Sin taxes, public health and public opinion (part one)

SUGGESTED

This is the first of a series of blog posts analysing the results of this survey in depth.

Economic levers: sin taxes

Taxes on alcohol, tobacco, salt and sugar have been levied for centuries as a means of generating government revenue. In recent decades, such taxes have been raised with the explicit objective of reducing the consumption of the targeted product on health grounds. There is a strong presumption in economics that, ceteris paribus, higher prices lead to reduced consumption.

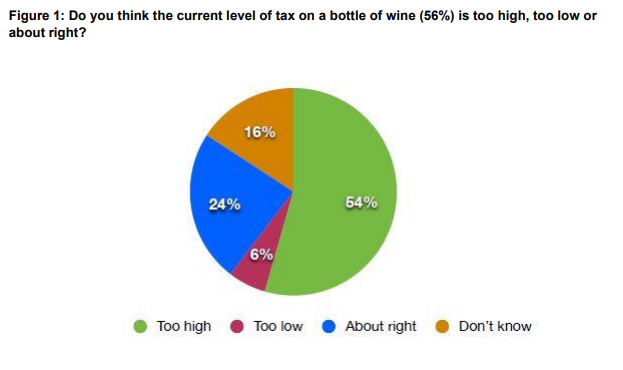

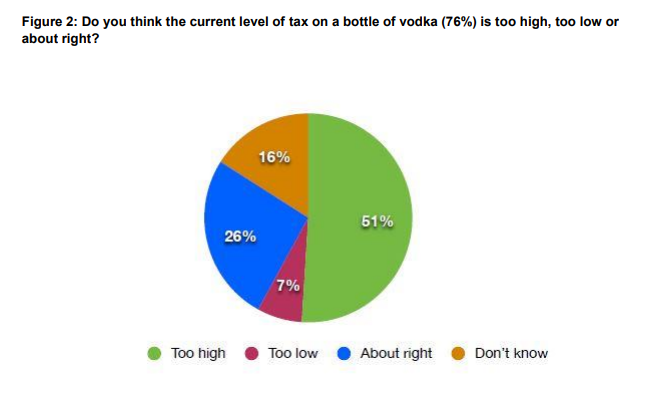

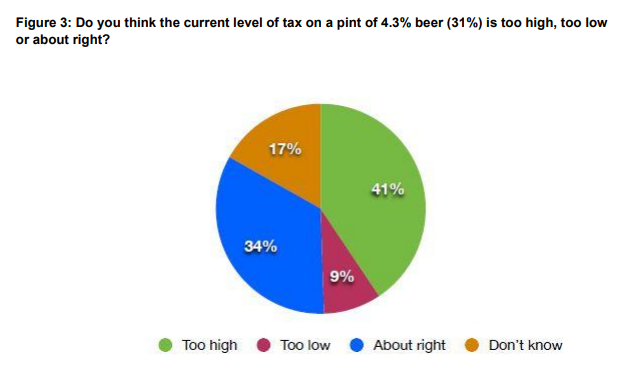

Taxes on tobacco and alcohol in the UK are amongst the highest in the world and many public health campaigners are eager to implement new taxes on sugar and soft drinks. Our survey found that most Britons feel that existing taxes on alcohol are too high. Fewer than ten per cent of respondents thought that taxes on beer, wine and spirits were too low. An absolute majority felt that taxes on wine and vodka were too high and a relative majority felt that taxes on beer were too high (see Figures 1-3).

Figure 2: Do you think the current level of tax on a bottle of vodka (76%) is too high, too low or about right?

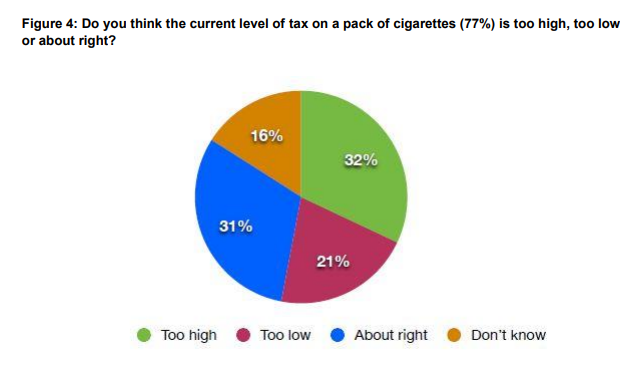

Opinion on tobacco duty was more mixed, but those who felt that tax on cigarettes was too high outnumbered those who thought it was too low by 3 to 2 (see Figure 4).

Figure 4: Do you think the current level of tax on a pack of cigarettes (77%) is too high, too low or about right?

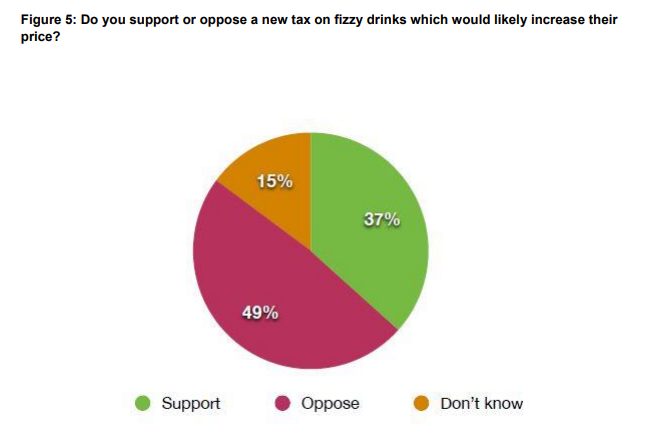

There was significant resistance to new taxes being levied on food and soft drinks. Of those who expressed an opinion, the majority were opposed to taxes on both fizzy drinks and food that is high in sugar and salt (Figure 5 and 6).

Figure 5: Do you support or oppose a new tax on fizzy drinks which would likely increase their price?

Figure 6: Do you support or oppose a new tax on food and drinks which contain high levels of sugar and salt which would likely increase their price?

Although not strictly a health-related tax, we also asked respondents about taxes on air travel. These taxes amount to £71 on an economy class, long haul flight. 55 per cent of respondents said that this was too much, 20 per cent said it was about right, and just 4 per cent said it was not enough. The remaining 21 per cent offered no opinion.

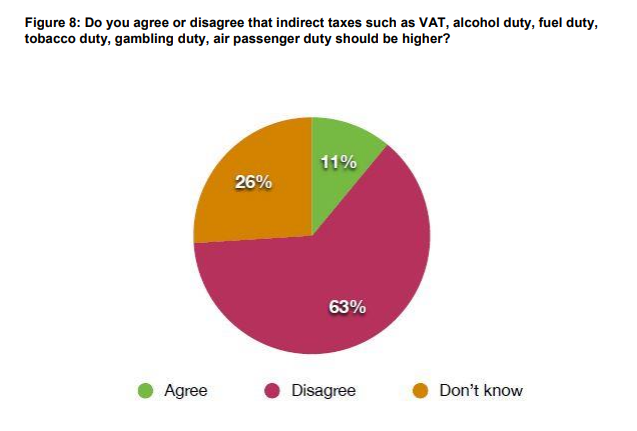

Taking all indirect taxation together, including VAT, tobacco duty, alcohol duty, air passenger duty, gambling duty and fuel duty, most respondents felt that these taxes were too high. Of those who expressed an opinion, those who thought indirect taxes were too high outnumbered those who felt that they were too low by more than 2 to 1 (Figure 7). When asked if these taxes should be higher, only 11 per cent agreed (Figure 8).

Figure 7: Do you agree or disagree that indirect taxes such as VAT, alcohol duty, fuel duty, tobacco duty, gambling duty, air passenger duty are too high?

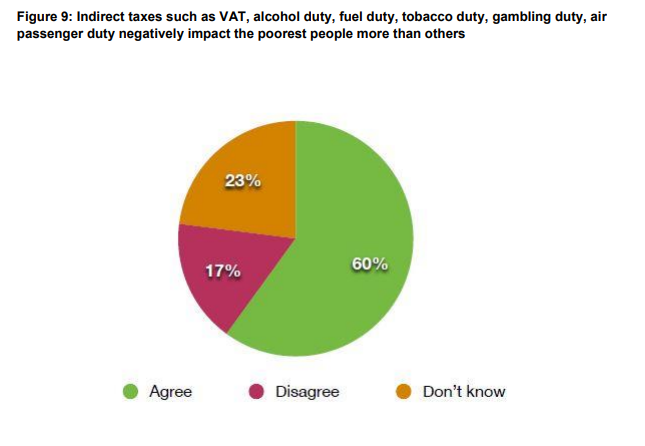

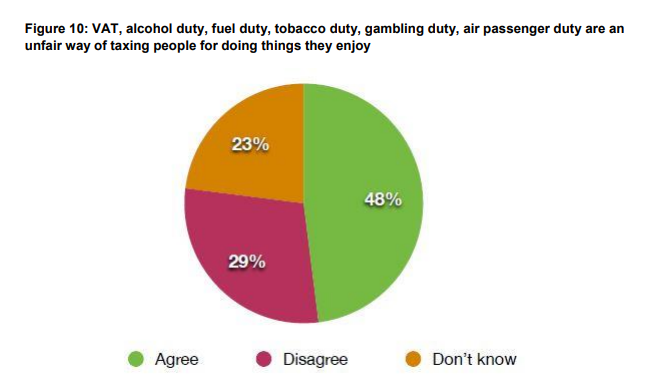

It is widely understood by economists that ‘sin taxes’ are economically regressive, ie. they take a greater proportion of income from the poor than from the rich. This regressive impact is particularly severe for products that are disproportionately purchased by people on low incomes, such as cigarettes. Our survey found widespread awareness of the regressive nature of indirect taxes. The majority of respondents agreed that they ‘negatively impact the poorest people more than others’. Those who agreed with this statement outnumbered those who did not by more than 3 to 1 (Figure 9). Of those who expressed an opinion, the majority also agreed that such taxes ‘are an unfair way of taxing people for doing things they enjoy‘ (Figure 10).

Figure 9: Indirect taxes such as VAT, alcohol duty, fuel duty, tobacco duty, gambling duty, air passenger duty negatively impact the poorest people more than others

Figure 10: VAT, alcohol duty, fuel duty, tobacco duty, gambling duty, air passenger duty are an unfair way of taxing people for doing things they enjoy

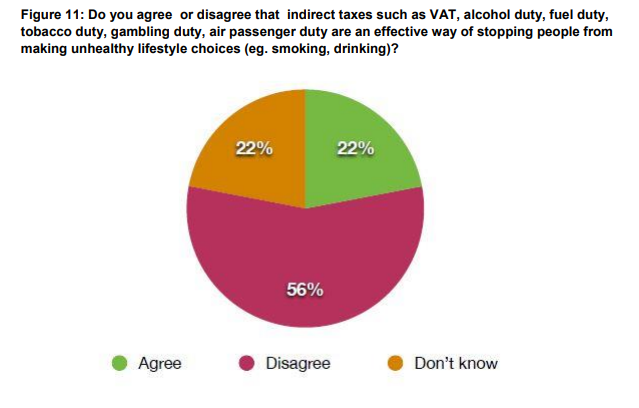

Finally, most respondents were sceptical about the ability of ‘sin taxes’ to achieve their stated purpose of making people healthier. Those who agreed that ‘indirect taxes such as VAT, alcohol duty, fuel duty, tobacco duty, gambling duty, air passenger duty are an effective way of stopping people from making unhealthy lifestyle choices’ were outnumbered by more than 2 to 1 by those who disagreed (Figure 11).

Figure 11: Do you agree or disagree that indirect taxes such as VAT, alcohol duty, fuel duty, tobacco duty, gambling duty, air passenger duty are an effective way of stopping people from making unhealthy lifestyle choices (eg. smoking, drinking)?

Download the full survey results here.