How zero-sum thinking leads to zero-sum policies

SUGGESTED

These two studies didn’t exactly capture the headlines, but they paint a bleak picture of the strong headwinds facing those who want to build a freer and more prosperous society.

What exactly is zero-sum thinking? It is the notion that in most transactions, one party has to win, and others have to lose. They think of life like a penalty shootout in football – it could take a while to find out who the winner is, but ultimately there will be one and to them will go the spoils.

So why does this matter? Firstly, in the long run, it need not be true. More importantly, however, zero-sum thinking lies behind almost every bad policy idea – from the misguided to the downright evil.

Zero-sum policies are not the preserve of any one ideological group in particular. As the Financial Times points out, both immigration restrictionists on the Right and positive discrimination advocates on the Left share the zero-sum mindset. The ‘immigrants come here and take our jobs’ is the classic case of zero-sum thinking in the former case. The premise is simple:

- There are a roughly fixed number of jobs going round in the economy;

- Increasing the supply of workers creates more rivalry for those jobs;

- Ergo: immigrants necessarily take jobs and/or lower wages.

While it is true that competition for any one job at any one time is likely to be a zero-sum game, that is not true of all of the jobs in the economy in the longer run. The premise of the zero-sum immigration argument rejects the mountains of economic theory and empirical data that shows how new workers create their own demand and thus new jobs; how a larger pool of workers allows for greater specialisation and capital investment, creating higher paid jobs in the long-run; or how immigrants are overrepresented among entrepreneurs. Indeed, this particular form of zero-sum thinking has its own label: ‘the lump of labour fallacy’.

Likewise, look at the example of the left-wing case for affirmative action:

- Certain groups have suffered a history of discrimination;

- There are a fixed number of X (university places, jobs) in society;

- Members of historically marginalised groups ought to have an advantage for consideration for allocation of that limited supply as compensation.

In this case, the zero-sum thinker doesn’t consider that the number of X can grow, raising standards across all groups without needing to artificially advantage or disadvantage anybody else based on their immutable characteristics.

The above are just two of the myriad examples of zero-sum thinking in policy debates, see also trade protectionism or the theory behind allowing workers to seize the means of production from capitalists.

Indeed, for most of human history, the world was stuck in a perpetual zero-sum game. One person, tribe, or nation’s increase in wealth almost always came at the direct expense of another’s. After the advent of Merchant Republics in the 15th Century allowed many more positive-sum trades, it was the advent of mass-markets and complex production processes during the Industrial Revolution that transformed the nature of our transactions.

No longer did individuals and nations need to do battle over a fixed quantity of scarce resources. The Industrial Revolution showed that workers, entrepreneurs, investors, and merchants could all become richer by co-operating voluntarily. Indeed, the price system, made possible by private property rights and voluntary economic interactions, also incentivised individuals and companies to search for new resources when they became scarce or come up with an alternative means of producing the same outcomes with fewer or different resources.

It is this basic framework that allowed most of the world to escape from the ‘Malthusian Trap’ and the poverty that came with it. The expansion of markets across the world, the division of labour that came with it, and the shared access to resources, information, and technology that it created, have done more than any force to raise living standards, life expectancy, and peace than any other in world history.

But it is not enough to simply point out that zero-sum thinking is usually wrong – zero-sum ideas also actively harm attempts to create institutional environments which foster positive-sum interactions. Going back to the immigration example, when the government imposes a limit on the number of people who can live and work in a given economy, so too do they limit the extra economic capacity and information exchange that they could have delivered. This manifests in the form of higher prices passed on to consumers by businesses whose labour costs have increased due to higher wage demands from protected natives in protected sectors. A concentrated interest (in this case, native workers in those protected sectors) have become richer at the expense of people suffering the subsequent dispersed cost (higher consumer prices, misallocation of capital investment). In a free labour market, entrepreneurs, investors, workers, and consumers can all become richer together. When the government intervenes to protect the interests of one group, another group must lose out.

The same is true for calls to restrict imports, trade union industrial action over wages, positive discrimination, and debates over bankers’ bonuses to name but a few. Ironically, policies inspired by zero-sum thinking actually do make the world more zero-sum. When government intervenes and imposes its preferences by force, the groups it favours benefit at the direct expense of less favoured groups.

But zero-sum thinkers will argue that one group must win and therefore, they’d prefer it to be the one that they like. While they are usually wrong, it is easy to see why they might believe it. The Financial Times analysis drew a correlation between propensity for zero-sum thinking and the economic environment a certain generation grows up in.

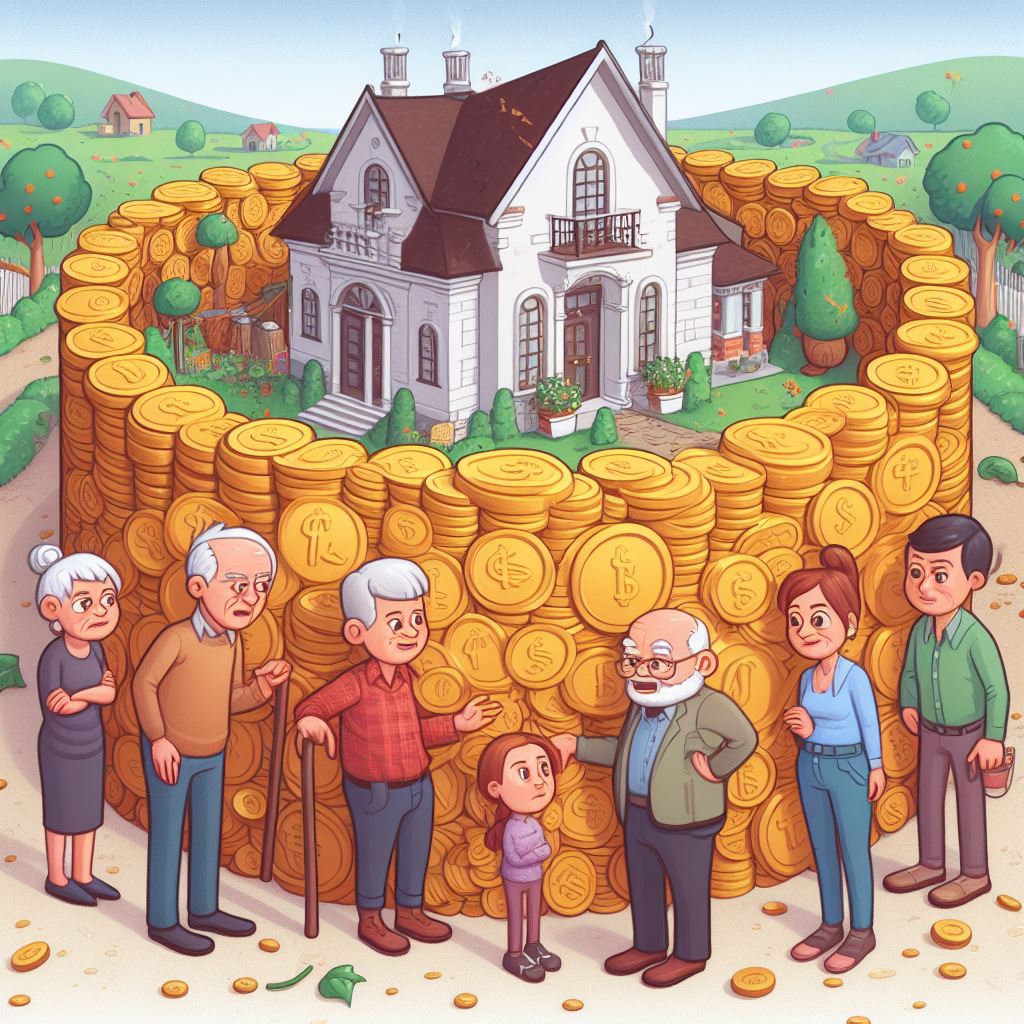

Baby Boomers, who have experienced unprecedented growth and an advantageous political economy throughout their lives, were most likely to think in positive-sum terms, whereas Gen Z and Millennials were least likely. These generations have acutely suffered the consequences of zero-sum games artificially created by government policies. Britain’s absurdly burdensome planning system has created a zero-sum housing market, while its triple-lock pensions policy confiscates wealth from the working age population and directly funnels it to the elderly (unlike a savings-based system, which can increase investment and productivity).

My concern is that this will turn into a self-perpetuating cycle.

- Zero sum policies breed economic stagnation;

- Economic stagnation breeds zero-sum thinking;

- Zero-sum thinking breeds demands for zero-sum policies.

Human history has been a story of zero-sum games. A handful of economies in Western Europe and America found away to escape that reality and created the blueprint for an era of unfathomable wealth and prosperity across the world. But the missions of eradicating poverty, maximising global living standards, and finally allowing everyone to escape the bonds of humans’ naturally nasty, brutish, and short lives, are nowhere near complete.

The rise of zero-sum thinking among the public and politicians muddies our path towards achieving that mission and puts what we have already achieved at risk. We can only hope that technological progress and new ways of thinking can show us all the importance of positive-sum interactions once again.

1 thought on “How zero-sum thinking leads to zero-sum policies”

Comments are closed.

Of course, government-controlled services do lead to zero sum situations (unless there are mechanisms for increasing supply, which there often are not). There are a fixed number of places at most schools and a fixed number of schools (this has been relaxed a little in recent years though free schools seem to be having their hands tied by government more and more). There is only one place at the front of the NHS queue. So the more people think in a zero sum way, the more they will think that those situations are the norm and cannot be solved by competition and market entry.