Iceland versus Ireland: lessons from the banking crisis

SUGGESTED

The joke played on the idea that Iceland had begun its rapid descent by not enacting a series of bailouts and that Ireland would quickly follow if it did not choose a different path. In my recent article in Economic Affairs, I assess the two sets of responses and separate the wheat from the chaff to provide a lesson for others.

In drafting its crisis policies, Ireland chose to bail out its banks, but could not change anything fundamental in its macroeconomic policies owing to its inclusion in the euro zone. Thus, it did not pursue an inflationary policy to monetise its debts, nor did it enact capital controls to stymie capital flight.

Iceland did the opposite. It allowed its banks to fail (though really only the foreign-domiciled portions of the banking sector), while inflating its money supply sharply to pay for other debts incurred. To stop investment funds from leaving the country, and as part of a bailout from the IMF, the country enacted strict capital controls.

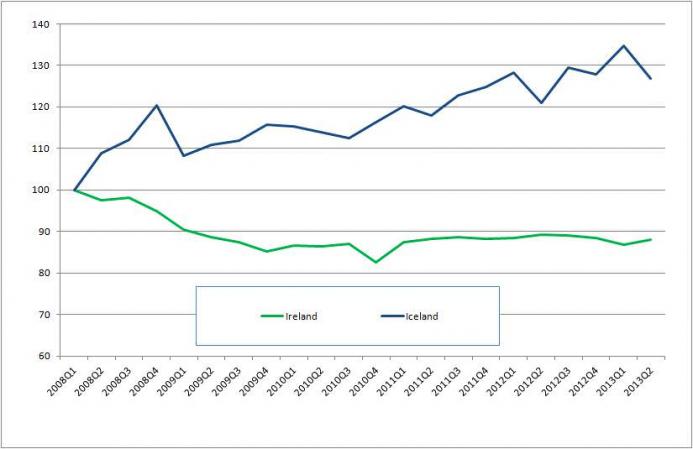

Which set of policies was most effective? The typical response over the last five years was that Iceland came out ahead. In Figure 1 we see the reason why.

Figure 1: Nominal GDP (2008 = 100)

Source: Federal Reserve Bank of St. Louis

When Iceland pursued the inflationary option, its recession seemed muted and short-lived. It bottomed out quickly, and nominal income surpassed the boom time high by early 2011. The idea was that exports were promoted by the depreciation of the Icelandic króna, and this was what spurred on the quick recovery.

In contrast, Ireland slowly ground to a halt. Locked in the euro zone it could not inflate its way to international competitiveness. Saddled with debts from bailouts it has been unable to get its footing and start a growth phase.

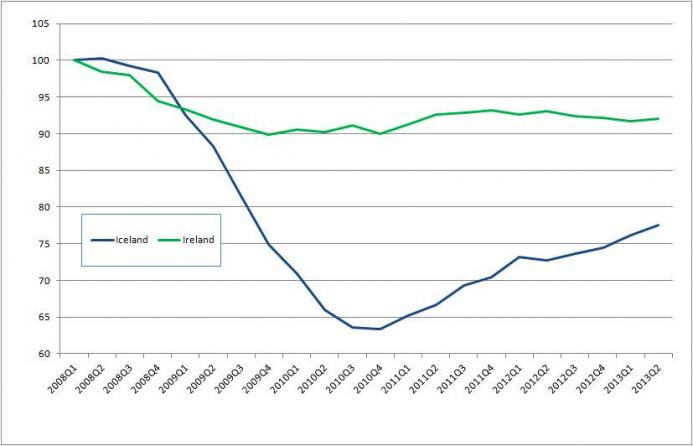

Now with five years of hindsight we can change the story a little bit. Because the inflationary effects of Iceland’s monetary policy took some time to appear, it is only retrospectively that we can see how well the recovery looked in real inflation-adjusted terms, as in Figure 2.

Figure 2: Real GDP (2008 = 100)

Source: Federal Reserve Bank of St. Louis

What a difference hindsight makes. Iceland’s collapse was deep and prolonged, owing mostly to the fact that Icelandic savings were wiped out by the high degrees of price inflation (which reached almost 20 per cent in 2009). The fall from grace for Icelanders felt worse than it appeared to outsiders owing to this loss in purchasing power and wealth.

Ireland’s path was initially more painful, though not for long. Outright deflation swept the Emerald Isle as prices fell. Irish exports were promoted not by a superficial depreciation of the exchange rate, as was the case in Iceland, but through a domestic price decline. As prices fell, regular Irish citizens saw their cost of living fall and what savings they had increased in purchasing power.

Yet for all the benefits that Ireland incurred by not inflating its problems away, growth has since been sluggish. By saving its financial system it has saddled itself with an immense debt to repay. Government debt to GDP is well over 100%, and the budget deficit remains in double digits. The country devotes so many resources to paying off the debts of its past sins that it has little to reinvest in its future.

Icelandic government debt is not much better, but it is at least not being directed at paying off debts to keep an insolvent financial sector afloat. Instead, the country allowed that part of the economy to fail which largely set the stage for a recovery on more stable footing. Resources are being redirected in a more sustainable way – a way that does not promote a bloated and unnecessary banking system.

Five years on it is unclear ‘who won’ the great policy debate of 2008. Ireland may have won the short-term battle through deflation, but it seems like Iceland is quickly catching up and might soon win the war thanks to its ability to allow bad debts to magically disappear through default.

Yet all is not as rosy as it might seem for Iceland. The capital controls it enacted thanks to the IMF led bailout are now stifling foreign investment. Unsure of whether they will be able to cash in and withdraw funds in the future, foreign investors are hesitant to fund projects on the island. Ireland’s commitment to free capital markets, whether by choice or because euro-zone policy forbids such restrictions, has allowed foreign funding to continue entering the country.

Time will tell which country will come out ahead when the dust settles, but for the rest of us there is a lesson to be learnt. Bailouts harm growth due to their debt overhang. Inflationary policies soften the short-term malaise but jeopardise the redirection of resources necessary to return the economy to stable growth. Finally capital controls are dangerous and may stop the necessary inflow of foreign funding from entering the country.

Never let a good crisis go to waste. In the cases of Iceland and Ireland, other debt-stricken countries should heed their lessons when drafting recovery policies of their own.

David Howden is the author of ‘Separating the Wheat from the Chaff: Icelandic and Irish Policy Responses to the Banking Crisis’, published in the October 2013 issue of Economic Affairs.