Wealth Generation: How to Boost Income Mobility in the UK

SUGGESTED

Summary

- Many argue that income mobility is declining. This applies to all types of income mobility (relative and absolute; intergenerational and intragenerational).

- As remedies, those who worry and others who want to improve mobility tend to propose expansions to welfare programmes.

- We argue that economic freedom (i.e., safer property rights, less regulated markets, lower taxation and open trade) is far more potent to improve income mobility than redistributive policies.

- There is a direct effect of economic freedom by removing legal hurdles to work. There is also an indirect effect by promoting economic growth in ways that are biased towards the poor.

- There is new international evidence suggesting that economic freedom promotes intergenerational absolute and relative income mobility.

- There is rich subnational data from Canada showing that economic freedom promotes intragenerational income mobility (relative and absolute).

- There is indirect evidence from economic history, economic geography and the economics of occupational licensing confirming the above results.

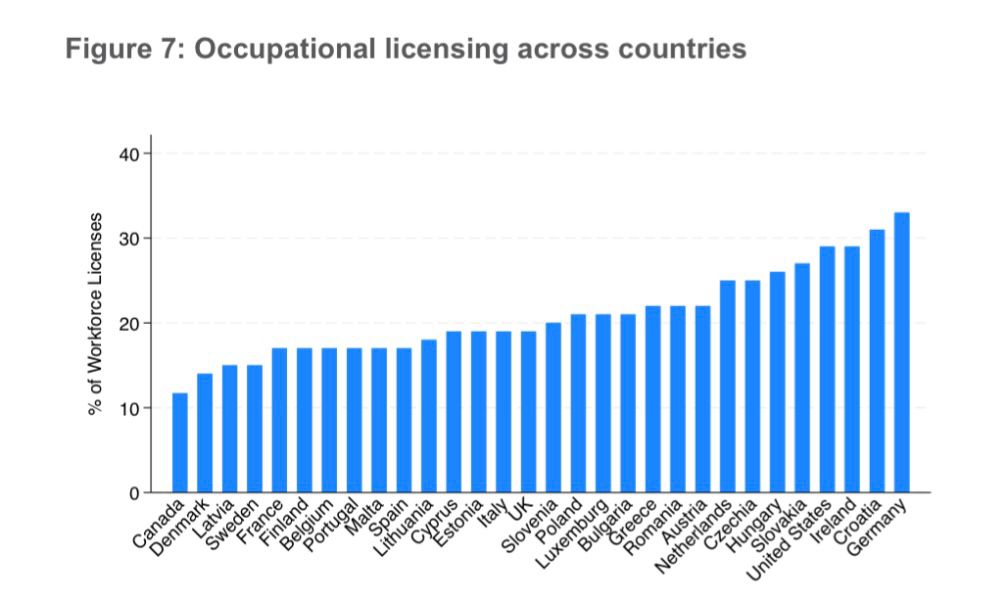

The UK is a middling country in terms of both income mobility and occupational licensing laws. - We highlight two main areas of reform to promote economic freedom to increase the UK’s performance in mobility: deregulation in occupational licensing laws and housing restrictions.

Introduction

Inequality is a dominant political topic across western societies. This is, in large part, due to the perceived connection with income mobility (see, for example, Wilkinson & Pickett 2011). It is a widely held fear that unequal societies offer fewer opportunities to people from low-income backgrounds (Corak 2013). They may find themselves locked in lower-income groups – even if they benefit from overall economic growth. This proposed causal connection between inequality and income mobility lies behind multiple justifications for increasing taxes on the rich and investing large sums in welfare state programmes such as education and health care.

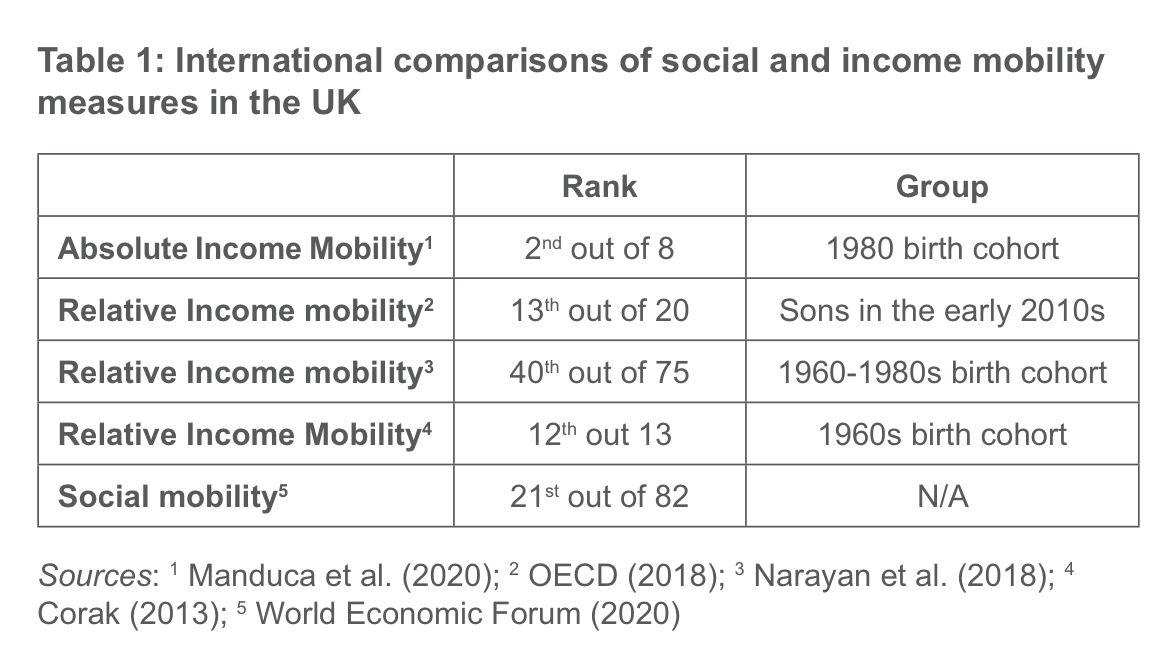

In the United Kingdom, this argument holds a particular strong grip on the public imagination because of a shared view that British income mobility is disappointing both in terms of trends and levels. Polls produced by the Social Mobility Commission suggest that three quarters of people in the UK believe that there ‘are large differences in opportunities’ while only a little over a third of the population believe that ‘everyone has a fair chance to go as far as their hard work will take them’ (Social Mobility Commission 2021). The Social Mobility Commission, in its July 2022 report, stated that ‘traditional approaches to improving social mobility haven’t always worked widely, despite the best of intentions’ (Social Mobility Commission 2022:2). The Commission’s report depicts Britain as a middling performer across all possible indicators when compared with other nations, with some slight deterioration since the 1970s (Social Mobility Commission 2022:48). While international comparisons are fraught with complications, it is clear that Britain is not exceptional in any way – neither good nor bad.1 Table 1 provides a comparison of possible indicators (which we will define in the next section) that is meant to demonstrate this middling position.

Critics of the United Kingdom’s performance on social mobility propose a variety of potential remedies, but they generally all boil down to the same: higher taxation and more welfare spending (Bukodi & Goldthorpe 2018:223; Blanden & Macmillan 2016). The current conversation has a myopic and unidimensional focus on the presumed connection between inequality and income mobility. All proposed remedies emanate from this connection.

Unconsidered and largely ignored in the entire conversation is the role that institutions play in enhancing upward income mobility. More precisely, the role of economic freedom (secure property rights, limited regulation and freedom to trade) has been generally ignored (even if it has theoretically been considered). Here, we argue that securing ‘economic freedom’ (i.e., limited government, limited regulation, safe and secure property rights, open trade and sound money) matters much more than redistributionist policies. Limited business and land-use regulation, more flexible labour markets, fewer barriers to business formation, and more open trade can do more to boost income mobility than is commonly appreciated.

In the three sections that follow, we first highlight why economic freedom matters to income mobility. In the first section, we discuss the different measurements of mobility and recent advances in the field of income mobility studies that attempt to connect freedom to income mobility. Secondly, we highlight the empirical evidence to that effect – both direct and indirect. Thirdly, we discuss policy options that could enhance income mobility in Britain.

Why would economic freedom matter to income mobility?

Before proceeding, we must point out that we will speak of income mobility, knowing full well that it is only one of many categories of mobility. For example, the last line of Table 1 mentions ‘social mobility’ – which is not the same as income mobility – which allows us to make a crucial distinction for the purposes of this study. Social mobility is a broader concept that is more frequently emphasised within the field of sociology. As one sociology textbook says, ‘social mobility refers to the movement of people up or down the social class hierarchy’ (Browne 2005:35). The stratification system necessitates the definition of ‘classes’ or ‘groups’. This is important because ‘groups’ and ‘classes’ carry some sense of social status that the percentile position on the income ladder may fail to carry. However, it is difficult to measure ‘classes’ internationally in a consistent way or without too much subjectivity. Most importantly, there are no reasons to believe that improvements in income mobility create deteriorations in social mobility (quite the opposite). We will focus on ‘income mobility’ throughout this article with the assumption that there is a carry-over to ‘social mobility’ more broadly defined.

Of greater importance to us are the two types of income mobility. The first is known as ‘absolute mobility’, which speaks as to whether a person enjoys gains in living standards over their lifetime. The second is known as ‘relative mobility’ and it speaks as to whether someone achieves a better rank in society based on the starting point of their parents. These types of mobility can be measured in two ways. One is to measure the change in a person’s income in relation to their parents’ (intergenerational mobility) or throughout their lifetime (intragenerational mobility).

The connection between income mobility and inequality is based on the ‘capabilities’ approach developed by economist and philosopher Amartya Sen. Sen emphasised that people must not only be legally free to choose but also practically (Sen 1993; Sen 2000). They must be able to rise up without being either prohibited by law or prevented by a lack of capabilities. Nearer the bottom of the income ladder, it is harder to seize educational possibilities or to invest in skill sets that could allow for upward mobility. There are limited capabilities to rise up. In contrast, nearer the top, opportunities can be more easily accessed. This relationship is hard to contest. It is well-embedded in standard economic theory as it assumes that opportunities to rise up are equally costly (e.g., the price of a university degree is roughly the same for everyone) but that the financial constraints of the poor make it harder for them to seize these opportunities.

Less frequently noted is the mitigating role of economic freedom. This can be seen in the microcosm of the Olympic Games. Athletic talents are innate and distributed independently of family wealth. However, the cost of developing that talent in order to compete in the Olympics is the same for rich and poor. Therefore, investing in developing that talent is harder for the poor even if they are innately talented. All else being equal, more unequal (equal) societies are expected to send a greater (smaller) share of athletes that come from richer households. Given that Olympic medals are generally associated with great socio-economic rewards for athletes, one can easily see the parallel with mobility as generally defined. It also means that a very unequal country may not be sending its most talented athletes to the Olympics, which makes it harder to win medals. And to be sure, there is evidence that countries with higher inequality tend to win fewer medals than those with lower levels of inequality (Berdahl, Uhlmann, Bai 2015).

However, economic freedom may mitigate that effect by incentivising efforts. If the monetary rewards from winning a medal are the same for all, then they are likely to be subjectively more valuable to the poor (assuming that income has a decreasing marginal utility). As a result, efforts are more valuable near the bottom. If property rights are secure (i.e., a component of economic freedom), this means that the poor can easily appropriate the gains of these efforts. Moreover, lightly regulated credit markets and low taxes may also complement this by increasing net returns on effort and reducing the costs of financing investments in athletic skills. Thus, countries with higher levels of economic freedom (i.e., limited government, limited regulation, open trade, safe and secure property rights, sound money)2 will also win more medals. Using the 2016 Summer Olympics and the Fraser Institute’s Economic Freedom of the World Index (EFW), Vadim Kufenko and Vincent Geloso (2021) found that countries with higher levels of economic freedom suffered no penalty from inequality. All the adverse effects of inequality were concentrated in the group of countries with low levels of economic freedom. In other words, economic freedom enhanced the capabilities of the poor more than income inequality reduced them.

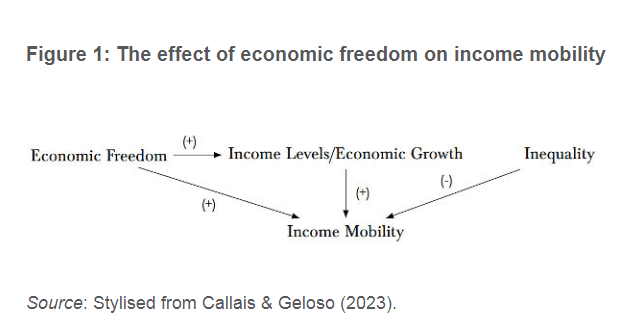

This microcosm generates a more general framework for how economic freedom matters to mobility. It is a framework that James Dean, Justin Callais, Christopher Boudreaux, Alicia Plemmons and Vincent Geloso have developed in multiple peer-reviewed articles and working papers on income mobility and economic freedom, which we summarise in Figure 1, and can apply to both intragenerational and intergenerational mobility (Dean & Geloso 2022; Callais & Geloso 2023; Callais, Geloso, Plemmons 2023a and 2023b; Callais & Young 2023). First, notice that we include a relationship from inequality to income mobility to reflect the standard view. The negative sign on the branch depicts the idea that more inequality means less income mobility. The other branches speak to the direct and indirect effects of economic freedom. The direct effect (the line that goes straight from economic freedom to income mobility) is easiest to understand: it is the absence of disincentives or barriers to the efforts at upward mobility from lower-income groups. For the sake of illustration, occupational licensing can be thought of as a barrier to mobility. Occupational licensing applies largely to people lower on the income ladder, such as certain groups of the self-employed (Plemmons 2021). The removal of such regulations would mean an increase in economic freedom followed by an increase in income mobility.

The indirect link works through the well-documented relationship between economic freedom and economic growth. The vast majority of empirical articles using economic freedom data have found that income levels are higher in economically freer societies. A weaker majority of articles also found that economic growth was faster as well (Hall & Lawson 2014). This is what explains the indirect linkage from economic freedom to mobility.

One could reply that economic growth only applies to absolute mobility in an evident manner – more economic growth means more absolute mobility. However, this relies on the heroic assumption that an extra dollar of income opens up the same additional possibilities to the poor as to the rich. This assumption is incorrect. For the sake of illustration, consider the demand for educational services. If the demand for education rises with income, then rising income levels entail more investment in education. However, it is also known that rising income levels at already high levels of income have a smaller effect on the demand for education (Hashimoto & Heath 1995).3 Lower-income households are thus likelier to increase their demand for education with economic growth. Another example is through the role of specialisation in economic growth. A frequently repeated idiom in economics is that the scope for specialisation is limited by the size of the market. By the size of the market, we do not mean merely the number of people but the number of exchanges that take place. Richer societies tend to have more exchanges and thus more room for specialisation. More room for specialisation opens up more avenues and paths to rise up. As a result, economic growth may actually open up possibilities that were hitherto locked away for poor people. Since economic freedom is linked to economic growth, the link between growth and mobility implies that it has an indirect effect on relative income mobility.

The evidence on mobility and economic freedom

There is a large body of evidence that supports the causal mechanisms we described above. This can be broken into the categories of ‘Direct Evidence’ and ‘Indirect Evidence’. Both categories show empirical evidence of a strong causal connection from economic freedom to income mobility.

Direct evidence

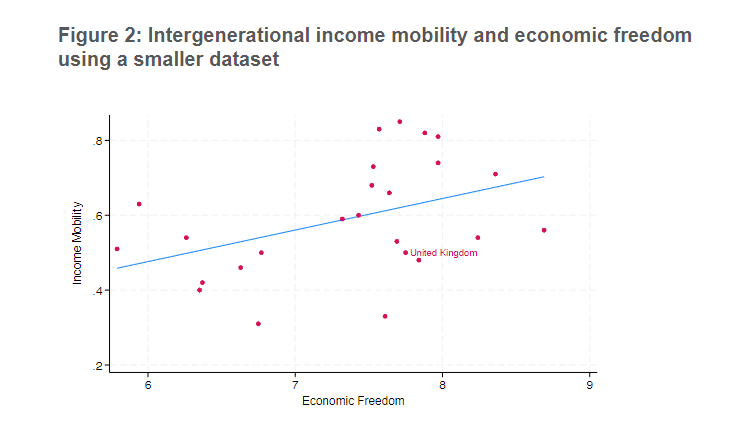

The first study that ever considered the role of economic freedom on income mobility was produced by Christopher Boudreaux (2014). He used what was then the best international data regarding intergenerational relative income mobility. His sample had few countries. Nevertheless, he found that economic freedom has a strong and positive association with relative intergenerational income mobility. In Figure 2, we create a scatterplot using the data from his paper. In that Figure, a higher value on the vertical axis is what is deemed more desirable because we invert the original income mobility measure, which is presented as a measure of persistence (i.e., the degree to which you remain in the same income bracket as your parents). This rearranged measure tells us the percent of one’s income that is independent to that of one’s parents. As can be seen, there is more mobility (i.e., less persistence) in countries that scored higher on indexes of economic freedom. In Figure 2, we also highlighted Britain, which appears to be a middling country both in terms of economic freedom and income mobility. Boudreaux solidified this stylised depiction by using a multiple regression model, which found a positive and significant association between mobility and economic freedom (Boudreaux 2014:246).

The limitation of that study is that Boudreaux used a small sample composed mostly of well-developed countries with high levels of economic freedom. Since the publication of his work, new datasets have emerged that have wider international coverage – more than 100 countries are now available (rather than less than 30) (Narayan et al. 2018). Justin Callais and Vincent Geloso made use of that larger dataset and found – as can be seen in Figure 3 – that the pattern holds when more countries are used. In Figure 3, we also highlighted Britain which again appears to be a middling country in terms of mobility. Using three different multiple regression models, Callais and Geloso (2023) went further and attempted to both disentangle the direct and indirect effects of economic freedom while also assessing whether economic freedom was more potent than inequality was. They found that the indirect effect of an extra point of economic freedom (on an index that goes from 0 to 10) could increase the income mobility coefficient by 0.08 to 0.11 – which is equal to between 15.5% and 21.3% of the mean value of the coefficient for all countries in their larger sample. When the direct effect is added, those proportions increase to between 21.7% and 25.7%. These proportions are as large or larger than the effect of inequality (based on standardised values).4

In subsequent econometric work with Alicia Plemmons, Callais and Geloso formally tested whether economic freedom is positively associated with intergenerational educational mobility in ways that enhance income mobility. They found that a one-point increase on the ten-point index of economic freedom increased the intergenerational income mobility coefficient (via educational mobility) by 0.025. Phrased differently, a one-point increase on the ten-point index of economic freedom increased income mobility via educational mobility by one-tenth of a standard deviation. This comes on top of the range of 0.08 to 0.11 from the earlier work of Callais and Geloso. The association with economic freedom is thus further strengthened (Callais, Geloso, Plemmons 2023a).

Unfortunately, international databases of intergenerational mobility require multiple national surveys. The surveys, by virtue of having differing methodologies, may have differing measurement errors that make it hard to reliably mix them all together in order to draw inferences.5 One solution is to look at subnational data on intergenerational income mobility, such as in the work of Raj Chetty and his team, who look at county-level data in the United States (Chetty et al. 2022a and 2022b; Chetty et al. 2014). The usefulness of the data is that there is a single unified methodology for the whole of the United States. This eliminates the issue of international comparability.6 The measure of absolute mobility in those data is defined as the ‘average income percentile rank in adulthood of children [born between 1978 and 1983] who grew up in that county with parents at the 25th percentile of the national parental household income distribution’ (Chetty et al. 2022a:113). Their relative income mobility measure is the relationship between a person’s income rank and their parents’ income rank. Callais, Geloso and Plemmons used those data in combination with recent estimates of economic freedom at the metropolitan level (known as Metropolitan Statistical Areas, or MSA) (Stansel 2019) to evaluate the association between economic freedom and the different measures of mobility (Callais, Geloso, Plemmons 2023b). Their econometric results suggest that a person who grew up in the 25th percentile of the income distribution but in the top quartile of the economic freedom distribution enjoyed 5% greater (i.e., upward) relative income mobility and 12% greater absolute income mobility than a person who grew up in the bottom quartile of the economic freedom distribution.

The evidence presented above hinges on intergenerational mobility measures. There are pitfalls associated with these measures that may affect any inferences based on them. As we have already alluded to above, the comparability of different national datasets used to create international comparisons is one such pitfall (Bukodi & Goldthorpe 2018:171, 189-90). Many others, and far more problematically, revolve around making sure we correctly estimate the ‘real’ income of parents and children. There are three reasons to be concerned on that front. The first is that incomes must be deflated by a price index. Price indexes have well-known biases due to the entry of new goods, changes in the quality of goods and the arrival of new stores (known as outlet substitution bias) that statistical agencies fail to measure (Boskin 2005). If the bias changes over time, as there is evidence that it does (Costa 2001), then the measure of a person’s current income relative to their parents’ past income is affected. In turn, income mobility measures are potentially biased. Secondly, the experience of inflation differs according to one’s position on the income ladder (Santioni, Carbonaro, Carlucci 2010).7 For example, using historical data, Vincent Geloso and Peter Lindert found that the evolution of price levels in the late 19th century in Canada, Australia, the United States and Great Britain was biased favourably towards the poor (Geloso & Lindert 2020). The prices of goods disproportionately consumed by the poor fell faster than the prices of goods disproportionately consumed by the rich. This makes the ‘real’ gains of the poor greater than if estimated using a single inflation adjustment for everyone. This matters for the evolution of income mobility because it means that we may overstate (understate) the real income of rich (poor) children relative to their parents. Lastly, there is the issue of household size, which has changed dramatically over time. Whereas most western countries had large households around 1950, they now report far smaller ones (Kufenko, Geloso, Prettner 2018). This affects measures of income mobility because of economies of scale that emerge in larger households. This is why adjustments for household size tend to show greater mobility (Chetty et al. 2017).8 Combined, these issues affect the quality of inferences based on intergenerational income mobility.

Fortunately, there is a way around these potential issues, which consists of looking at the far higher-quality data on intragenerational income mobility that is available at the subnational level for some countries, such as Canada. The problems of intergenerational comparisons are circumvented by the use of intragenerational measurements, since we compare one person with their past self. This is far more easily done due to the ability to link multiple administrative databases (e.g., tax records, transfer records, etc.) together to estimate income. Moreover, the use of subnational data circumvents the issue posed by assembling different national surveys into an international database that may have large measurement errors due to cross-national differences in survey designs.

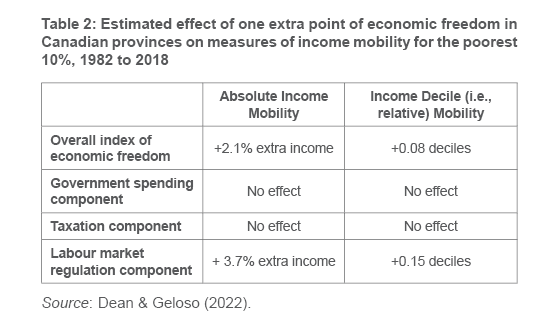

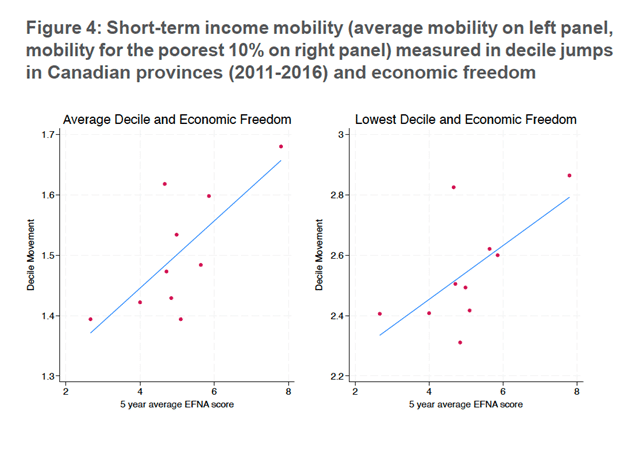

To do so, we can rely on Canadian data due to its high quality and long-time coverage. Statistics Canada created the longitudinal administrative database (LAD) which tracks 20% of tax units (whose data is merged with other administrative data) over rolling five-year windows (e.g., 1982 to 1987; 1983 to 1988) since 1982. This can thus be mixed with subnational indexes of economic freedom, such as the Fraser Institute’s Economic Freedom of North America (EFNA), to assess whether economic freedom improves mobility. The Canadian datasets provide relative income mobility (defined as the number of income deciles the average person climbed up over a five-year period) and absolute income mobility (defined as the percentage gain in income over the same period). One particular virtue of the Canadian data is that all the measures are estimated at different points on the income ladder (e.g., poorest decile, second-poorest decile, … top decile). This allows a focus on the mobility experience of the poorest. Table 2 below provides a summary of the results of a recent econometric study that ties economic freedom in Canadian provinces to income mobility for the poorest 10% of individuals (Dean & Geloso 2022). An extra point on the EFNA index (which is scaled to ten) implies greater income gains (i.e., more absolute mobility) and a faster climb up the income ladder. The two panels in Figure 4 show the scatterplot of the relationship between EFNA and relative income mobility. The left panel shows relative mobility on average whereas the right panel shows mobility from the very bottom. Both confirm the pattern depicted in Figures 2 and 3 above.

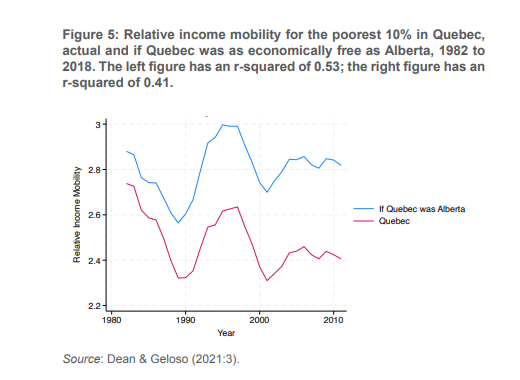

The Canadian data – because of its continuousness – illustrates the importance of economic freedom. Canada’s least economically free province is Quebec, while its freest one is Alberta. Since 1982, as the bottom line of Figure 5 shows, Quebec’s level of income mobility has been falling. Given the econometric results summarised in Table 2, what would Quebec’s income mobility look like had the province been as economically free as Alberta? The top line of Figure 5 shows this counterfactual scenario. As can be seen, Quebec’s declining level of income mobility for the poorest is entirely reversed. This illustrates the crucial importance of economic freedom.

Indirect evidence

The above-presented evidence is more direct, but there is a great amount of indirect evidence that complements these findings about the connection between economic freedom and mobility. This is particularly true when one consults works in economic history. For example, consider the frequently used 1958 National Child Development Study and the 1970 British Cohort Study. Using this data and making some valuable corrections, Gregg, Macmillan and Vittori (2017) found that the income rank of sons born in the 1970 birth cohort exhibited a far stronger correlation with their parents’ income rank than for sons born in the 1958 birth cohort. This means greater persistence of initial socio-economic conditions. Both are marked by periods of a relatively strong welfare state and strong intervention in the British economy. However, estimates from the late Victorian period – which was marked by far less social spending and government intervention in the economy – suggest surprisingly high levels of mobility in earnings (probably not lower than in the 20th century) (Long 2013). Consulting the Historical Index of Economic Liberty created by Leandro Prados de la Escosura to measure economic freedom in 21 OECD countries from 1850 to today, one can also see that the United Kingdom was a historically free country in economic terms (Prados De La Escosura 2016). In 1850, its score was the third highest in the group. In 1890, this was still the case. It should be noted that this index does not include government spending in its component. Rather, it measures economic freedom in terms of property rights, sound money, free trade and regulation. As such, it speaks most directly to the hurdles that governments could place in the way of people (whereas spending can be argued to enhance mobility).

In the United States, the period pre-1920 was marked both by high levels of income mobility and high levels of economic freedom. The subsequent decline occurs in a period of rapidly rising government intervention in the economy (Long & Ferrie 2013; Ferrie 2005; Song et al. 2020; Prados De La Escosura 2016). To be sure, these are just observations, but they point in the same direction as the contemporary evidence we highlighted above. One reason for the great upward income mobility is that geographic mobility allowed people to access high-opportunity areas (something that will matter when we discuss policy implications). One recent article found that the ability to migrate within the United States during the early 20th century was ‘three to four times the effect of one year of education’ on average whereas the effect for the poorest households was ‘ten times that of education’ (Ward 2022). The absence of barriers to geographic mobility (i.e., free labour markets) was sufficient to generate high-income mobility.9

These findings for the United States and the United Kingdom are also consistent with other findings that periods of large extensions of the welfare state are not associated with visible gains in mobility. For example, British intergenerational mobility for cohorts of sons born from 1950 to 1972 shows little gain. This is in spite of the fact that this is a period of rapid growth of the welfare state (Nicoletti & Ermisch 2008).10 Similarly, vast extensions to government programmes such as public education in the UK during the 1850s and 1880s appear to have relatively small effects (Long 2013). This is also consistent with contemporary evidence, applying to state-level policies in the United States, suggesting that ‘neither state public education investments, state investments in broader social welfare spending, nor tax rates differences have more than a small effect on income mobility’ (Lefgren, Pope, Sims 2022).

There are also other forms of indirect evidence in the form of modern policy-oriented studies. For example, Brian Meehan et al. (2019) used occupational licensing data in low-income occupations in the United States to assess whether these regulations hindered absolute intergenerational mobility. They argued that ‘by creating barriers to entry, growth in occupational licensing can potentially affect the income of non-practitioners and thus negatively affect intergenerational mobility’ because of higher prices for consumers and lower incomes for those who are prohibited from entering these fields.11 They found that a doubling in occupational licensing from 1993 to 2012 reduced upward absolute income mobility by between 1.6% and 6.25%. This sizeable effect speaks directly to economic freedom as occupational licensing is a form of labour market regulation that limits the ability of workers to engage in an economic activity of their volition. This type of result is consistent with other works that show that occupational licensing tends to limit the chances of transitioning out of welfare programmes (Hazlett & Fearing 1998). The problem with the Meehan et al. results is that they rely on absolute income mobility rather than relative income mobility. However, there are good reasons to believe their results extend to relative mobility. In Figure 6, we show a scatterplot of the percentage of employment that is licensed against the same measures of income mobility used by Callais and Geloso (2023) discussed above. As can be seen, greater levels of income mobility are associated with smaller shares of the workforce being subjected to licensing – an association that echoes Meehan et al. (2019).

Note: We excluded Latvia as it was an extreme outlier (income mobility was close to 0.1 which is well outside the range of any other country). The other countries are the same as in figure 7 below. Sources for licensing: For the United States, we used Kleiner & Krueger. (2010). For Canada, we used Zhang (2019). For all other countries we used Kleiner (2017:7). Sources for income mobility: Callais & Geloso (2023). The r-squared for the corresponding figure is 0.15.

Another example is that of housing regulations. One key finding in the growing income mobility literature is that ‘places matter’ (Chetty et al. 2014). Simply put, some areas offer more opportunities than others. Accessing these areas is an easy way to climb up the social ladder. More often than not, especially historically, cities are where these better and more numerous opportunities are located. However, municipal and national governments in countries like the United States, Canada and the United Kingdom have gradually increased land-use regulations such that the supply of housing in cities has grown less elastic. The result is that housing costs increased as well, and this locked people away from the cities and the opportunities they provide. This is why there are increasingly louder calls by economists to tackle the issue of land-use regulations in order to increase income mobility (Sutherland 2020; Erdmann, Furth, Hamilton 2019; see also Stutts 2021; Rothwell & Massey 2015). For our purposes, land-use regulations can be seen as a form of government intervention that intrudes upon economic freedom by limiting the ability to access more productive areas.

Policy recommendations for Britain

These connections between economic freedom and income mobility offer relatively simple policy options for Britain. The most obvious two would consist of going down the route of occupational deregulation and housing deregulation.

As indicated above, occupational licensing is limiting upward income mobility (relative and absolute). And the United Kingdom is not a great performer in that respect. As can be seen from Figure 7, close to 19% of the British workforce operates under some form of licensing system – in excess of high-income mobility countries such as Denmark (14%), Sweden (15%) and Finland (17%) (Kleiner 2017:7). These statistics likely understate how much Britain’s occupational regulations hinder income mobility as many of the regulated professions appear to be closer to the lower end of the income distribution (Fernie 2011; Shackleton 2017:20; Forth et al. 2011:28). Moreover, the trend in Britain is currently going in the wrong direction – that of greater occupational licensing. Whereas the proportion is 19% today, it was closer to 13.5% in 2008 (Forth et al. 2011:43). The 2008 level was itself double that observed in 1998 (Shackleton 2017:19).

We can use the aforementioned results of Meehan et al. (2019) to obtain an idea of the potential benefit of occupational deregulation on absolute income mobility (the same variable that Meehan et al. concentrated on). To do so, we can imagine what would happen if Britain deregulated to the point of being as regulated as Denmark – a deregulation that reduces occupational regulations by 26%. This would improve absolute income mobility by between 0.42% and 1.63%. As the income mobility figure that Meehan et al. (2019) concentrated on is the proportion of children who exceed their parents’ income level, this is not a negligible potential gain. Indeed, as the Social Mobility Commission reported that this proportion was around 67% for people born in 1985 (the most recent cohort studied), the gain from ‘becoming Denmark’ would bring the UK back close to the level observed during the 1970s (which were the height of upward absolute income mobility) (Social Mobility Commission 2022:46). Going back to the level observed in the late 1990s in the United Kingdom – which would mean a halving of regulation – would be sufficient to bring income mobility up by between 0.8% and 3.13% – enough to fully match the level observed for the birth cohorts of the 1970s and 1960s.

It is harder to quantify the potential benefits with regards to housing deregulation, but there is little doubt as to whether they would be greater than occupational deregulation. Evidence for the United States suggests as much. One article found that lifetime household income would – on average – be $635,000 to $910,000 higher if people born in low-opportunity areas were able to access areas that offer more opportunities. That effect was two thirds as large as the inherited status from parents, suggesting that geographic mobility is a potent tool to offset any inherited barriers to upward mobility (Rothwell & Massey 2015). Obviously, that is conditional on the ability of the housing supply to adjust to the influx of workers and families into high-opportunity areas.

In the United Kingdom, house prices for first-time buyers used to be between two and three times greater than average annual income from 1969 to 1999. That ratio is now many times greater (Provan et al. 2017:29). This has been directly tied to the role of regulatory barriers to land-use (Hilber & Vermeulen 2016). In the absence of regulatory constraints (i.e., refusal of proposed development by Local Planning Authorities), prices would have been 35% lower in the 2000s than they actually were (Hilber & Vermeulen 2016:360). Such a reduction in prices would have highly uneven effects across the income distribution for two reasons. First, homeownership is higher up the income ladder, which means that richer households obtain some gains from higher housing prices in the form of greater housing wealth. Second, housing costs represent a far greater share of household expenditures near the bottom of the income ladder. In the 2000s, housing costs equalled 15% of the median household’s income. In contrast, this proportion stood at 25% for households at the 10th and 15th centiles of the income distribution (Niemietz 2011:196). Easing land-use regulations would thus have larger effects on lower-income households and allow them to use their income for non-housing purposes such as investments in skill development, higher education and business investments.

Conclusion

Few contest the moral importance of income mobility. Regardless of how well or how badly Britain performs in that respect (something that is intensely debated), few would also oppose policies that promote more income mobility. The problem is that there has been a unidimensional focus on a single connection – that of inequality and income mobility. Most proposed policy courses originate from that perceived connection. Undiscussed are the roles of policies that would enhance economic freedom by pulling back government interventions in the economy. We highlighted here some recent research that emphasises the crucial importance of economic freedom. From this recent research, we propose different courses of action – notably occupational and housing deregulation – that would increase income mobility in Britain.

PDF Viewer

Fullscreen Mode

About the Authors

Justin Callais is an Assistant Professor of Economics and Finance at the University of Louisiana at Lafayette. He is also a research fellow at the Archbridge Institute and lead researcher for the institute’s Social Mobility in the 50 States project. He received his PhD in agricultural and applied economics from Texas Tech University. His articles have been published in journals such as the European Economic Review, Journal of Comparative Economics, Journal of Economic Behavior and Organization, Southern Economic Journal, and Public Choice.

Vincent Geloso is an Assistant Professor of Economics at George Mason University. He held prior appointments at Texas Tech University, Bates College and King’s University College. He holds a PhD in economic history from the London School of Economics and Political Science and a master’s degree in economic history from the same institution. He has published more than 90 scientific articles in journals such as Economic Journal, Journal of Development Economics, European Economic Review, Research Policy, European Journal of Political Economy, Public Choice, Economics & Human Biology, Journal of Economic Behavior and Organization, Contemporary Economic Policy, and the British Medical Journal: Global Health. He is also associate editor at Structural Change and Economic Dynamics, Cliometrica and Essays in Economic and Business History.

References

Arshed, N., Anwar, A., Kousar, N., & Bukhari, S. (2018) Education enrollment level and income inequality: A case of SAARC economies. Social Indicators Research, 140, 1211-1224.

Bailey, J. B., Thomas, D. W., & Anderson, J. R. (2019) Regressive effects of regulation on wages. Public Choice, 180, 91-103.

Berdahl, J. L., Uhlmann, E. L., & Bai, F. (2015) Win–win: Female and male athletes from more gender equal nations perform better in international sports competitions. Journal of Experimental Social Psychology, 56, 1-3.

Bernstein, D. E. (2001) Only one place of redress: African Americans, labor regulations, and the courts from Reconstruction to the New Deal. Duke University Press.

Bishop, J. A., Liu, H., & Rodríguez, J. G. (2014) Cross-country intergenerational status mobility: is there a Great Gatsby curve?. In Economic Well-Being and Inequality: Papers from the Fifth ECINEQ Meeting (Vol. 22, pp. 237-249). Emerald Group Publishing Limited.

Blanden, J., & Macmillan, L. (2016) Educational inequality, educational expansion and intergenerational mobility. Journal of Social Policy, 45(4), 589-614.

Boskin, M. J. (2005) Causes and Consequences of Bias in the Consumer Price Index as a Measure of the Cost of Living. Atlantic Economic Journal, 33, 1-13.

Boudreaux, C. J. (2014) Jumping off of the Great Gatsby curve: how institutions facilitate entrepreneurship and intergenerational mobility. Journal of Institutional Economics, 10(2), 231-255.

Browne, K. (2005) An introduction to sociology (3rd ed.). Polity Press.

Bukodi, E., & Goldthorpe, J. H. (2018) Social mobility and education in Britain: Research, politics and policy. Cambridge University Press.

Callais, J. T., & Geloso, V. (2023) Intergenerational income mobility and economic freedom. Southern Economic Journal, 89(3), 732-753.

Callais, J. T., & Young, A. T. (2023) A rising tide that lifts all boats: An analysis of economic freedom and inequality using matching methods. Journal of Comparative Economics.

Callais, J. T., Geloso, V., & Plemmons, A. (2023a) Economic Freedom and Intergenerational Educational Mobility. Available at SSRN 4539822.

Callais, J., Geloso, V., & Plemmons, A. (2023b) Intergenerational Mobility, Social Capital, and Economic Freedom. Working Paper, Archbridge Institute.

Chambers, D., McLaughlin, P. A., & Stanley, L. (2019) Barriers to prosperity: The harmful impact of entry regulations on income inequality. Public Choice, 180(1), 165-190.

Chetty, R., Grusky, D., Hell, M., Hendren, N., Manduca, R., & Narang, J. (2017) The fading American dream: Trends in absolute income mobility since 1940. Science, 356(6336), 398-406.

Chetty, R., Hendren, N., Kline, P., & Saez, E. (2014) Where is the land of opportunity? The geography of intergenerational mobility in the United States. The Quarterly Journal of Economics, 129(4), 1553-1623.

Chetty, R., Jackson, M. O., Kuchler, T., Stroebel, J., Hendren, N., Fluegge, R. B., … & Wernerfelt, N. (2022a) Social capital I: measurement and associations with economic mobility. Nature, 608(7921), 108-121.

Chetty, R., Jackson, M. O., Kuchler, T., Stroebel, J., Hendren, N., Fluegge, R. B., … & Wernerfelt, N. (2022b) Social capital II: determinants of economic connectedness. Nature, 608(7921), 122-134.

Corak, M. (2013) Income inequality, equality of opportunity, and intergenerational mobility. Journal of Economic Perspectives, 27(3), 79-102.

Costa, D. L. (2001) Estimating real income in the United States from 1888 to 1994: Correcting CPI bias using Engel curves. Journal of Political Economy, 109(6), 1288-1310.

Dean, J., & Geloso, V. (2022) Economic freedom improves income mobility: evidence from Canadian provinces, 1982–2018. Journal of Institutional Economics, 18(5), 807-826.

Dean J., & Geloso, V. (2021) Economic Freedom Leads to Greater Income Mobility. Montreal: Montreal Economic Institute.

Erdmann, K., Furth, S., & Hamilton, E. (2019) The Link Between Local Zoning Policy and Housing Affordability in America’s Cities. Mercatus Policy Brief.

Fernie, S. (2011) Occupational licensing in the United Kingdom: The case of the private security industry. Employment in the Lean Years: Policy and Prospects for the Next Decade, 102.

Ferrie, J. P. (2005) History lessons: The end of American exceptionalism? Mobility in the United States since 1850. Journal of Economic Perspectives, 19(3), 199-215.

Fishback, P. V. (1992) Soft coal, hard choices: The economic welfare of bituminous coal miners, 1890-1930. Oxford University Press.

Forth, J., Bryson, A., Humphris, A., Koumenta, M., & Kleiner, M. (2011) A review of occupational regulation and its impact. UK Commission for Employment and Skills.

Geloso, V., & Lindert, P. (2020) Relative costs of living, for richer and poorer, 1688–1914. Cliometrica, 14, 417-442.

Gregg, P., Macmillan, L., & Vittori, C. (2017) Moving towards estimating sons’ lifetime intergenerational economic mobility in the UK. Oxford bulletin of economics and statistics, 79(1), 79-100.

Hall, J. C., & Lawson, R. A. (2014) Economic freedom of the world: An accounting of the literature. Contemporary economic policy, 32(1), 1-19.

Hashimoto, K., & Heath, J. A. (1995) Income elasticities of educational expenditure by income class: The case of Japanese households. Economics of education review, 14(1), 63-71.

Hazlett, T. W., & Fearing, J. L. (1998) Occupational licensing and the transition from welfare to work. Journal of Labor Research, 19(2), 277-294.

Hilber, C. A., & Vermeulen, W. (2016) The impact of supply constraints on house prices in England. The Economic Journal, 126(591), 358-405.

Kleiner, M. (2017) The influence of occupational licensing and regulation. IZA World of Labor.

Kleiner, M. M., & Krueger, A. B. (2010) The prevalence and effects of occupational licensing. British Journal of Industrial Relations, 48(4), 676-687.

Kufenko, V., & Geloso, V. (2021) Who are the champions? Inequality, economic freedom and the Olympics. Journal of Institutional Economics, 17(3), 411-427.

Kufenko, V., Geloso, V., & Prettner, K. (2018) Does size matter? Implications of household size for economic growth and convergence. Scottish Journal of Political Economy, 65(4), 437-443.

Lefgren, L. J., Pope, J. C., & Sims, D. P. (2022) Contemporary state policies and intergenerational income mobility. Journal of Human Resources, 57(4), 1107-1146.

Long, J. (2013) The surprising social mobility of Victorian Britain. European Review of Economic History, 17(1), 1-23.

Long, J., & Ferrie, J. (2013) Intergenerational occupational mobility in Great Britain and the United States since 1850. American Economic Review, 103(4), 1109-1137.

Manduca, R., Hell, M., Adermon, A., Blanden, J., Bratberg, E., Gielen, A. C., … & Sirniö, O. (2020) Trends in Absolute Income Mobility in North America and Europe (No. 13456). Institute of Labor Economics (IZA).

Meehan, B. J., Timmons, E., Meehan, A., & Kukaev, I. (2019) The effects of growth in occupational licensing on intergenerational mobility. Economics Bulletin, 39(2), 1516-1528.

Morrisson, C., & Murtin, F. (2013) The Kuznets curve of human capital inequality: 1870–2010. The Journal of Economic Inequality, 11, 283-301.

Murphy, R. (2019) The quality of legal systems and property rights by state: a ranking and their implications for economic freedom. Available at SSRN 3466437.

Narayan, A., Van der Weide, R., Cojocaru, A., Lakner, C., Redaelli, S., Mahler, D., Ramasubbaiah, R., & Thewissen, S. (2018) Fair Progress?: Economic Mobility Across Generations Around the World, Equity and Development, Washington DC: World Bank.

Nicoletti, C., & Ermisch, J. F. (2008) Intergenerational earnings mobility: changes across cohorts in Britain. The BE Journal of Economic Analysis & Policy, 7(2).

Niemietz, K. P. (2011) A new understanding of poverty. Institute of Economic Affairs Monographs.

OECD. (2018) A Broken Social Elevator? How to Promote Social Mobility. OECD Publishing.

Plemmons, A. M. (2021) Does occupational licensing costs disproportionately affect the self-employed?. Journal of Entrepreneurship and Public Policy, 10(2), 175-188.

Prados De La Escosura, L. (2016) Economic freedom in the long run: evidence from OECD countries (1850–2007). The Economic History Review, 69(2), 435-468.

Provan, B., Belotti, A., Lane, L., & Power, A. (2017) Low-cost home ownership schemes. Social Mobility Commission & London School of Economics.

Rothwell, J., & Massey, D. (2015) Geographic effects on intergenerational income mobility. Economic Geography, 91(1), 83-106.

Santioni, R., Carbonaro, I., & Carlucci, M. (2010) Consumer Price Indexes: An Analysis of Heterogeneity Across Sub-Populations. In Price Indexes in Time and Space: Methods and Practice (pp. 133-149). Physica-Verlag HD.

Sen, A. (1993) Markets and Freedoms: Achievements and Limitations of the Market Mechanism in Promoting Individual Freedoms. Oxford Economic Papers, 45(4), 519-541.

Sen, A. (2000a) Social justice and the distribution of income. Handbook of income distribution, 1, 59-85.

Shackleton, J. R. (2017) Conspiracy Against the Public? Occupational Regulation in the UK Economy. Institute of Economic Affairs.

Shukla, V., & Mishra, U. S. (2019) Educational expansion and schooling inequality: testing educational Kuznets Curve for India. Social Indicators Research, 141, 1265-1283.

Social Mobility Commission (2021) Social Mobility Barometer 2021. Social Mobility Commission.

Social Mobility Commission (2022) State of the Nation 2022: A fresh approach to social mobility. Social Mobility Commission.

Song, X., Massey, C. G., Rolf, K. A., Ferrie, J. P., Rothbaum, J. L., & Xie, Y. (2020) Long-term decline in intergenerational mobility in the United States since the 1850s. Proceedings of the National Academy of Sciences, 117(1), 251-258.

Stansel, D. (2019) Economic freedom in US metropolitan areas. Journal of Regional Analysis & Policy, 49(1), 40-48.

Stutts, B. G. (2021) Essays in Urban Economics. PhD Thesis, Southern Methodist University.

Sutherland, D. (2020) Modernising state-level regulation and policies to boost mobility in the United States (No. 1628). OECD Publishing.

Thomas, D. W. (2019) Regressive effects of regulation. Public Choice, 180

(1-2), 1-10.

Ward, Z. (2022) Internal Migration, Education, and Intergenerational Mobility Evidence from American History. Journal of Human Resources, 57(6), 1981-2011.

West, E. G. (1994) Education and the state: A study in political economy. Indianapolis: Liberty Fund.

Wilkinson, R., & Pickett, K. (2011) The spirit level: Why greater equality makes societies stronger. Bloomsbury Publishing USA.

World Economic Forum (2020) The Global Social Mobility Report [data]. <http:// www3.weforum.org/docs/Global_Social_Mobility_Report.pdf>

Zhang, T. (2019) Effects of occupational licensing and unions on labour market earnings in Canada. British Journal of Industrial Relations, 57(4), 791-817.

Footnotes

- Different countries use different survey methodologies that create problems of consistency when researchers try to assemble into international databases. As such, in reviewing the measurements of mobility, Professor John Goldthorpe (one of Britain’s leading experts on social mobility) concluded in a recent book that there is ‘no evidence whatever of the (…) being a low mobility society’ (Bukodi & Goldthorpe 2018:203).

- This is the standard definition of economic freedom across indexes that purport to measure it (i.e., Fraser Institute and Heritage Foundation).

- It is also worth noting that this is consistent with the idea that initial investments in education tend to be made by richer people as societies grow and later by lower-income groups, such that educational inequality tends to fall in the long run. See Shukla & Mishra (2019); West (1994); Morrisson & Murtin (2013); Arshed et al. (2018).

- Using a larger dataset than that of Boudreaux but smaller than Callais and Geloso (2023), Bishop, Liu, Rodríguez (2014) found a similar result: economic freedom increases mobility.

- This is one of the reasons why Jonathan Goldthorpe refuses standard depictions of the UK as a low-mobility country (Bukodi & Goldthorpe (2018:203).

- There is, however, a downside. Indices of economic freedom that compare countries have property rights components. In contrast, subnational indexes rarely have property rights components because there are very minor variations in that component within countries (see Murphy 2019).

- As an illustration, Santioni et al. point out that, in 1990, the American consumer price index represented a consumer at the 75th centile of the income distribution.

- In their work, they provide alternative specifications according to household economies of scale linked to size, which leads to different degrees of decline in absolute mobility.

- For an overview of how unregulated labour markets were in the United States during that era, see Fishback (1992) and Bernstein (2001).

- Although Nicoletti and Ermisch do find lower mobility for people who would have come of age during the 1980s.

- This is consistent with evidence that entry regulations tend to increase income inequality. See Chambers, McLaughlin, Stanley (2019); Thomas (2019); Bailey, Thomas, Anderson (2019).