosher (Kenigsberg & Zivotofsky 2020) or halal (Hamdan et al. 2018). There are moral questions, such as whether cultivated meat represents a further commodification of animals and the risk of unintended consequences of biotechnology through to whether this technology could enable consumption of human flesh. Hopkins & Dacey (2008) and Schaefer & Savulescu (2014) tackle the ethical issues posed by cultivated meat and conclude that, on balance, the technology would still be a moral improvement over conventional meat.

If cultivated meat were to become a wildly successful product that replaces existing livestock agriculture, however, it would have a significant displacement effect on the farming industry. This could be beneficial for society at large, freeing up agricultural workers and land for other pursuits, akin to the experience over the last few centuries in increasing farming productivity and resulting in millions raising their standard of living from peasants working the land to better jobs in towns and cities.

Regulatory hurdles to cultivated meat

Cultivated meat must comply with the UK’s novel food regulations, which derive from retained EU law.1 This section describes the regime and explores whether they could undermine the sector.

What are the EU’s novel food regulations?

The novel food regulations are a premarket approval process operated by the European Food Safety Authority (EFSA) and, since Brexit, the Food Standards Agency (FSA) in the Britain.2 The regulations apply to any product, including ingredients and production processes, that do not have a history of consumption within the EU prior to 15 May 1997 when the first novel food regulation came into force. An applicant must submit detailed information about the product to the regulator, who then undertakes a public consultation and a risk assessment in conjunction with an expert group or scientific advisory committee. This regulatory process has been applied to an extensive list of foods and ingredients, including chia and basil seeds, mung bean protein, and CBD products.

In the EU, successful applications are sent to a committee for final approval, the Standing Committee on Plants, Animals, Food and Feed, which includes a representative from every member state. This final step can take around nine months, as it must be approved by a supermajority. In this respect, the UK Parliament made minor changes when retaining the regulations into UK law after Brexit. In Britain, the expert recommendation is sent to ministers, who make the final decision instead of a member state committee. This could accelerate the approval process compared with the multi-member state approval required by the EU. Applicants can also use the same data when applying to the UK as they do the EU, though an EU approval is not recognised in the UK and thus producers have to go through the process twice to sell in both jurisdictions.

The resulting novel food authorisation contains a list of conditions, such as how much of the ingredient can be used in different foods, and labelling and other requirements. There is a simplified route for products that have been authorised elsewhere, but only if they have 25 years of continuous use (meaning it would not be until 2045 that Singapore’s approval of cultured chicken nuggets could enable an accelerated approval process in the EU or UK).

Have the novel food regulations held back innovation?

The EU’s approach to food regulation generally holds back innovation. The rules ostensibly aim to protect human life, health and consumers. However, as Alemanno & Gabbi (2016) explain, the regulations were written in the context of food safety scares in the 1990s and early 2000s and thus tightly regulate food innovation.

The EU food regulations explicitly endorse the precautionary principle (Regulation EC No. 178/2002, s. 21). The EU’s legal glossary defines the precautionary principle as ‘an approach to risk management, where, if it is possible that a given policy or action might cause harm to the public or the environment and if there is still no scientific agreement on the issue, the policy or action in question should not be carried out’ (EUR-Lex 2022). This effectively reverses the onus of proof, requiring the proposer of a new technology to substantiate that it is safe. This risks, by being too cautious, delaying or denying access to a beneficial innovation.

More specifically, Rickard (2016) criticises the EU’s precautionary approach in relation to foods containing genetically modified organisms (GMOs). 3 Just a single GMO crop has ever been approved by the European Commission for commercial cultivation, maize MON 810, despite the EU importing millions of tons of soybeans and other GMO crops to feed livestock. The UK government has announced the intention to diverge from the EU’s precautionary approach with respect to gene editing (Eustice 2021).4

Just like GMO regulation, novel food regulations also embody the precautionary principle. They require new foods to be proven safe to a regulator before being marketed to consumers. Accordingly, the process requires significant investment in time and money to develop an application, undertake the requisite safety testing, and interface with the authorities.5 There have been concerns for several years that the process presents a barrier to innovation.

Agricultural economist Graham Brookes (2007), in a report on the novel foods regulatory impact, contends that new product launches are significantly influenced by the regulatory environment, as regulation has a large impact on the time-to-market and thus whether a firm is likely to receive a decent return on its investment. Brookes finds that the EU’s novel food process took an average of 35 months (range 16–60 months) in the first decade of operation, reducing revenues due to delays in getting a product to market and increasing uncertainty. Accordingly, Brookes concludes that the regulations reduce R&D expenditure and food innovation. Similarly, Scarpa & Dalfrà (2008) argue that the novel food regulations are ‘practically inaccessible to small and medium enterprises’, limiting innovation, research and development. Bremmers et al. (2008: 33), in the context of the dairy industry, highlight how the novel food process hampers the competitiveness of smaller businesses due to high fixed costs of seeking approval.

A decade later, Hyde et al. (2017) argued that the novel food regulations have failed to protect public safety, evidenced by the continued presence of unapproved goods on the market; while simultaneously failing to encourage innovation, evidenced by the slowness of the process (then averaging 40 months), high cost of seeking approval, and low number of approvals. The regulations were updated in 2015 in an attempt to address some of these concerns.6 However, the underlying substantive requirements and associated burdens remain largely unchanged. Holle (2018: 325) concludes that despite ‘superficial friendliness towards innovation’ of the updated regulation, ‘its true character is conservative and hardly supportive of novelty’. Holle highlights the definitional issues, such as the arbitrariness of including all new products from 15 May 1997, the lack of binding deadlines, or the protection of intellectual property in the process.

More recently, regulatory consultant Christiaan Kalk (2019) estimated that the EU’s novel food process costs businesses at least ‘€250,000 to €350,000’ (£210,000 to £295,000). He describes this as a ‘considerable hurdle to many start-up companies’ that lack existing revenues. 7 Kalk compares the EU’s novel food process to the Generally Recognized as Safe (GRAS) equivalent in the United States, which can, in some circumstances, simply be affirmed by an independent panel and a peer-reviewed study with limited need for consultations with the Food and Drug Administration (FDA), and can take months rather than years.

How could the novel food regulations hold back cultivated meat?

The FSA is committed to ‘supporting food innovation’ in respect to cultivated meat (May 2022). However, there is yet to be a single cultivated meat application in the UK (or, for that matter, the EU) under the existing novel foods process. This is no coincidence. There have been significant concerns that the novel food regulations could hold back approvals. For example, Eamonn Ives (2020: 55), in a paper for The Entrepreneurs Network, identified the novel food regulatory process as a key barrier to the new technology. It is also notable that the government’s food strategy highlighted, under the headline of reducing barriers and bureaucracy, the need to review the novel food regulations to help innovators and investors (DEFRA 2022: 20). This statement effectively acknowledges that the current framework could be improved.

This section discusses concerns about the speed of approvals, the lack of clarity, and the requirements. It refers extensively to claims made by industry figures, individuals who have a clear interest in reducing their regulatory burden, but who nevertheless appear to be raising legitimate issues. They are supported by independent analysts and consistent with the previous literature regarding the novel food process.

The speed of regulatory approval

The speed of regulatory approval is likely to have a large impact on the development of the cultivated meat in the UK. On the one hand, ‘delayed regulatory approval may result in the UK falling behind in the global agri-tech race,’ warns Henry Worthington (2021: 3) of Oxford Economics, while on the other hand: swift regulatory approval in the UK would allow domestic firms to leverage their existing market knowledge and networks to further develop their technological know-how in anticipation of the global market opening up. This could help establish UK firms as trend setters and the knowledge spillovers could help establish an ecosystem of technologically advanced businesses in the UK. (Worthington 2021: 4)

Worthington also argues that a first-mover advantage could include setting global standards and allowing domestic producers to build up manufacturing scale and a global brand. The novel food regulations have specific time limits: a one-month validation process, followed by up to nine months’ risk assessment process. However, this is ‘on a start stop the clock basis if further information is needed’ (Food Standards Agency 2020) – meaning the process could theoretically carry on indefinitely. The regulator then has another seven months for subsequent risk management considerations and a decision. The Food Standards Agency (2020) states that the novel food process ‘will take at least a year’. While there is a lack of post-Brexit data on the FSA’s processing times, this is likely to be a substantial underestimate. Previous applications under the same novel food process in the EU have taken over three years, according to reporting by Politico’s Arthur Neslen (2020a) and the aforementioned studies.

The uncertainty about time-to-market risks companies seeking approval outside of the UK. In an earlier example, Neslen (2020b) reports that the Dutch Food Safety Authority (NVWA) prevented Eat Just, the company behind the cultivated chicken nugget in Singapore, from holding tastings in 2018 because of the lack of EU approval. ‘What’s happening in Singapore should have been happening in Europe,’ said Ira van Eelen, who sits on Eat Just’s board and whose father, Dutch scientist Willem van Eelen, patented the technology. ‘We have so much very good technology in Europe that we could be up there with anybody, but if they don’t gear up in a different way then we will lose out and lose out big time’ (Neslen, 2020b).

Peter Verstrate, who is the COO of Mosa Meat, the Dutch-based cultivated-meat start-up that produced the first cultured burger in 2013, has ‘no doubt’ that their first cultivated meat offerings will be outside of Europe because of the long approval process (Neslen 2020b). ‘We won’t shy away from applying elsewhere if that brings us to the market faster,’ Verstrate said. ‘That’s not a threat, just a fact of life.’ Belgium-based Peace of Meat, in comments given to the Food Navigator news site, has similarly stated that the novel foods process is ‘far too rigid and too slow’ and has spoken positively about Singapore’s approach (Southey 2021). The same issues apply to the UK, where it would not be possible to bring a product like Eat Just’s to market as rapidly as in Singapore. Indeed, UK-based Higher Steaks has raised concerns that the potential for long delays could force it to go elsewhere (Neslen 2020b).

The stop-start process has also raised specific concerns. It may be designed to allow the regulator to go back for more information, rather than reject an application. But it also creates uncertainty about timelines. Ketelings et. al. (2021), who interviewed stakeholders in the cultivated meat sector, found concern from an industry source that:

EFSA could ask for additional information, so if they think the products’ safety is not yet demonstrated based on the information you submitted as a company, they can ask for additional information. That could come down to the approval process being on hold for a considerable time.

It is much more difficult to develop a product or make investment decisions when there is such an unknown prospect of time-to-market. While it is possible that the concerns from industry are overblown, the difference in approval times between the UK and other jurisdictions, such as Singapore, risk having a large impact on where producers operate (as in the case of Eat Just’s cultivated chicken nugget) and are likely to continue to do so in future.

The lack of clarity

The novel foods regulatory process might be less worrying if the regulators were clear with the companies about the information they expect. However, as of November 2022, the FSA was yet to issue guidance on what nutritional and toxicological information would be required from a company seeking authorisation for cultivated meat. This means companies are being forced to make assumptions about what will be required and risk being delayed as the regulator goes back and forth with companies, demanding new information.

Perhaps even more importantly, the process also expects companies to completely define their products and production process prior to submission, with no feedback available on an interim or modular basis. It would not be possible, for example, for a company to seek separate approval for each ingredient, specific process or machinery. A process like this may be appropriate for a well-defined novel food; it is, however, ill-suited to a rapidly evolving industry, with new manufacturing processes that are constantly changing and improving.

Mosa Meat CEO Maarten Bosch is quoted by journalist Sandra Wirsching (2020) in the European Biotechnology magazine warning that the requirements to completely define the product in advance put the company:

…in a challenging position, as we know already that our manufacturing process will still change in some details over the upcoming two years. We are currently figuring out how this can work to not delay everything too long.

UK-based Ivy Farms has similarly raised concerns that having to fully define the product in advance of a regulatory process limits further innovation (White 2021). If the system is unchanged, companies could be forced to delay applying for regulatory approval until they are confident their processes cannot be substantially improved or, more likely, be using outdated technology by the time they receive regulatory approval.

The requirements

The regulatory requirements themselves could also raise challenges. The EFSA (2018) checklist on submission of applications, which the FSA is still using in the UK, includes over 150 items. This ranges from a production flow chart to stability testing details and estimates of the anticipated intake of the novel food. It is unstated which of these items will be required for cultivated meat or what information will be required to fulfil the criteria. Lähteenmäki-Uutela et al. (2021) warn, in the context of cultivated meat and other alternative protein products, that the expansive requirements ‘may prove insurmountable for small companies, and it is demanding and time-consuming even for larger companies, dampening the transformative potential of all novel foods’.

For example, novel food safety testing typically requires providing 10kg of material to independent labs. But producing this much cultivated meat is very expensive without a large-scale production process, something that most cultivated meat start-ups lack. Mosa Meat CEO Maarten Bosch warns that ‘it’s obvious, that if this (rule) is applied to the cell-based meat space as well, all approval-related processes would be extremely delayed’ (Wirsching 2020). In a catch-22, it may only be possible to obtain investment for large-scale production in the knowledge that the product will be approved, but it will be difficult to gain approval without already having undertaken that investment.

This section has established that the cultivated meat industry, along with outside analysts, is concerned that the novel food regulatory process will raise serious challenges

What about labelling regulations?

The novel food regulatory process empowers the FSA to stipulate labelling requirements. Froggatt & Wellesley (2019: 26), in a report for Chatham House, warn that food labelling is one of the main barriers for producers of existing plant-based meat alternatives and could slow the adoption of cultivated meat. This is because, as Bryant & Dillard (2019) find, public attitudes towards cultivated meat are highly sensitive to how it is described and labelled.

There is a significant risk, as highlighted by van der Weele et al. (2019), that vested interests will seek regulatory barriers against cultivated meat. Indeed, incumbent meat and dairy producers in the US and Europe have already lobbied to limit the ability of producers of alternative protein products to use common terminology such as ‘milk’, ‘burger,’ ‘steak’, ‘bacon’ or ‘sausage’. 8

Accordingly, it will be important for the FSA to ensure the labelling requirements for cultivated meat are not undermining the product or unduly reflecting incumbent interests. There are effectively two decisions that will need to be made. Firstly, whether the producers can use terms like ‘meat’, ‘chicken’, ‘sausage’ or ‘bacon’. A ban on these terms would make cultivated meat less appealing for consumers and thus undermine the potential benefits. It would also make little sense since, as discussed, these products use actual animal cells and will be an equivariant product.

Secondly, there is the question of whether the product should require a label suggesting it was produced in vitro and, if so, which word (e.g. ‘cultivated’, ‘cultured’, ‘lab-grown’) would be most appropriate. Norton (2015) claims that ‘a label indicating that a product contains in vitro meat may be unnecessary if in vitro meat is indistinguishable from traditional meat’. Nevertheless, there is industry acceptance, for example from the Alliance for Meat, Poultry and Seafood Innovation (AMPS Innovation 2021), for a word such as ‘cultivated’ on the product packaging. In any case, producers would likely voluntarily adopt this stipulation to build market awareness and differentiate – and therefore it would not be a problematic requirement.

In sum, a specific question which will be raised during the regulatory process is that of labelling requirements – an issue likely to have a large impact on commercial success or failure. It would be most sensible to allow use of product terms such as ‘burger’ and ‘bacon’ while only requiring use of a descriptive term such as ‘cultivated’. This would balance the need for consumer information and commercial viability.

The reform opportunity for cultivated meat

The UK has the opportunity, outside of the EU’s regulatory orbit, to reform food regulation to become more welcoming of cultivated meat. The goal of the novel food regulatory process should be to ensure the products meet the minimum necessary safety requirements and deliver consumer transparency – while avoiding excessively burdensome rules and processes that hold back the consumer benefits of new products. The regulations should be risk-based, that is, minimise risk while accepting that nothing is entirely risk-free, including the existing methods of food production. A reform agenda, following these principles, would not only benefit the development of cultivated meat but also support other beneficial food innovation.

The Singapore experience demonstrates that the novel foods process can be improved without lowering standards. Singapore Food Agency (SFA) first issued guidance for cultivated meat applications in 2019.9 This is part of an SFA ‘novel foods’ regulatory framework that is meant to correspond with the goals of the EU’s regulatory framework, yet appears to operate in a much faster and more consultative manner. Dutch life sciences lawyer Karin Verzijden (2021) describes Singapore’s requirements for cultivated meat as a ‘modest framework’ as part of a ‘relatively informal and accelerated, yet science-based’ process. Singapore’s regulatory approval process is said to take between three and six months, though Verzijden says SFA considers this ‘slightly optimistic’.

Importantly, according to Verzijden, SFA also seems to offer:

their assistance as a service rather than that they position themselves as rigid safety assessors. Also, they much encourage companies to consult SFA early in their product development process (referred to as ‘early-stage engagement’).

There are also straightforward rules about labelling – customers must be informed that a food is ‘cultured’ without restricting words such as ‘chicken’ or ‘beef’.

SFA does not appear to have ignored safety concerns when approving Eat Just’s chicken nugget. ‘It was found to be safe for consumption at the intended levels of use and was allowed to be sold in Singapore as an ingredient in Eat Just’s nuggets product,’ SFA said (BBC News 2020). Nor have there been any reported safety issues with the product, demonstrating that the regulatory process is sufficient. Singapore’s approach may partly reflect cultural differences that are hard to replicate. Nevertheless, it does appear there are lessons to be learnt both from Singapore and from how other products are regulated.

Singapore is leading the global regulatory race, being the first to approve a product, while other regulators – in the United States (FDA & USDA 2020), Israel (Gross 2021) and Japan (Yamaguchi 2020) – are also improving their processes for cultivated meat. Furthermore, the UK government has stated the intention to review the novel foods regulatory framework to support innovation (Cabinet Office 2022: 63; DEFRA 2022). There are several steps that could be taken to address these concerns and ensure consumers and industry can benefit.

Clarify requirements by establishing an FSA Advice Unit

The FSA appears unprepared for the forthcoming applications of cultivated meat under the novel food framework. It is yet to state what is expected of firms or to establish an expert or scientific advisory group, let alone publish guidance and establish an advice unit. This contrasts with the FSA’s approach to cannabidiol (CBD) products that, at the very least, have guidance in the form of a web page from the FSA (2022).

The most straightforward way to alleviate at least some of the uncertainty would be for the FSA to be more interactive with firms – by providing clarity in guidance and about what it expects from cultivated meat products through an advice unit. This could be modelled on the Financial Conduct Authority (FCA)’s Advice Unit, which provides financial sector firms with individualised feedback on the regulatory implications of innovative business models and publishes tools and resources for all firms (FCA 2016).

This could be supported by the establishment of an advisory committee, as suggested by Froggatt & Wellesley (2019: 34) in the EU context, to support the development of detailed guidance for applicants and undertake premarket consultation on upcoming regulatory issues such as production materials, processes and labelling. A consultation process could support the FSA’s subsequent regulatory assessments while including the public and industry in standard-setting and providing a much clearer path to market.

Update the existing regulatory framework to prioritise innovation

The underlying regulatory process could be improved to be more welcoming of cultivated meat and other new food technologies. These suggestions should be investigated by policymakers to address the aforementioned issues.

This includes:

- Applying a ‘British innovation principle’ to the FSA – requiring consideration of potential benefits to the environment and human health in regulatory decisions rather than just potential harms – counterbalancing the incorporation of the precautionary principle into UK food law (Hewson 2021);10

- Developing a formal mechanism for pre-application consultation between cultivated-meat producers and the FSA, providing greater certainty about the requirements;

- Instigating an iterative, staged or compartmentalised regulatory process, with the regulator approving the product in stages throughout development, like the UK’s Medicines and Healthcare products Regulatory Agency (MHRA)’s ‘rolling review’ approach to Covid vaccines, to speed up the approval process;

- Reviewing the FSA novel food framework timelines with the goal of speeding up the process and ensuring the FSA cannot indefinitely delay approvals by seeking more information;

Exploring the creation of an amendment mechanism so ongoing or approved applications can be updated to reflect newer technologies and methods; - Reviewing the requirements for novel food products and cultivated meat, including the number of external tests and safety tests, and the associated batch samples;

- Removing requirements to prove that products are just as or more nutritious than existing products – instead focusing the regulation on safety;

- Removing secondary ministerial approval by allowing consumers to immediately purchase the product after safety testing and a positive recommendation from the regulator – the minister could maintain an optional veto;

- Embracing novel methods for food safety testing including the latest toxicology methods such as predictive in silico models and post-marketing monitoring, as explored by de Boer & Bast (2018), and big data analysis, as discussed by Marvin et al. (2017);

- Developing a database of approved ingredients, production processes and methods for cultivated meat and other novel products, thereby not requiring equivalent methods used by different companies to go through the regulatory process multiple times; and

- Eliminating the 20-day delay before an approved product can be put on the market.

Introduce a ‘food sandbox’

An innovation-focused regulatory sandbox for food could support the introduction of cultivated meat. This could be modelled on the FCA’s ‘Regulatory Sandbox’, which ‘allows firms to test innovative propositions in the market with real consumers’. The FCA (2021) states that the sandbox aims to provide firms with:

- The ability to test products and services in a controlled environment;

reduced time-to-market at potentially lower cost; - Support in identifying appropriate consumer protection safeguards to build into new products and services; and

- Better access to finance.

Firms with an innovative product apply to join the sandbox and, if successful, are then allocated a dedicated case manager who help support the development and testing of the product. The FCA (2021) works closely with companies to develop appropriate safeguards for each product, provides ‘informal steers’ on regulatory implications of an innovative product or business model and can ‘modify an unduly burdensome rule, for the purpose of the test’. A Deloitte survey of firms in the sandbox (Strachan & Nair 2018) found the process has helped firms to test products with real customers, gain a greater understanding of the regulatory process and achieve legitimacy with customers; thereby helping achieve full authorisations upon leaving the sandbox.

The FCA’s sandbox model has several limitations. It is designed for companies before they scale, as a form of validation rather than a guaranteed path to approval. So, while it might be appropriate for some initial small-scale testing of cultivated meat, the longer-term benefits could be limited if an onward regulatory path is not established. Additionally, developing a ‘sandbox’ could be a distraction from reforming the underlying regulation.

Nevertheless, an FSA-led ‘food sandbox’ could help refocus the regulator on innovative products and provide a simplified process for cultivated meat products. This model could also provide greater clarity and help avoid later negative regulatory enforcement action while being more adaptive to the evolving technology.

Recognise overseas approvals

A straightforward way to simplify the path to regulatory approval in the UK would be to actively recognise approvals by equivariant regulators (Hewson 2022). This would enable consumers to have accelerated access to novel food products while not undermining safety.

It would not be unusual for a regulator to consider approvals elsewhere in the application process. Singapore’s FSA already asks applicants under its novel food process to submit ‘any safety assessment reports conducted for and/or by overseas food safety authorities, especially in jurisdictions such as Australia, Canada, New Zealand, Japan, the EU and the United States of America’. The UK could similarly recognise equivalent, high-standard authorities such as Singapore’s Food Safety Standards, Food Standards Australia New Zealand, and the US Food and Drug Administration. This recognition could be either in a shortened application process or, ideally, by recognising the entire approval process.

The obvious candidate for UK recognition of foreign approvals is that of the EU’s EFSA. Because the EU law is retained, its novel food approval criteria are precisely identical to those of the UK. Yet, the British FSA (2020) is requiring applications for novel food that were previously submitted to the EU, but remained uncompleted, to be separately submitted in the UK. This is resulting in the denial to British consumers of access to new food technologies. In 2021, EFSA approved mung bean protein for use in Eat Just’s egg substitute product, while the UK has not (Askew 2021). It is superfluous for the UK to require companies to go through precisely the same regulatory process twice. Obviously, if the UK ever opted to diverge from the EU’s standards, recognition of those approvals could cease.

If it is felt there is a risk that simply recognising overseas approvals results in companies opting to seek approval in other jurisdictions, thereby making the UK a rule-taker and limiting the ability for the UK to set global standards or achieve a first-mover advantage, that concern might be handled by seeking mutual recognition agreements with similar jurisdictions. However, if the principal proposals of this paper were to be accepted, the UK would have a nimble and innovation-promoting regulatory regime itself.

Conclusion

Food has been in a state of flux for centuries. We have found countless new ways to mix and combine ingredients, discovered new technologies and massively diversified our diets through trade and commerce. It is not unimaginable that, once again, what we eat will change.

Cultivated meat is a ground-breaking technology that could help alleviate many of the concerns associated with livestock farming. It has the potential to significantly help the environment by cutting down carbon emissions and land use; to improve human health by reducing the risk posed by disease; and to improve animal welfare by reducing industrial livestock farming. It can even achieve all these important goals without taking away consumer choice or reducing the quality of diets and enjoyment associated with meat consumption.

Cultivated meat is at risk of being held back by slow, uncertain, rigid regulation. The UK has the opportunity, by developing a responsive light-touch regulatory framework, to become a global hotbed of activity in cultivated meat research, while simultaneously setting international standards.11 This would allow British start-ups to build market understanding, expand their technical know-how and achieve cost-efficiencies faster than their competitors can. It could even attract many companies to come to market first in the UK, benefiting British consumers and creating a global hive of activity. But this is only possible if the regulator is willing to take a new approach and if policymakers update existing processes.

The immense benefits to humanity are laying there on the ground, waiting to be picked up. It would be madness to sacrifice the environment, human health and animal welfare, as well as scaring a potential industry away from Britain because of bureaucratic hurdles.

PDF viewer

About the authors

Matthew Lesh is the Head of Public Policy at the Institute of Economic Affairs.

He often appears on television and radio, is a columnist for London’s CityAM newspaper, and a regular writer for dozens of publications including The Times, The Telegraph and The Spectator. He is also a Fellow of the Adam Smith Institute and Institute of Public Affairs.

Matthew graduated with First Class Honours from the University of Melbourne with a Bachelor of Arts (Degree with Honours) and completed a Masters in Public Policy and Administration at the London School of Economics, where he received the Peter Self Prize for Best Overall Result.

References

Alemanno, A., & Gabbi, S. (2016) Foundations of EU Food Law and Policy: Ten Years of the European Food Safety Authority. Routledge.

AMPS Innovation, ‘Alliance for Meat, Poultry, & Seafood Innovation submits comments in response to U.S. Department of Agriculture advance notice of public rulemaking’, Alliance for Meat, Poultry & Seafood Innovation, 12 February 2021 (https://ampsinnovation.org/alliance-for-meat-poultry-seafood-innovation-submits-comments-in-response-to-u-s-department-of-agriculture-advance-notice-of-public-rulemaking/).

Anthis, K., & Anthis, J. R. (2019) ‘Global farmed & factory farmed animals estimates’, Sentience Institute (https://sentienceinstitute.org/global-animal-farming-estimates).

Arshad, M. S., Javed, M., Sohaib, M., Saeed, F., et al. (2017) Tissue engineering approaches to develop cultured meat from cells: A mini review. Cogent Food & Agriculture, 3(1): 1320814 (https://doi.org/10.1080/23311932.2017.1320814).

Askew, K. ‘France bans use of meaty names for veggie food’, Food Navigator, 23 April 2018 (https://www.foodnavigator.com/Article/2018/04/23/France-bans-use-of-meaty-names-for-veggie-food).

Askew, K. ‘Eat Just mung bean protein gets novel foods nod’, Food Navigator, 20 October 2021 (https://www.foodnavigator.com/Article/2021/10/20/Eat-Just-mung-bean-protein-gets-novel-foods-nod-Bringing-JUST-Egg-to-Europe-will-be-one-of-the-most-important-milestones-for-our-company).

Bayes-Brown, G., ‘Ivy Farm reveals aim to be the first British company to put cultured meat on people’s plates’, Oxford University Innovation, 17 May 2021 (https://innovation.ox.ac.uk/news/ivy-farm-launch/).

BBC News, ‘Scientists aim for lab-grown meat’, BBC News, 13 August 2005 (http://news.bbc.co.uk/1/hi/sci/tech/4148164.stm).

BBC News, ‘World’s first lab-grown burger is eaten in London’, BBC News, 5 August 2013 (https://www.bbc.com/news/science-environment-23576143).

BBC News, ‘EU court bans dairy-style names for soya and tofu’, BBC News, 14 June 2017 (https://www.bbc.com/news/business-40274645).

BBC News, ‘Singapore approves lab-grown “chicken” meat’, BBC News, 2 December 2020 (https://www.bbc.com/news/business-55155741).

Bhat, Z. F., Kumar, S., & Bhat, H. F. (2017) In vitro meat: A future animal-free harvest. Critical Reviews in Food Science and Nutrition 57(4): 782–89 (https://doi.org/10.1080/10408398.2014.924899).

Bremmers, H. J., Meulen, B. M. J. van der, Poppe, K. J., & Wijnands, J. H. M. (2008) Administrative burdens in the European food industry: With special attention to the dairy sector. LEI Wageningen UR (https://edepot.wur.nl/7172).

Brennan, T., Katz, J., Yossi Quint, & Spencer, B. (16 June 2021) Cultivated meat: Out of the lab, into the frying pan. McKinsey (https://www.mckinsey.com/industries/agriculture/our-insights/cultivated-meat-out-of-the-lab-into-the-frying-pan).

Brookes, G. (2007) Economic impact assessment of the way in which the EU novel foods regulatory approval procedures affect the EU food sector. Confederation of the Food and Drink Industries of the European Union (CIAA) & the Platform for Ingredients in Europe (PIE) (https://www.pgeconomics.co.uk/pdf/novelfoods.pdf).

Bryant, C., & Dillard, C. (2019) The impact of framing on acceptance of cultured meat. Frontiers in Nutrition, 6:103 (https://doi.org/10.3389/fnut.2019.00103).

Byrne, B. (2021) State of the industry report: Cultivated meat. The Good Food Institute. (https://gfi.org/resource/cultivated-meat-eggs-and-dairy-state-of-the-industry-report/).

Cabinet Office. (2022) The benefits of Brexit: How the UK is taking advantage of leaving the EU. London: HM Government (https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1054643/benefits-of-brexit.pdf).

Copa Cogeca, ‘Open letter: Vegan imitations must stop hijacking the names of meat products’, Farming Independent, 15 September 2020 (https://www.independent.ie/business/farming/comment/open-letter-vegan-imitations-must-stop-hijacking-the-names-of-meat-products-39531367.html).

de Boer, A., & Bast, A. (2018) Demanding safe foods – Safety testing under the novel food regulation (2015/2283). Trends in Food Science & Technology 72: 125–33 (https://doi.org/10.1016/j.tifs.2017.12.013).

DEFRA. (2022) Government food strategy. Department for Environment Food & Rural Affairs. (https://www.gov.uk/government/publications/government-food-strategy/government-food-strategy).

Dimbleby, H. (2021) The National Food Strategy independent review. (https://www.nationalfoodstrategy.org/).

Edelman, P. D., McFarland, D. C., Mironov, V. A., & Matheny, J. G. (2005) Commentary: In Vitro-cultured meat production. Tissue Engineering 11(5–6): 659–62 (https://doi.org/10.1089/ten.2005.11.659).

EFSA. (2021) Guidance on the preparation and submission of an application for authorisation of a novel food in the context of Regulation (EU) 2015/22831 (Revision 1)2. EFSA Journal 19(3): e06555 (https://doi.org/10.2903/j.efsa.2021.6555).

Ekmekcioglu, C., Wallner, P., Kundi, M., Weisz, U., et al. (2018) Red meat, diseases, and healthy alternatives: A critical review. Critical Reviews in Food Science and Nutrition 58(2): 247–61 (https://doi.org/10.1080/10408398.2016.1158148).

ESFA. (2018) Administrative guidance on the submission of applications for authorisation of a novel food pursuant to Article 10 of Regulation (EU) 2015/2283. EFSA Supporting Publications 15(2): 1381E (https://doi.org/10.2903/sp.efsa.2018.EN-1381).

EUR-Lex. (2022) Precautionary principle (https://eur-lex.europa.eu/EN/legal-content/glossary/precautionary-principle.html).

Eustice, G. (29 September 2021) Plans to unlock power of gene editing unveiled. UK Government (https://www.gov.uk/government/news/plans-to-unlock-power-of-gene-editing-unveiled).

FCA. (1 June 2016) Advice Unit. Financial Conduct Authority (https://www.fca.org.uk/firms/innovation/advice-unit).

FCA. (17 August 2021) Regulatory sandbox. Financial Conduct Authority (https://www.fca.org.uk/firms/innovation/regulatory-sandbox).

FDA & USDA. (2020) Formal agreement between FDA and USDA. FDA. (https://www.fda.gov/food/domestic-interagency-agreements-food/formal-agreement-between-fda-and-usda-regarding-oversight-human-food-produced-using-animal-cell).

Food Standards Agency. (2019a) Public attitudes tracker – Wave 18. Food Standards Agency.

Food Standards Agency. (2019b) Food and you: Secondary analysis – Wave 5. Food Standards Agency (https://www.food.gov.uk/sites/default/files/media/document/food-and-you-wave-5-secondary-analysis-current-food-landscape.pdf).

Food Standards Agency. (31 December 2020) Novel foods authorisation guidance. Food Standards Agency (https://www.food.gov.uk/business-guidance/regulated-products/novel-foods-guidance).

Food Standards Agency. (31 March 2022) Cannabidiol (CBD) guidance for England and Wales. Food Standards Agency (https://www.food.gov.uk/business-guidance/cannabidiol-cbd).

Freinkel, S. (2011) Plastic: A Toxic Love Story. Boston: Houghton Mifflin Harcourt (https://www.scientificamerican.com/article/a-brief-history-of-plastic-world-conquest/).

Froggatt, A., & Wellesley, L. (2019) Meat analogues: Considerations for the EU. Chatham House (https://www.chathamhouse.org/2019/02/meat-analogues).

Gaillac, R., & Marbach, S. (2021) The carbon footprint of meat and dairy proteins: A practical perspective to guide low carbon footprint dietary choices. Journal of Cleaner Production 321: 128766 (https://doi.org/10.1016/j.jclepro.2021.128766).

Gerber, P. J., Steinfeld, H., Henderson, B., et al., (2013) Tackling climate change through livestock: A global assessment of emissions and mitigation opportunities. Food and Agriculture Organization of the United Nations. Rome: FAO (http://www.fao.org/docrep/018/i3437e/i3437e.pdf).

Godfray, H. C. J., Aveyard, P., Garnett, T., Hall, J. W., et al. (2018) Meat consumption, health, and the environment. Science (New York, N.Y.) 361(6399): eaam5324 (https://doi.org/10.1126/science.aam5324).

González, A., & Koltrowitz, S. ‘The $280,000 lab-grown burger could be a more palatable $10 in two years’, Reuters, 9 July 2019 (https://www.reuters.com/article/us-food-tech-labmeat-idUSKCN1U41W8).

Gross, T., ‘Novel food regulation in Israel – From directive to regulation’, Gsap, 8 June 2021 (https://www.gsap.co.il/novel-food-regulation-in-israel-from-directive-to-regulation/).

Hamdan, M. N., Post, M. J., Ramli, M. A., & Mustafa, A. R. (2018) Cultured meat in Islamic perspective. Journal of Religion and Health 57(6): 2193–206 (https://doi.org/10.1007/s10943-017-0403-3).

Hartmann, C., & Siegrist, M. (2017) Consumer perception and behaviour regarding sustainable protein consumption: A systematic review. Trends in Food Science & Technology, 61: 11–25 (https://doi.org/10.1016/j.tifs.2016.12.006).

Hewson, V. (2021) A British innovation principle. London: Institute of Economic Affairs (https://iea.org.uk/publications/a-british-innovation-principle/).

Hewson, V. (2022) Changing the rules: A unilateral approach to non-tariff barriers. London: Institute of Economic Affairs (https://iea.org.uk/publications/changing-the-rules-a-unilateral-approach-to-non-tariff-barriers/).

Hocquette, J.-F. (2016) Is in vitro meat the solution for the future? Meat Science, 120: 167–76 (https://doi.org/10.1016/j.meatsci.2016.04.036).

Holle, M. (2018) Pre-market approval and its impact on food innovation: The novel foods example. In Regulating and Managing Food Safety in the EU: A Legal-Economic Perspective (eds. H. Bremmers & K. Purnhagen). Springer International Publishing, 291–330 (https://doi.org/10.1007/978-3-319-77045-1_14).

Hopkins, P. D., & Dacey, A. (2008) Vegetarian meat: Could technology save animals and satisfy meat eaters? Journal of Agricultural and Environmental Ethics, 21(6): 579–96 (https://doi.org/10.1007/s10806-008-9110-0).

Hyde, R., Hartley, S., & Millar, K. (2017) European novel foods policy at a critical juncture: Drawing lessons for future novel food governance through a retrospective examination of Regulation 258/97. Food and Drug Law Journal 72(3): 472–505.

IPCC. (2020) Chapter 5: Food security – Special report on climate change and land (https://www.ipcc.ch/srccl/chapter/chapter-5/).

Ives, E. (2020) Green entrepreneurship. The Entrepreneurs Network (https://www.tenentrepreneurs.org/research/green-entrepreneurship).

Jarchlo, A. I., & King, L. (2022) Survey of consumer perceptions of alternative, or novel, sources of protein. Food Standards Agency (https://www.food.gov.uk/research/behaviour-and-perception/survey-of-consumer-perceptions-of-alternative-or-novel-sources-of-protein).

Jones, B. A., Grace, D., Kock, R., Alonso, S., et al. (2013) Zoonosis emergence linked to agricultural intensification and environmental change. Proceedings of the National Academy of Sciences, 110(21): 8399–404 (https://doi.org/10.1073/pnas.1208059110).

Josephs, J. ‘Beyond Meat boss: Tax on negative impacts “does appeal”’, BBC News, 2 August 2021 (https://www.bbc.com/news/business-58032552).

Kalk, C. ‘Navigating regulations (EU novel foods, US GRAS) to deliver food innovation’, Isbi, August 2019 (https://www.lsbi.eu/blog/navigating-regulations-eu-novel-foods-us-gras-deliver-food-innovation).

Kenigsberg, J. A., & Zivotofsky, A. Z. (2020) A Jewish religious perspective on cellular agriculture. Frontiers in Sustainable Food Systems 3: 128 (https://www.frontiersin.org/article/10.3389/fsufs.2019.00128).

Ketelings, L., Kremers, S., & de Boer, A. (2021) The barriers and drivers of a safe market introduction of cultured meat: A qualitative study. Food Control 130: 108299 (https://doi.org/10.1016/j.foodcont.2021.108299).

Lähteenmäki-Uutela, A., Rahikainen, M., Lonkila, A., & Yang, B. (2021) Alternative proteins and EU food law. Food Control 130: 108336 (https://doi.org/10.1016/j.foodcont.2021.108336).

Machovina, B., Feeley, K. J., & Ripple, W. J. (2015) Biodiversity conservation: The key is reducing meat consumption. Science of The Total Environment 536: 419–31 (https://doi.org/10.1016/j.scitotenv.2015.07.022).

Marvin, H. J. P., Janssen, E. M., Bouzembrak, Y., Hendriksen, P. J. M. et al. (2017) Big data in food safety: An overview. Critical Reviews in Food Science and Nutrition 57(11): 2286–95 (https://doi.org/10.1080/10408398.2016.1257481).

May, R. (10 January 2022). A third of UK consumers are willing to try lab-grown meat and a quarter would try insects. Food Standards Agency (https://www.food.gov.uk/news-alerts/news/a-third-of-uk-consumers-are-willing-to-try-lab-grown-meat-and-a-quarter-would-try-insects).

MHRA. (2 December 2021) UK medicines regulator gives approval for first UK COVID-19 vaccine. UK Government (https://www.gov.uk/government/news/uk-medicines-regulator-gives-approval-for-first-uk-covid-19-vaccine).

Morris, R. ‘Lab-grown chicken nuggets to go on sale in Singapore’, Newsday, 3 December 2020 (https://www.bbc.co.uk/sounds/play/p0908z49).

Neslen, A. ‘From mealworms to “miracle” berries, EU sees boom in novel food applications’, POLITICO, 14 December 2020a (https://www.politico.eu/article/license-to-krill-efsa-sees-boom-in-novel-food-applications/).

Neslen, A. ‘Europe lags behind in lab-grown meat race’, POLITICO, 27 December 2020b (https://www.politico.eu/article/as-cultured-nuggets-go-on-sale-in-singapore-industry-fears-that-eu-will-chicken-out-of-global-tech-race/).

Norton, T. (2015) From the lab to the supermarket: In vitro meat as a viable alternative to traditional meat production. Journal of Food Law & Policy 11(1) (https://scholarworks.uark.edu/jflp/vol11/iss1/9).

Odegard, I., & Sinke, P. (2021) LCA of cultivated meat: Future projections for different scenarios. CE Delft (https://cedelft.eu/publications/rapport-lca-of-cultivated-meat-future-projections-for-different-scenarios/).

Patton, L., & Larkin, C. ‘Beyond Meat gives up early gain after KFC confirms plant-based chicken’, Bloomberg.Com., 5 January 2022 (https://www.bloomberg.com/news/articles/2022-01-05/beyond-meat-surges-after-kfc-confirms-plant-based-chicken-debut).

Perreten, V., Schwarz, F., Cresta, L., Boeglin, M., et al. (1997) Antibiotic resistance spread in food. Nature 389(6653): 801–2 (https://doi.org/10.1038/39767).

Ramirez, V. B., ‘New cultured meat factory will churn out 5,000 bioreactor burgers a day’, Singularity Hub, 2 July 2021 (https://singularityhub.com/2021/07/02/a-cultured-meat-factory-in-israel-will-churn-out-5000-bioreactor-burgers-a-day/).

Regulation (EU) 2015/2283, 327 OJ L (2015) (http://data.europa.eu/eli/reg/2015/2283/oj/eng).

Rickard, S. (2016) Ploughing the wrong furrow. IEA Discussion Paper 75. London: Institute of Economic Affairs (https://iea.org.uk/publications/ploughing-the-wrong-furrow/).

Ritchie, H., & Roser, M. (2019) Meat and dairy production. Our World in Data (https://ourworldindata.org/meat-production).

Ritchie, H., & Roser, M. (2020) Environmental impacts of food production. Our World in Data (https://ourworldindata.org/environmental-impacts-of-food).

Scarpa, B., & Dalfrà, S. (2008) Regulating the novel foods sector: Moving forward. European Food and Feed Law Review 3(5): 292–9.

Schaefer, G. O., & Savulescu, J. (2014) The ethics of producing in vitro meat. Journal of Applied Philosophy 31(2): 188–202 (https://doi.org/10.1111/japp.12056).

Scipioni, J., ‘This restaurant will be the first ever to serve lab-grown chicken (for $23)’, CNBC, 18 December 2020 (https://www.cnbc.com/2020/12/18/singapore-restaurant-first-ever-to-serve-eat-just-lab-grown-chicken.html).

SFA. (2021) Requirements for the Safety Assessment of Novel Foods and Novel Food Ingredients. Singapore Government (https://www.sfa.gov.sg/docs/default-source/food-import-and-export/Requirements-on-safety-assessment-of-novel-foods_13Dec2021_final.pdf).

Shellenberger, M., & Nordhaus, T. (1 October 2015) How to strand assets: Nature-saving through disruptive technological change. The Breakthrough Institute (https://thebreakthrough.org/issues/energy/how-to-strand-assets).

Singer, P. (1975) Animal Liberation: A New Ethics for Our Treatment of Animals. New York: Random House.

Southey, F. ‘When will cultivated meat hit Europe? “The regulatory process is far too rigid and slow”’, Food Navigator, 4 May 2021 (https://www.foodnavigator.com/Article/2021/05/04/When-will-lab-grown-meat-reach-the-European-market).

Speder, B. (2021) Rolling reviews: A useful tool to speed up the regulatory review process. Regulatory Rapporteur 18(5): 22–4.

Stephens, N., Di Silvio, L., Dunsford, I., Ellis, M., et al. (2018) Bringing cultured meat to market: Technical, socio-political, and regulatory challenges in cellular agriculture. Trends in Food Science & Technology 78: 155–66 (https://doi.org/10.1016/j.tifs.2018.04.010).

Stewart, C., Piernas, C., Cook, B., & Jebb, S. A. (2021) Trends in UK meat consumption: Analysis of data from years 1–11 (2008–09 to 2018–19) of the National Diet and Nutrition Survey rolling programme. The Lancet Planetary Health 5(10): e699–e708 (https://doi.org/10.1016/S2542-5196(21)00228-X).

Strachan, D., & Nair, S. (2018) FCA sandbox: A journey through the FCA regulatory sandbox. Centre for Regulatory Strategy EMEA, Deloitte (https://www2.deloitte.com/uk/en/pages/financial-services/articles/journey-through-financial-conduct-authority-regulatory-sandbox.html).

Stubbs, R. J., Scott, S. E., & Duarte, C. (2018) Responding to food, environment and health challenges by changing meat consumption behaviours in consumers. Nutrition Bulletin 43(2): 125–34 (https://doi.org/10.1111/nbu.12318).

Tuomisto, H. L., & Teixeira de Mattos, M. J. (2011) Environmental impacts of cultured meat production. Environmental Science & Technology 45(14): 6117–23 (https://doi.org/10.1021/es200130u).

van der Weele, C., Feindt, P., Jan van der Goot, A., van Mierlo, B., et al. (2019) Meat alternatives: An integrative comparison. Trends in Food Science & Technology 88: 505–12 (https://doi.org/10.1016/j.tifs.2019.04.018).

Verbeke, W., Marcu, A., Rutsaert, P., Gaspar, R., et al. (2015) ‘Would you eat cultured meat?’: Consumers’ reactions and attitude formation in Belgium, Portugal and the United Kingdom. Meat Science 102: 49–58 (https://doi.org/10.1016/j.meatsci.2014.11.013).

Verzijden, K., ‘Singapore cultured meat regulatory approval process compared to EU’, Food Health Legal, 26 April 2021 (http://foodhealthlegal.eu/?p=1081).

Wanat, Z., ‘Veggie burgers survive EU vote’, POLITICO, 23 October 2020 (https://www.politico.eu/article/veggie-burgers-survive-eu-vote/).

White, K., ‘Cultured meat startup Ivy Farm urges FSA to be “nimble” on regulation’, The Grocer, 20 May 2021 (https://www.thegrocer.co.uk/meat/cultured-meat-startup-ivy-farm-urges-fsa-to-be-nimble-on-regulation/656301.article).

Wirsching, S., ‘Upscaling in the race to cultured meat’, European Biotechnology, 11 May 2020 (https://european-biotechnology.com/up-to-date/backgrounds-stories/story/upscaling-in-the-race-to-cultured-meat.html).

Worthington, H. (2021) The socio-economic impact of cultivated meat in the UK. Oxford Economics (https://www.oxfordeconomics.com/recent-releases/The-socio-economic-impact-of-cultivated-meat-in-the-UK).

Yamaguchi, N., ‘Japan: Regulatory updates on shaping the cultivated meat market’, The Good Food Institute Asia Pacific, 28 October 2020 (https://www.gfi-apac.org/blog/japan-regulatory-updates-on-shaping-the-cultivated-meat-market/).

Footnotes

- The latest update of the novel food regulations, drafted in 2015 and implemented in 2018, explicitly applied the procedure to cultivated meat (‘food consisting of, isolated from or produced from cell culture or tissue culture derived from animals, plants, microorganisms, fungi or algae’ (Regulation (EU) 2015/2283, 2015)). A complication, highlighted by Stephens et. al. (2018), is the possibility that some cultivated meat production processes could include GMOs. These products would likely require approval under separate regulations for GMOs, an issue outside the scope of this paper.