How the UN gets poverty wrong (Part 3)

SUGGESTED

He claims statistical backing for his anecdotes but provides no robust evidence on either suicide or food insecurity. What is the actual trend in suicide rates? Statistics from the ONS show in 2010 there were 10.2 suicides per 100,000 people. This rose to 11.1 in 2013; a statistically significant increase but a small one. Since then it has fallen back to 10.1. Putting this in context, even at the height of the recession and austerity, the suicide rate did not go significantly higher than those registered in the early 2000s (10.9 to 11.9). Indeed, today’s rate is down from 14.7 per 100,000 in 1981.

The Special Rapporteur points to increasing food insecurity, saying we have no measurement of this. Well actually we do (for now). Statistics from Eurostat show the share of households unable to afford a meal with meat, fish, chicken or a vegetarian equivalent every second day has been falling from 9.3 per cent in 2012 to 5.4 per cent in 2017. It is true that food insecurity on this measurement went up sharply after 2009, but it is almost as if Professor Alston has arrived too late.

Figure 7: Share of households unable to afford a meal with meat, fish, chicken or a vegetarian equivalent every second day – Eurostat

The only evidence he gives on food security beyond the anecdotal, are statistics on foodbank use. Alston writes:

‘Food bank use is up almost four-fold since 2012, and there are now about 2,000 food banks in the UK, up from just 29 at the height of the financial crisis.’

Yet the claim that food bank use is up almost four-fold since 2012 refers actually to the number of food parcels handed out by the Trussell Trust, which runs the majority but not all food banks. That is not the same as the number of individual users. Between 2012/13 and 2017/18, the volume of food parcels handed out rose from 346,992 to 1,332,952 – roughly fourfold.

The Trussell Trust has previously been caught out presenting a rise in volume of food handed out as the same thing as individual users and it seems the Special Rapporteur has made a similar mistake. It is also true that the Trussell Trust has expanded its operations so it is little wonder it is handing out more and more food. It also operates foodbanks in Bulgaria.

Much is made in the preliminary statement on benefits reform and particularly the introduction of the Government’s new Universal Credit. Unsurprisingly, the appraisal of what is a major reform is unduly negative, reliant on selective evidence and anecdotes, and delivered in a sneering tone, with the conclusion that it is “fast falling into Universal Discredit”.

He continues: ‘While some surveys suggest certain claimants do have positive experiences with Universal Credit, an increasing body of research makes clear that there are far too many instances in which Universal Credit is being implemented in ways that negatively impact many claimants’ mental health, finances, and work prospects.’

Referenced to support these quantitative claims is just one paper reliant on qualitative research methodology. Government ministers are presented as uncaring and deliberately wanting to instil hardship.

We are told “recent statistics indicate dramatic fluctuations in sanctioning, perhaps reflecting different instructions from on high”. What we are not told is that sanction rates are at their lowest since the introduction of Universal Credit, at 2.8 per cent as of May 2018, down from 4.9 per cent in August 2015, down from 6.9 per cent in March 2017.

Universal Credit is an ambitious reform that, despite good intentions, has been critiqued for mistakes in its implementation, which have impacted on the vulnerable. The government has responded to some of these criticisms and tried to mitigate adverse unintended consequences. Yet for Professor Alston, everything is seen in the worst possible light.

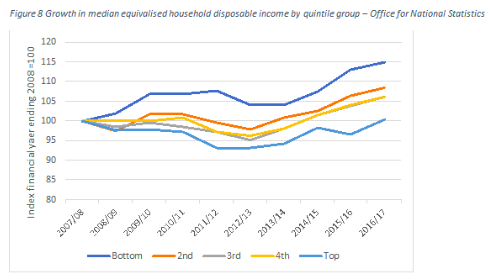

He writes that “poverty is a political choice” implying that the British Government deliberately chose to impoverish people. Everything is down to austerity – the fact that this was a global financial crisis does not matter. He ignores key evidence from the ONS which shows incomes actually increased for the lowest income quintile over the period 2008 to 2017. Incomes for the richest quintile took the largest hit and have only just recovered to pre-crisis levels.

Figure 8: Growth in median equivalised household disposable income by quintile group – Office for National Statistics

Income inequality, according to the Gini coefficient, is gradually declining. There is far more decency to this country than Professor Alston is prepared to give credit for and the manner of his conduct while visiting our country has been little short of insulting. That is not to say we do not have problems but what is called for is a more reasoned and evidenced case, pinpointing the actual issues.

Since he began his job as Special Rapporteur in 2014, Professor Alston has visited eight countries, two of which have been in the G7 group of richest economies (UK and USA). His brief is for extreme poverty and human rights. The United Nations classifies extreme poverty as living below a sustenance level of $1.90 per day. His job is literally defined by a measurement of absolute poverty, a concept he scorns. While we have real instances of poverty in this country, we do not have it on this scale.

In two countries today, people are dying of starvation where the cause is purely political – Venezuela and Yemen. Yet the Special Rapporteur’s statement is extensively (if not well) researched and that has required time, money, and effort. Surely these resources would be better used elsewhere? Beyond generating angry tweets from leftists, damning headlines in The Guardian, and fraught expressions of concern from Channel 4 News reporters, his efforts will change little here.

1 thought on “How the UN gets poverty wrong (Part 3)”

Comments are closed.

The following essay on ethical taxation shows how to eliminate poverty as one of its 17 features.

Socially Just Taxation and Its Effects (17 listed)

Our present complicated system for taxation is unfair and has many faults. The biggest problem is to arrange it on a socially just basis. Many companies employ their workers in various ways and pay them diversely. Since these companies are registered in different countries for a number of categories, the determination the criterion for a just tax system becomes impossible, particularly if based on a fair measure of human work-activity. So why try when there is a better means available, which is really a true and socially just method?

Adam Smith (“Wealth of Nations”, 1776) says that land is one of the 3 factors of production (the other 2 being labor and durable capital goods). The usefulness of land is in the price that tenants pay as rent, for access rights to the particular site in question. Land is often considered as being a form of capital, since it is traded similarly to other durable capital goods items. However it is not actually man-made, so rightly it does not fall within this category. The land was originally a gift of nature (if not of God) for which all people should be free to share in its use. But its site-value greatly depends on location and is related to the community density in that region, as well as the natural resources such as rivers, minerals, animals or plants of specific use or beauty, when or after it is possible to reach them. Consequently, most of the land value is created by man within his society and therefore its advantage should logically and ethically be returned to the community for its general use, as explained by Martin Adams (in “LAND”, 2015).

However, due to our existing laws, land is owned and formally registered and its value is traded, even though it can’t be moved to another place, like other kinds of capital goods. This right of ownership gives the landlord a big advantage over the rest of the community because he determines how it may be used, or if it is to be held out of use, until the city grows and the site becomes more valuable. Thus speculation in land values is encouraged by the law, in treating a site of land as personal or private property—as if it were an item of capital goods, although it is not (see Mason Gaffney and Fred Harrison: “The Corruption of Economics”, 2005).

Regarding taxation and local community spending, the municipal taxes we pay are partly used for improving the infrastructure. This means that the land becomes more useful and valuable without the landlord doing anything—he/she will always benefit from our present tax regime. This also applies when the status of unused land is upgraded and it becomes fit for community development. Then when this news is leaked, after landlords and banks corruptly pay for this information, speculation in land values is rife. There are many advantages if the land values were taxed instead of the many different kinds of production-based activities such as earnings, purchases, capital gains, home and foreign company investments, etc., (with all their regulations, complications and loop-holes). The only people due to lose from this are those who exploit the growing values of the land over the past years, when “mere” land ownership confers a financial benefit, without the owner doing a scrap of work. Consequently, for a truly socially just kind of taxation to apply there can only be one method–Land-Value Taxation.

Consider how land becomes valuable. New settlers in a region begin to specialize and this improves their efficiency in producing specific goods. The central land is the most valuable due to easy availability and least transport needed. This distribution in land values is created by the community, after an initial difficult start and not by the natural resources. As the village and city expand, speculators in land values will deliberately hold potentially useful sites out of use, until planning and development have permitted their site-values to grow. Meanwhile there is fierce competition for access to the most suitable sites for housing, agriculture and manufacturing industries. The limited availability of useful land means that the high rents paid being by tenants make their residences more costly and the provision of goods and services more expensive. It also creates unemployment, causing wages to be lowered by the monopolists, who control the big producing organizations, and whose land was previously obtained when it was cheap. Consequently this basic structure of our current macroeconomics system, works to limit opportunity and to create poverty, see above reference.

The most basic cause of our continuing poverty is the lack of properly paid work and the reason for this is the lack of opportunity of access rights to the land on which the work must be done. The useful land is monopolized by a landlord who either holds it out of use (for speculation in its rising value), or charges the tenant heavily for its access. In the case when the landlord is also the producer, he/she has a monopolistic control of the land and of the produce too, and can charge more for this right than what an entrepreneur, who seeks greater opportunity, normally would be able to afford.

A wise and sensible government would recognize that this problem derives from lack of opportunity to work and earn. It can be solved by the use of a tax system which encourages the proper use of land and which stops penalizing everything and everybody else. Such a tax system was proposed almost 140 years ago by Henry George, a (North) American economist, but somehow most macro-economists seem never to have heard of him, in common with a whole lot of other experts. (I would guess that they don’t want to know, which is worse!) In “Progress and Poverty” 1879, Henry George proposed a single tax on land values without other kinds of tax on produce, services, capital gains, etc. This regime of land value tax (LVT) has 17 features which benefit almost everyone in the economy, except for landlords and banks, who/which do nothing productive and wrongly find that land dominance has its own reward.

17 Aspects of LVT Affecting Government, Land Owners, Communities and Ethics

Four Aspects for Government:

1. LVT, adds to the national income as do all other taxation systems, but it can and should replace them.

2. The cost of collecting the LVT is less than for all of the production-related taxes—then tax avoidance becomes impossible because the sites being taxed are visible to all.

3. Consumers pay less for their purchases due to lower production costs (see below). This creates greater satisfaction with the government’s management of national affairs.

4. The national economy stabilizes—it no longer experiences the 18 year business boom/bust cycle, due to periodic speculation in land values (see below).

Six Aspects Affecting Land Owners:

5. LVT is progressive–owners of the most potentially productive sites pay the most tax.

6. The land owner pays his LVT regardless of how his site is used. When fully developed, a large proportion of the ground-rent from tenants becomes the LVT, with the result that land has less sales-value but a significant “rental”-value (even when it is not being used).

7. LVT stops the speculation in land prices and any withholding of land from proper use is not worthwhile.

8. The introduction of LVT initially reduces the sales price of sites, (even though their rental value can still grow over long-term use). As more sites become available, the competition for them becomes less fierce so entrepreneurs are more active.

9. With LVT, land owners are unable to pass the tax on to their tenants as rent hikes, due to the reduced competition for access to the additional sites that come into use.

10. With LVT, land prices will initially drop. Speculators in land values will want to foreclose on their mortgages and withdraw their money for reinvestment. Therefore LVT should be introduced gradually, to allow these speculators sufficient time to transfer their money to company-shares etc., and simultaneously to meet the increased demand for produce (see below).

Three Aspects Regarding Communities:

11. With LVT, there is an incentive to use land for production or residence, rather than it being nused.

12. With LVT, greater working opportunities exist due to cheaper land and a greater number of available sites. Consumer goods become cheaper too, because entrepreneurs have less difficulty in starting-up their businesses and because they pay less ground-rent–demand grows, unemployment decreases.

13. Investment money is withdrawn from land and placed in durable capital goods. This means more advances in technology and cheaper goods too.

Four Aspects About Ethics:

14. The collection of taxes from productive effort and commerce is socially unjust. LVT replaces this extortion by gathering the surplus rental income, which comes without any exertion from the land owner or by the banks–LVT is a natural system of national income-gathering.

15. Bribery and corruption on information about land cease. Before, this was due to the leaking of news of municipal plans for housing and industrial development, causing shock-waves in local land prices (and municipal workers’ and lawyers’ bank balances).

16. The improved and proper use of the more central land reduces the environmental damage due to a) unused sites being dumping-grounds, and b) the smaller amount of fossil-fuel use, when traveling between home and workplace.

17. Because the LVT eliminates the advantage that landlords currently hold over our society, LVT provides a greater equality of opportunity to earn a living. Entrepreneurs can operate in a natural way– to provide more jobs. Then earnings will correspond to the value that the labor puts into the product or service. Consequently, after LVT has been properly introduced it will eliminate poverty and improve business ethics.

TAX LAND NOT LABOR; TAX TAKINGS NOT MAKINGS!