Sin taxes, public health and public opinion (part three)

SUGGESTED

Attitudes to government intervention

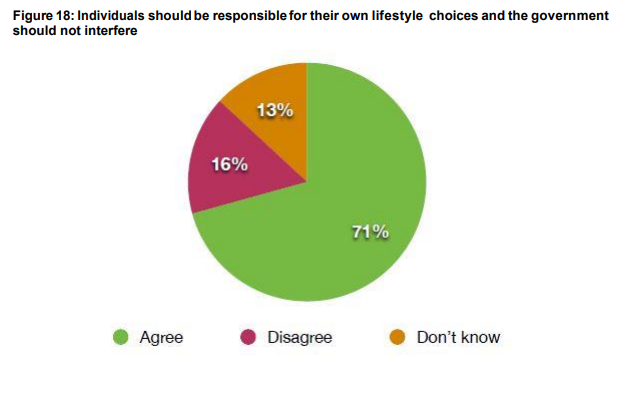

When asked explicitly whether they believe in personal responsibility or government intervention, our survey showed that the British public strongly supports personal responsibility and opposes ‘nanny state’ regulation. As Figure 18 shows, 71 per cent of respondents agreed with the statement ‘Individuals should be responsible for their own lifestyle choices and the government should not interfere’. Only 16 per cent disagreed. Excluding the ‘don’t knows’, the proportion of respondents who think ‘the government should not interfere’ rises to 81 per cent.

Figure 18: Individuals should be responsible for their own lifestyle choices and the government should not interfere

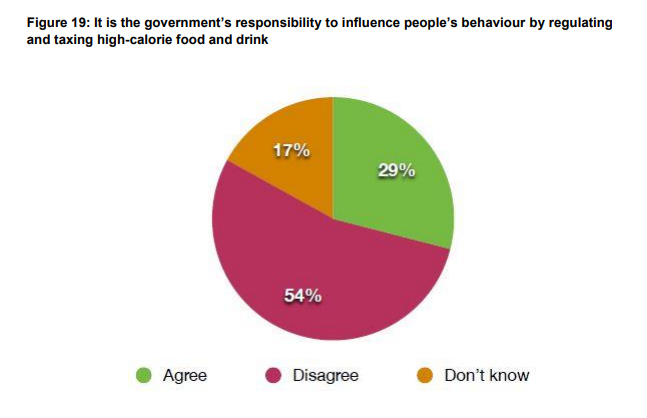

Government ‘interference’ means different things to different people, however. When asked a similar question, but with a specific example of government intervention added, the proportion of respondents who objected to regulation fell from 71 per cent to 54 per cent (Figure 19). A majority continued to oppose government intervention, with only 29 per cent agreeing that it is the government’s responsibility to influence people’s behaviour by regulating and taxing high-calorie food and drink, but the size of the majority fell. It appears that there is a sizeable minority of people who oppose government interference in the abstract, but support it in specific instances because they are prepared to make an exception in certain circumstances or because they do not see certain interventions as ‘interference’ in the first place.

Figure 19: It is the government’s responsibility to influence people’s behaviour by regulating and taxing high-calorie food and drink

Nevertheless, opponents of ‘regulating and taxing high-calorie food and drink’ still outnumber proponents by nearly 2 to 1 and there appears to be little appetite for further intervention in lifestyles. 38 per cent of respondents in our survey said that the government already ‘interferes too much in trying to make people adopt healthy lifestyles’ whereas only 21 per cent thought that ‘there should be more government regulation to stop people making unhealthy lifestyle choices’. The remainder either didn’t know or felt that the balance was about right.

Demographic differences

Demographic differencesComRes’s fieldwork was carried out on a large, representative sample of British adults whose voting intentions, age and socio-economic group were known to the pollsters. Certain groups had noticeably different attitudes.

Age

In general, young adults in our survey were the least likely to oppose economic measures to encourage healthier lifestyles, but this is largely because they were least likely to offer an opinion at all. The 18-24 year olds in our survey were most likely to answer ‘don’t know’ to any of the questions. Sometimes the rate of ‘don’t knows’ was as high as 40 per cent amongst this group.

In fact, it was the 65+ year old group that was most supportive of government interventions. This is surprising because they tended to be more likely than average to oppose ‘interference’ in the abstract. 75 per cent of them claimed to believe that ‘individuals should be responsible for their own lifestyle choices and the government should not interfere’, and they were less likely than any other age group to believe that ‘There should be more government regulation to stop people making unhealthy lifestyle choices’.

Despite these protestations, the 65+ year old group was more likely to support health warnings on food and new taxes on ‘unhealthy’ food and drink than the younger people in our survey. They were more likely to oppose a relaxation of the smoking ban than any other age group (44 per cent) – although, as with the other age groups, a relative majority would still support it (48 per cent). They were also least likely to believe that tax on beer and vodka (but not wine) was too high.

The 65+ age group was, however, the most resistant to financial incentives for people to give up smoking, lose weight and cut down on drinking. Financial incentives were unpopular with every age group, but support was strongest amongst 18-24 year olds (36 per cent) and declined incrementally for older age groups.

Socio-economic groups

People in the poorest socio-economic group (DE) were least likely to support government intervention in lifestyles (12 per cent) and least likely to support a new tax on fizzy drinks (33 per cent). They were also most likely to support a relaxation of the smoking ban (57 per cent) and most likely to believe that taxes on cigarettes were too high. They were, however, most likely to support financial incentives for healthy living.

By contrast, people in the wealthiest group (AB) were most likely to support higher taxes on alcohol and tobacco, and were most likely to support new taxes on food and soft drinks. They were most likely to believe that taxes on cigarettes, beer and vodka (but not wine) were too low. Interestingly, they were also least likely to see these taxes as unfair, regressive and ineffective.

Voting intention

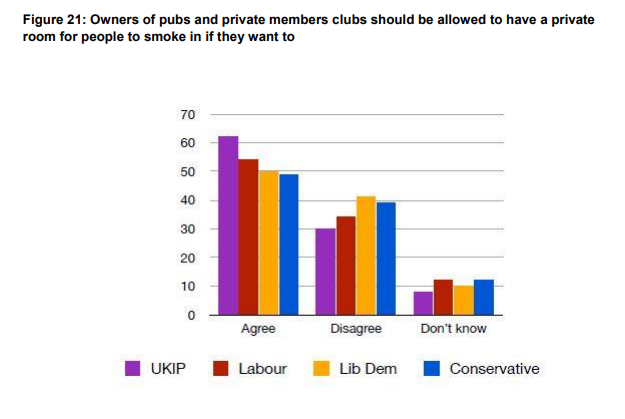

In our survey, Lib Dem voters were almost always more likely to support government intervention and UKIP voters were almost always the most resistant. This was not always the case, however. Conservative voters were slightly less likely to support smoking rooms (49 per cent) than Lib Dem voters (50 per cent) and Labour voters (54 per cent) (Figure 21).

Figure 21: Owners of pubs and private members clubs should be allowed to have a private room for people to smoke in if they want to

Labour is often portrayed as the nanny state party, even by its supporters, but Labour voters in our survey were not especially supportive of the public health policies they were asked about. They were more likely than Conservative and Lib Dem voters to agree that ‘the government interferes too much in trying to make people adopt healthy lifestyles’ and were more likely than supporters of either party to consider taxes on alcohol and tobacco to be too high. They were also more likely than supporters of any other party to regard ‘sin taxes’ as ‘an unfair way of taxing people for doing things they enjoy’.

Our survey showed a clear divide between those who support interventions which raise money for the government (taxes) and those which involve spending money (financial incentives). Conservative voters were more strongly opposed to financial incentives for healthy living than supporters of other parties, including UKIP, but were somewhat more sanguine about the impact of ‘sin taxes’ on the poor. Labour voters, by contrast, were more concerned about the impact of indirect taxation on the poor and were more likely to regard them as being too high.

There was some evidence of a traditional class divide, with Conservative voters more likely than Labour voters to view tax on wine and air travel as excessive whilst Labour voters were more likely than Conservative voters to regard tax on beer and cigarettes as excessive. These differences were quite small, however, and the proportion of Labour and Conservative voters who believed that indirect taxes were too high and that new taxes on food and drink were a bad idea were exactly the same (52 per cent and 38 per cent respectively).

There was a much greater divide between Lib Dem voters and UKIP voters. Lib Dem voters tended to be most supportive of government interventions regardless of whether they involved raising money or spending money. UKIP voters were their mirror image, opposing lifestyle interventions whether they be bans, taxes or subsidies. Lib Dem voters were consistently most likely to believe that taxes on cigarettes, air travel and all forms of alcohol were too low whereas UKIP voters were consistently the most likely to believe that these taxes were too high. However, even amongst Lib Dem voters, higher taxes and financial incentives were supported by only a minority.

Other demographic trends

Differences between male and female attitudes in our survey were negligible. There was also little difference between regions, although people in Scotland, Wales and Northern England were somewhat less likely to support government intervention in lifestyles than the rest of the UK.

Public sector workers were consistently more likely to support ‘sin taxes’ and warning labels than private sector workers, although both sectors were equally hostile to financial incentives being given to smokers, heavy drinkers and the obese. The public sector was significantly more likely to support graphic warnings on alcohol (64 per cent against 51 per cent) and more likely to support new taxes on food and drink (43 per cent against 31 per cent).

Conclusion

There is a broad consensus amongst economists that taxes on tobacco, food and soft drinks are regressive, and the evidence that economic measures can effectively tackle obesity, in particular, is very weak. Our survey shows that the British public is aware of the regressive nature of these taxes and is sceptical about their efficacy as health measures. An absolute majority of respondents felt that such taxes negatively affect the poor and a relative majority felt that they were an unfair way of taxing people for doing things they enjoy.

71 per cent of the British adults surveyed – and 81 per cent of those who gave an opinion – believed that it should be the individual’s responsibility to make their own lifestyle choices and that the government should not interfere. This echoes the results of a 2013 Ipsos MORI poll which found that only 30 per cent of British adults agreed that ‘It is the government’s responsibility to influence people’s behaviour to encourage healthy lifestyles’. This view was largely reflected by respondents’ opposition to economic measures, including taxes and incentives, being used to encourage healthy lifestyles.

Of those who expressed an opinion, 69 per cent felt that indirect taxes were too high and 59 per cent felt that pubs should be able to accommodate smokers in a private room. Of the new ‘public health’ policies mentioned in the survey, only health warnings enjoyed majority support, perhaps because they are not perceived to impinge on freedom or impose a cost on consumers and taxpayers.

Although people of different ages, socio-economic status and political inclination had different attitudes towards government intervention in lifestyles, these differences were often quite trivial. There was very little desire for higher taxes on alcohol, tobacco and air travel amongst any group. A firm majority of those who gave an opinion were in favour of pubs being allowed to open a smoking room and were opposed to new taxes being levied on ‘unhealthy’ food and soft drinks. The idea of using taxpayers’ money to incentivise healthy living also faced strong, majority opposition.

It is not difficult to see an element of self-interest in some of the responses. Poorer groups tend to be more supportive of financial incentives, perhaps because they expect to be the recipients of them, while wealthier groups may oppose them because they expect to pay the bill. Similarly, tobacco taxes may be more popular with the general public than alcohol or food taxes because most people do not smoke and will not have to pay them. But self-interest only explains so much. Non-smokers make up 80 per cent of the population. If they wished to exploit smokers, 80 per cent of our survey;s respondents would have supported higher cigarette taxes. In fact, only 21 per cent did so.

In any survey, it is easy for people to say that think a certain tax is too high. Opinion polls, including this one, tend not to ask which taxes they would like to see raised for another tax to be lowered. But the results shown above indicate that the public is aware of the negative effects of indirect taxation. The shared opposition of rich and poor alike to giving financial incentives to smokers, drinkers and the obese suggests that they are not under the illusion that the government has an endless pot of money, nor that such policies come without a cost. The pubic’s scepticism towards taxes and subsidies as health measures seems to be backed up by a broader conviction that individual responsibility is better than government interference.

All in all, our survey found the British public to be generally liberal (in the uncorrupted sense of the word) when it came to individual lifestyle choices. They tend to prefer free choice rather than government intervention, and there is little demand for new or higher taxes on alcohol, tobacco, food and soft drinks.

Download the full survey results here.