No – automation will not make Marx ‘relevant again’

SUGGESTED

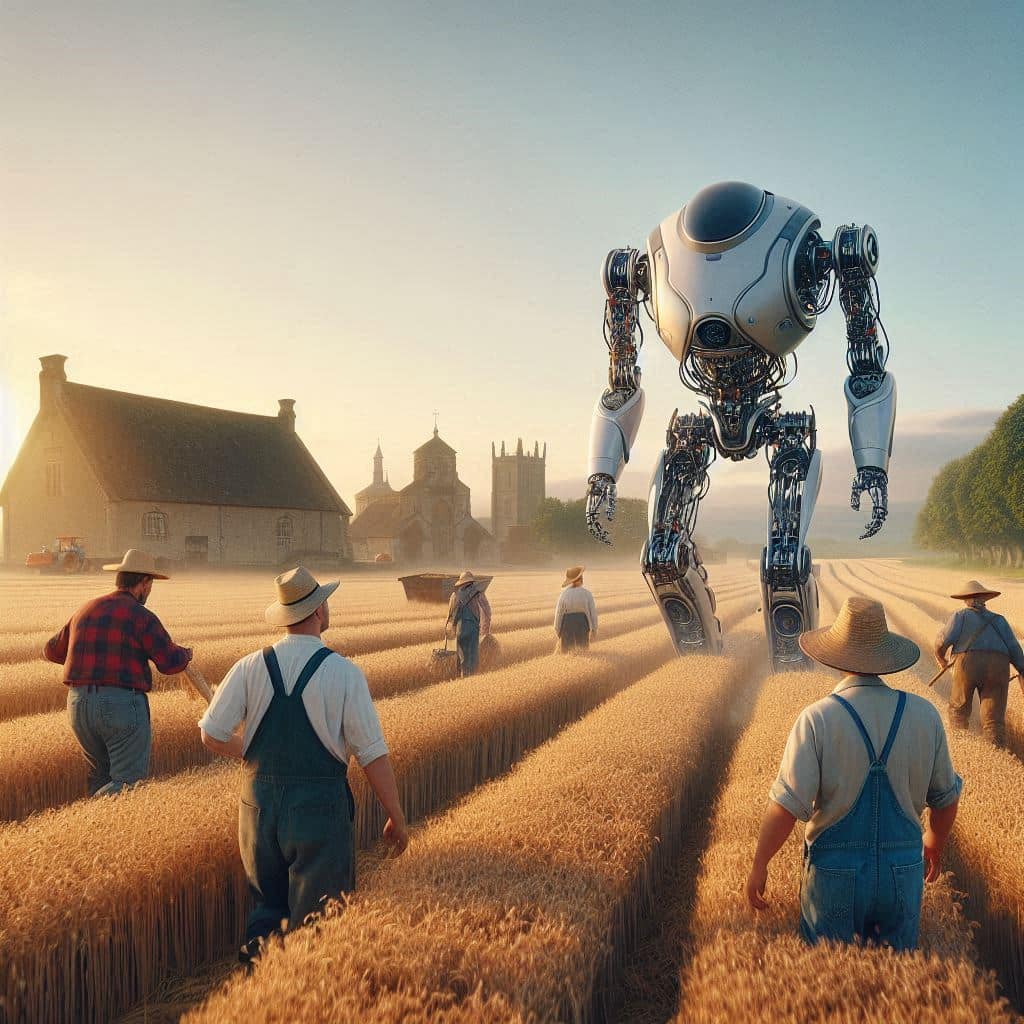

Carney argued that, if mechanisation led to lower living standards and greater inequality, “Marx and Engels may again become relevant.” There are quite a few conditional statements in that analysis, but it is not clear why the governor would want to stir up fears when deeper consideration would raise different but more important questions.

Carney compared the coming mechanisation with the first Industrial Revolution. In the early few decades of the first Industrial Revolution, he argued, labourers did not benefit fully from productivity gains arising from mechanisation. This apparently gave birth to the ideas of Marx and Engels.

This whole construction is somewhat bizarre. Living standards were not stagnant as mechanised looms replaced the cottage industries in the late eighteenth century. The Industrial Revolution gets a bad press. It is true that a relatively small number of skilled artisans suffered from mechanisation in the short term. However, the vast majority of people became better off, as the price of essentials fell when it became possible to produce them with less skilled labour and much more capital. It is true that, as people moved to the cities, poverty became more visible. Perhaps this is what spurred the writings of Marx and Engels. Nevertheless, incomes rose, and work, food and the other necessities of life were more secure.

Presumably, Mark Carney is of Irish extraction. It would not be surprising if his family moved away from Ireland because of the potato famine in the 1840s (like, I believe, one of my ancestors did). Before the Industrial Revolution and in countries that remained wedded to old methods of production, the poor were one bad harvest away from malnutrition or death.

Not only that, there was no spread of Marxist ideas of any consequence in Britain at that time. The first Marxist organisation in the UK was not formed until the 1880s, several decades after the period to which Carney is referring. Engels’ most important work was not even translated into English until 1885. Indeed, as the electoral franchise was widened, it tended to be the Conservatives who benefited. The countries in which Marxist ideas took hold were not those where the Industrial Revolution was taking place.

The past does not fit Carney’s description, but what about the future?

The Governor of the Bank of England suggested that mechanisation will lead to the stagnation of incomes amongst large groups of people, with the owners of capital receiving a much greater share of the national income. Mark Carney gave examples of middle class jobs being taken over by machines; hence, the analogy with the Industrial Revolution.

There is no question that a small group of people can be temporarily hurt by mechanisation, just as happened in the eighteenth century. If a newspaper columnist can read out a column which can be captured, corrected, and typeset by voice recognition software, newspapers will be cheaper – but copy editors will no longer have work. Their next best options may be limited in the short run. But Carney was not describing the prospect of a small group of people losing their jobs – something that has happened since the beginning of time. Carney was describing a possible situation in which huge numbers of people had their roles taken over by machines. Is it plausible, that all such people will become worse off?

Imagine a world where two types of goods or services are produced. The production of widget A can be mechanised using robots, but the production of widget B cannot. Both widgets are a large proportion of the economy.

As a result of mechanisation, much more of widget A can be produced with far less labour. What happens next? Perhaps many people making widget A are laid off. There will be other things they can do, but in the short term they will be paid less. The concern is that the owners of the robots will now earn all the returns. In addition, inequality also widens because makers of widget B are still in work, but everything they buy is cheaper.

The profits to makers of widget A could be enormous. But this is not a stable situation. More entrepreneurs will produce widget A (from which large profits can be made). Widget A will then be cheaper, better quality, and more plentiful, just as cotton and woollen goods became in the nineteenth century. Excess profits will be competed away. More people will be available for the production of widget B and will change occupations. This may be services, such as nursing care or providing care for the elderly. The provision of these services will also become more plentiful and cheaper.

Interestingly, in every Western (and most developed Asian) countries, the major realistic long-term economic fear is that of population ageing and a resultant shortage of tax-paying workers whilst the number of the older population increases. This is likely to lead to unaffordable, tax-funded pension and healthcare provision. If people who believe that robots will change the world are right, their coming will ease the most serious problems developed countries face.

It is difficult to imagine a large proportion of the population being worse off in this scenario. People may have to switch occupations, but if so many things can be produced with less labour, everything will be more plentiful and cheaper.

To some extent, this is a continuation of a process that has been going on for some time. Except in London, working hours have been falling for decades in the UK. They may fall further as leisure becomes more valuable than the accumulation of more widgets. People may increasingly prefer to consume (and produce) more bespoke products like artisan beers and bread – again, something that is already happening. Perhaps this process will allow us to rethink work as it becomes less important for putting bread and butter on the table. Furthermore, if the total returns paid to owners of capital increase (which they may do in aggregate simply because there is more capital in the production process), then we should implement policies that allow capital to be spread more widely. It is certainly important that monopoly profits are not protected by intellectual property laws. There is much that Catholic social teaching has to say about the importance of saving and the nature of work in documents like Rerum Novarum and Laborem Exercens.

My own hunch is that changes in labour markets will be slow and not revolutionary (in any sense of the word). Well-functioning economies cope with change well. Economists should be careful when they attempt to predict what is going to happen to both the economy and its consequential impact on the political system over the next 50 years. They struggle to predict the immediate future with any accuracy. Carney’s words are mere speculation and deflect attention from a serious analysis of important problems.

This article was first published on the Acton Institute’s Transatlantic Blog.

1 thought on “No – automation will not make Marx ‘relevant again’”

Comments are closed.

I suspect Carney was just trying to impress his various upper class, left wing friends in what passes for “the arts” these days. They’re all gleefully denying the crimes of communism just now and pretending the Berlin Wall didn’t fall towards the west. He’s just dancing to the music of time.